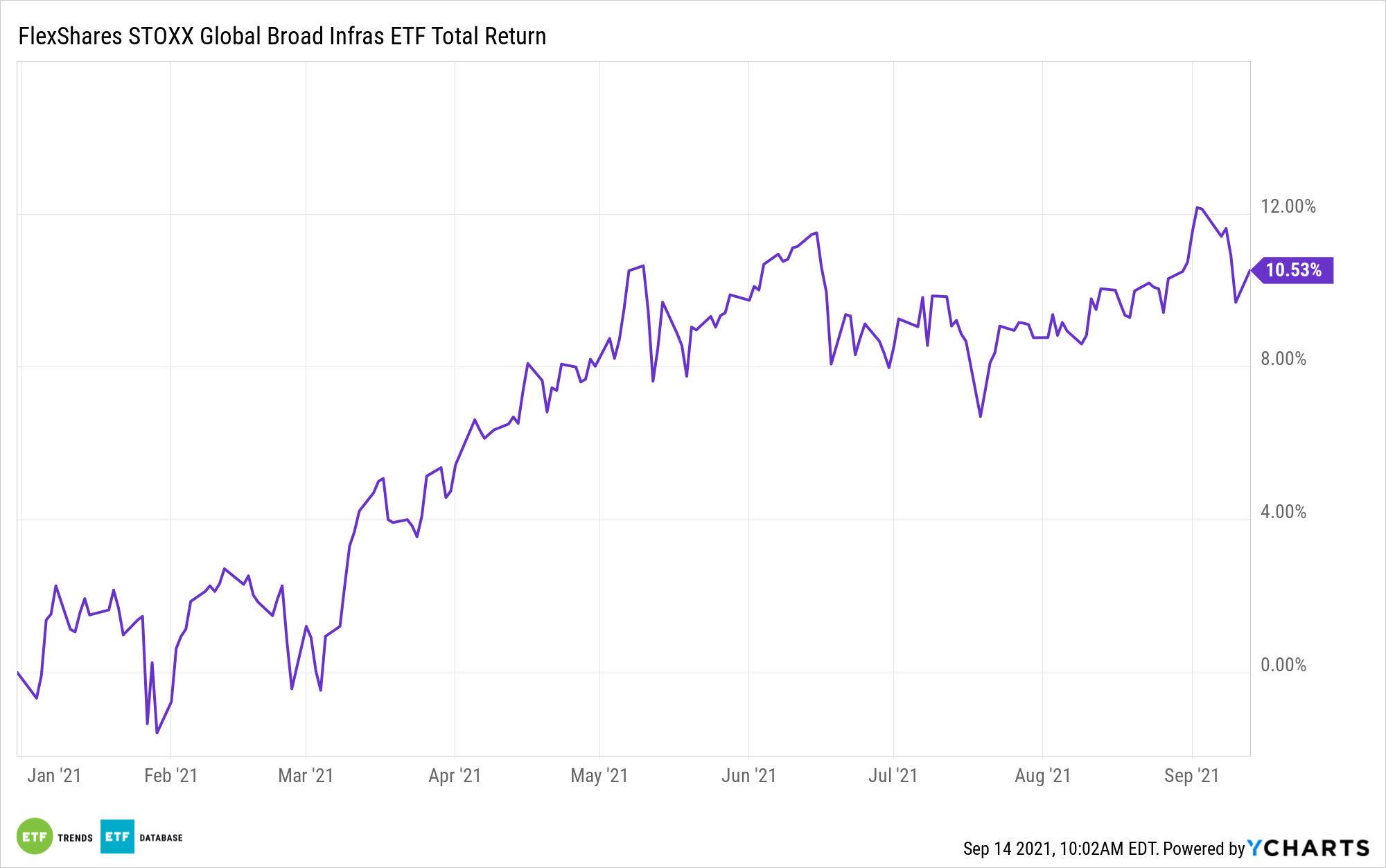

While ETFs have given investors access to infrastructure investing, a one-size-fits-all approach may not be ideal. As such, there’s a diversified option with the FlexShares STOXX Global Broad Infrastructure Index Fund (NFRA).

While an all-encompassing ETF may give broad exposure to a sector, it may miss out on opportunities that diversification can identify. That idea can be applied to infrastructure, where niche exposure can play a pivotal role in identifying infrastructure investments.

“Some infrastructure strategies may focus on traditional projects like roads, bridges, energy assets and water/waste management facilities,” a FlexShares Fund Focus said. “Today, though, critical infrastructure includes newer technologies like cellular towers and broadband networks, as well as so-called ‘social infrastructure,’ which includes health care facilities and privatized postal services.”

“Seeking infrastructure investment strategies that take this broader view of qualifying assets may help diversify portfolios across and within sectors, as well as around the world,” the Fund Focus said further. “This additional diversification may help improve the hedging characteristics of an infrastructure strategy, while potentially exposing investors to growth opportunities that exist in this evolving space.”

Per its fund description, NFRA seeks investment results that generally correspond to the price and yield performance (before fees and expenses) of the STOXX® Global Broad Infrastructure Index. The index reflects the performance of a selection of companies that, in aggregate, offer broad exposure to publicly traded developed- and emerging-market infrastructure companies, including U.S. companies, as defined by STOXX Ltd. pursuant to its index methodology.

A Global Approach

While the primary infrastructure play is here at home with the trillion dollar bill undergoing its push through Congress, diversification can also span to other parts of the globe. Seeking opportunities abroad for additional diversified exposure is just another added benefit of NFRA.

“To create sufficiently diversified portfolios, we believe that infrastructure strategies also need a construction methodology that looks broadly and deeply for the best opportunities,” the Fund Focus said. “Investors may also want to focus on strategies that take a global approach. This may allow them to take advantage of countries where modern infrastructure projects—like privatized postal services—could be well established.”

“Targeting modern infrastructure may also require a more sophisticated way to identify companies that operate infrastructure assets,” the Fund Focus added. “We believe that legacy infrastructure indices may not be the most efficient way to uncover investment opportunities, because many indices have historically been organized using top-down sector codes that classify common stocks.”

For more news, information, and strategy, visit the Multi-Asset Channel.