Amid low interest rates and a weak dollar, the market is ripe for real asset ETF strategies.

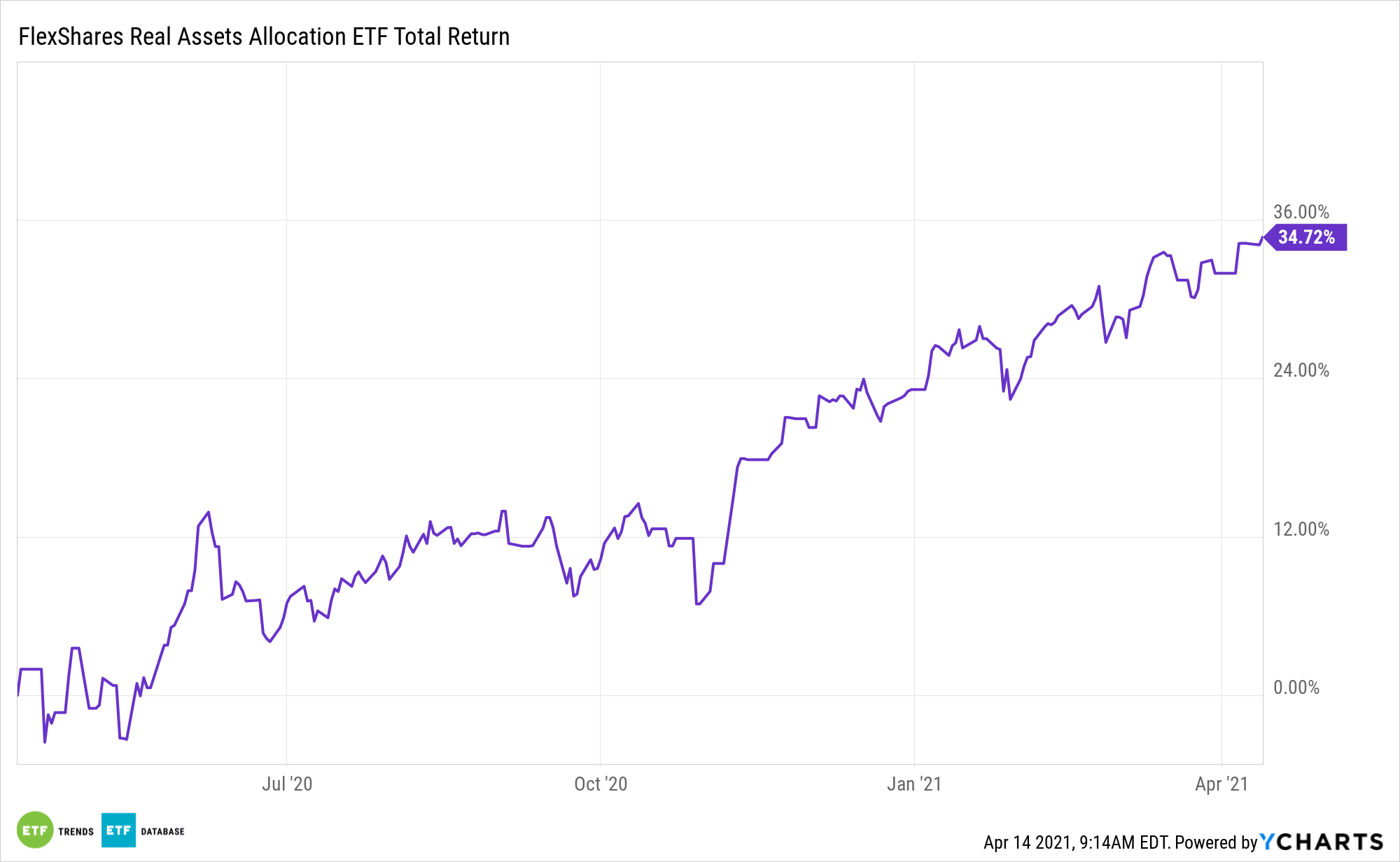

Investors looking for broad-based exposure to real assets such as energy, infrastructure, and real estate can check all of those boxes and then some with the FlexShares Real Asset Allocation Index Fund (NasdaqGM: ASET).

ASET “seeks to provide investors with a core real asset allocation that helps address their inflation-hedging, diversification, and income needs. Designed to serve as a real assets allocation solution, the strategy applies a proprietary optimization to the three underlying funds in an effort to minimize the volatility of returns and lower risk in the fund,” according to FlexShares.

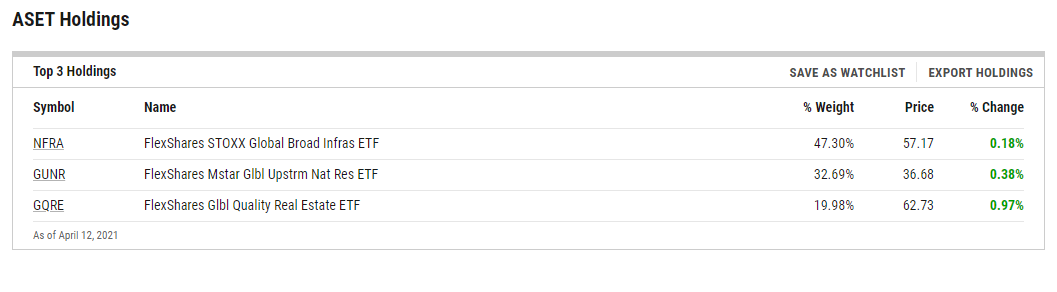

ASET employs an ETF of ETFs strategy and holds three other FlexShares products:

- FlexShares Global Quality Real Estate Index Fund (NYSEArca: GQRE)

- FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA)

- FlexShares Morningstar Global Upstream Natural Resource Index Fund (NYSEArca: GUNR)

Why Go with This ASET?

