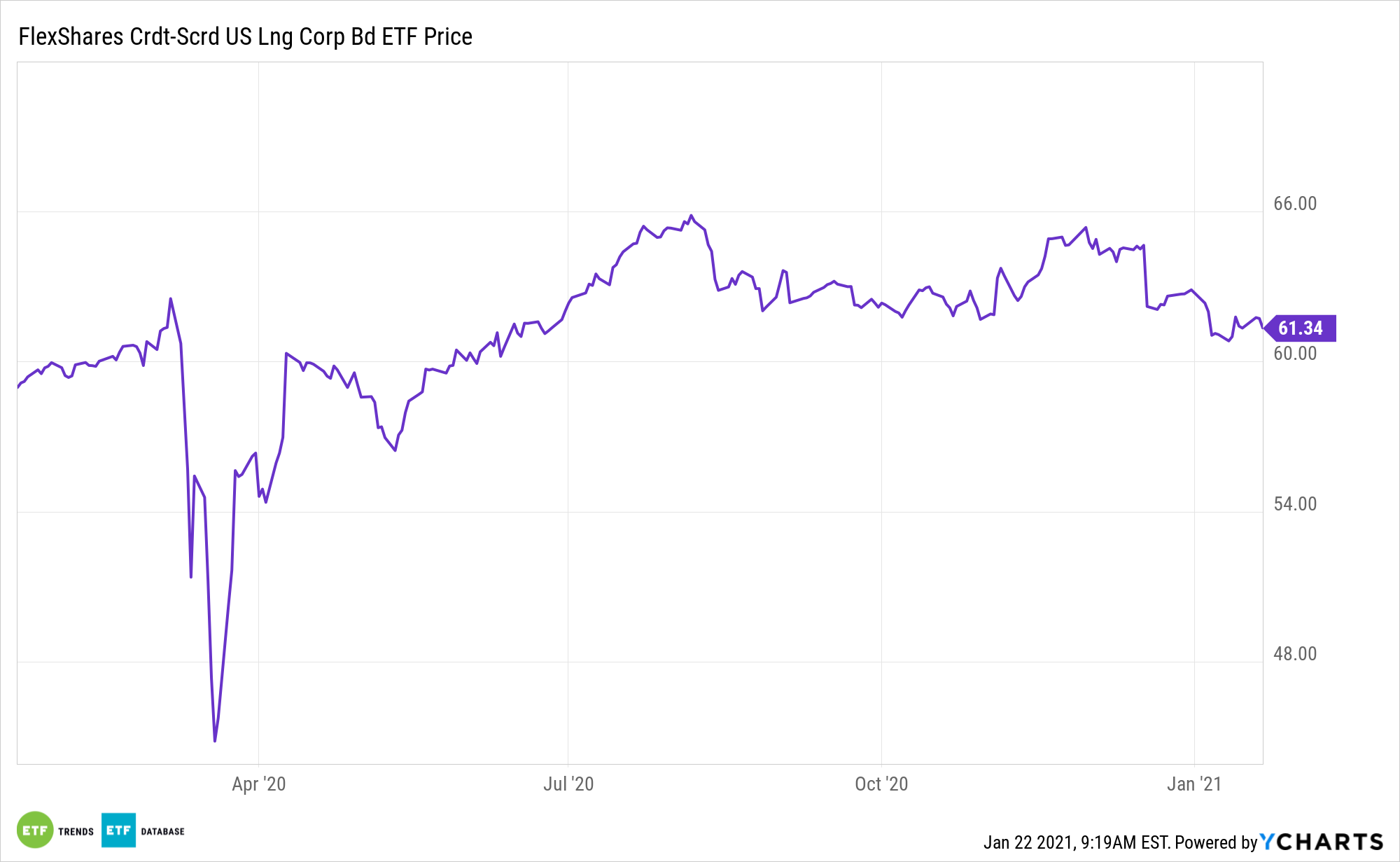

No two corporate bonds are alike. With varying degrees of quality, strategies like the FlexShares Credit‐Scored US Long Corporate Bond Index Fund (CBOE: LKOR) are crucial.

“LKOR follows the Northern Trust Credit-Scored US Long Corporate Bond Index, which addresses potential corporate bond liquidity challenges by optimizing a carefully selected subset of all credit issuers from which illiquid, orphaned and small lot names have been removed,” says FlexShares. “Then, multiple factors are taken into account including the characteristics of issuers’ total debt structure, minimum exposure percentages, and odd-lot trade restrictions, to aid in developing our corporate bond indexes.”

LKOR’s peace of mind is pivotal in today’s market environment.

“All else the same, credit quality benefits—or default risk is lower than otherwise—the longer is the term to maturity of outstanding debt,” according to Moody’s Investors Service. “Longer maturities reduce the risk that the borrower may not be able to fund the principal payment once the obligation matures. Today’s historically low bond yields have increased the attractiveness of locking up access to financial capital for an extended period and have thereby reduced principal repayment risk.”

Corporate Bond Analysis: Reasons to Love LKOR

LKOR is worth considering because with interest rates already so low, the Fed has little room for further cuts, meaning upside on government debt is potentially limited going forward.

“The outstanding loan debt of U.S. nonfinancial corporations most recently peaked at the $3.258 trillion of 2020’s first quarter loan debt and has since contracted at an annualized rate of 12.7% to the $3.070 trillion of 2020’s third quarter,” notes Moody’s. “(In this discussion, loans exclude mortgage loans.) By contrast, the outstanding bond debt of U.S. nonfinancial companies expanded at an annualized rate of 16.1% from the $6.54 trillion of 2020’s first quarter to the $7.048 trillion dollars of the third quarter.”

LKOR excludes illiquid and smaller issuers to improve liquidity and transparency. Additionally, the fund targets company bonds that have a higher credit quality, lower risk of default, and potential for higher yield and price appreciation.

“The record suggests that the current slowdown by debt excluding bonds and mortgages is the harbinger of a deceleration by the yearly growth rate of total non financial-corporate debt. Corporate credit quality is likely to benefit considerably if the growth of outstanding corporate debt slows amid rapid corporate earnings growth,” finishes Moody’s.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.