ASET is worth considering because stocks are preferable to futures for real assets exposure.

“We believe an equity-based approach to natural resources may be a good alternative way to gain commodity exposure versus a futures-based approach,” said FlexShares. “Historically speaking, it has materially and persistently outperformed a futures-based approach.”

Momentum for massive infrastructure spending also highlights the near-term allure of ASET.

Infrastructure developments are typically large, long in duration, and capital-intensive, carrying a high overall cost. Nevertheless, the projects compensate investors by including fairly predictable expenditures to maintain the asset, as well as regulated pricing that typically provides stable and reliable cash flows. Select investors have long enjoyed the unique characteristics of infrastructure to diversify equity risk exposure, generate income, and hedge against long-term inflation.

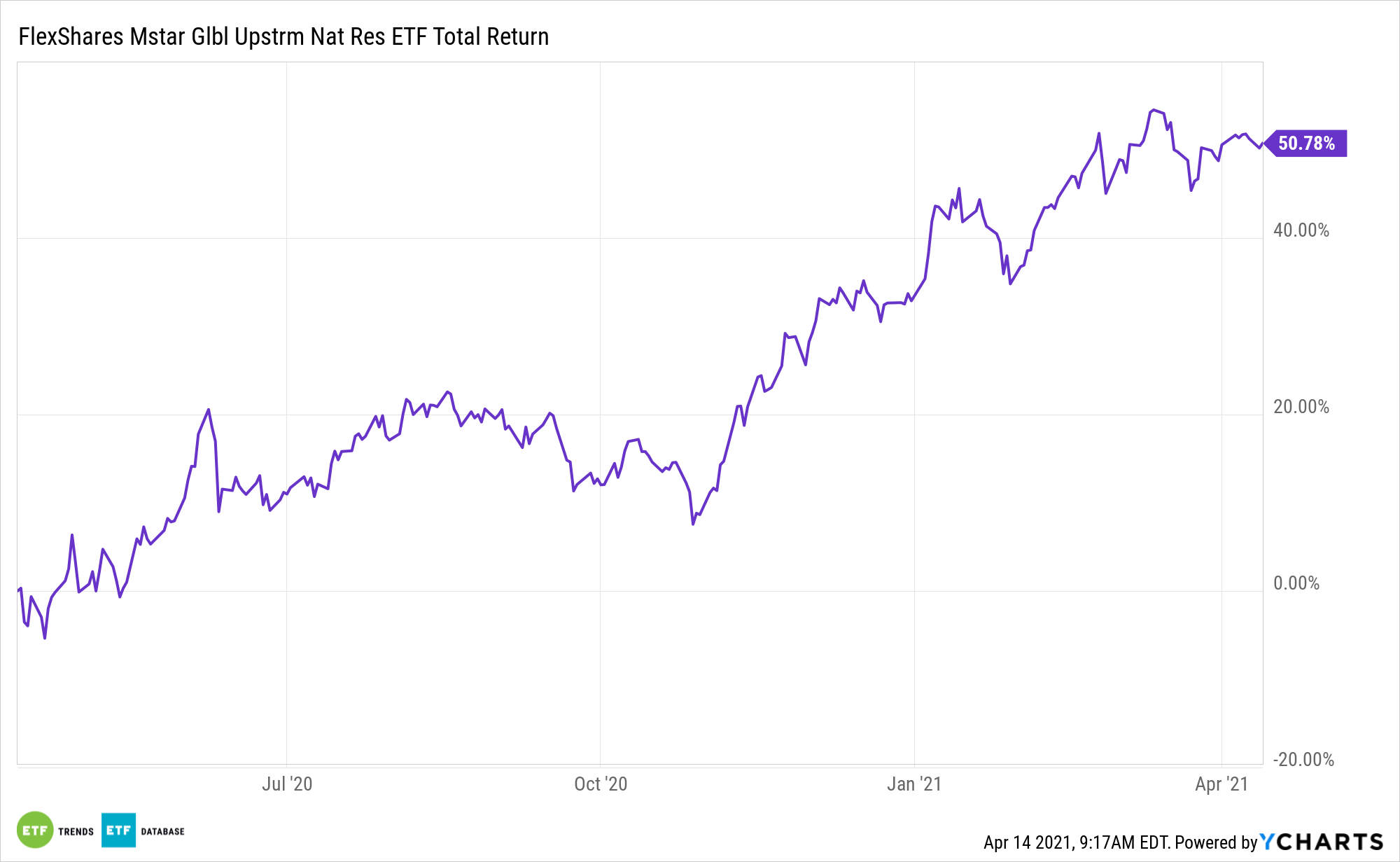

ASET’s allocation to stablemate GUNR is also relevant in the current environment.

“Driving this outperformance was the equity market exposure, but commodity prices still played a large part in the return expectation. The modest growth environment during the time frame — combined with OPEC-controlled supply — which steadily removed the oil glut of the prior decade also played a role. We believe that the continued rise of the Emerging market middle class should support commodity demand more broadly in the years ahead,” adds FlexShares.

GUNR provides exposure to the rising demand for natural resources and tracks global companies in the energy, metals and agriculture sectors, while maintaining a core exposure to the timberlands and water resources sectors, is a part of the risk management theme.

For more on multi-asset strategies, please visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.