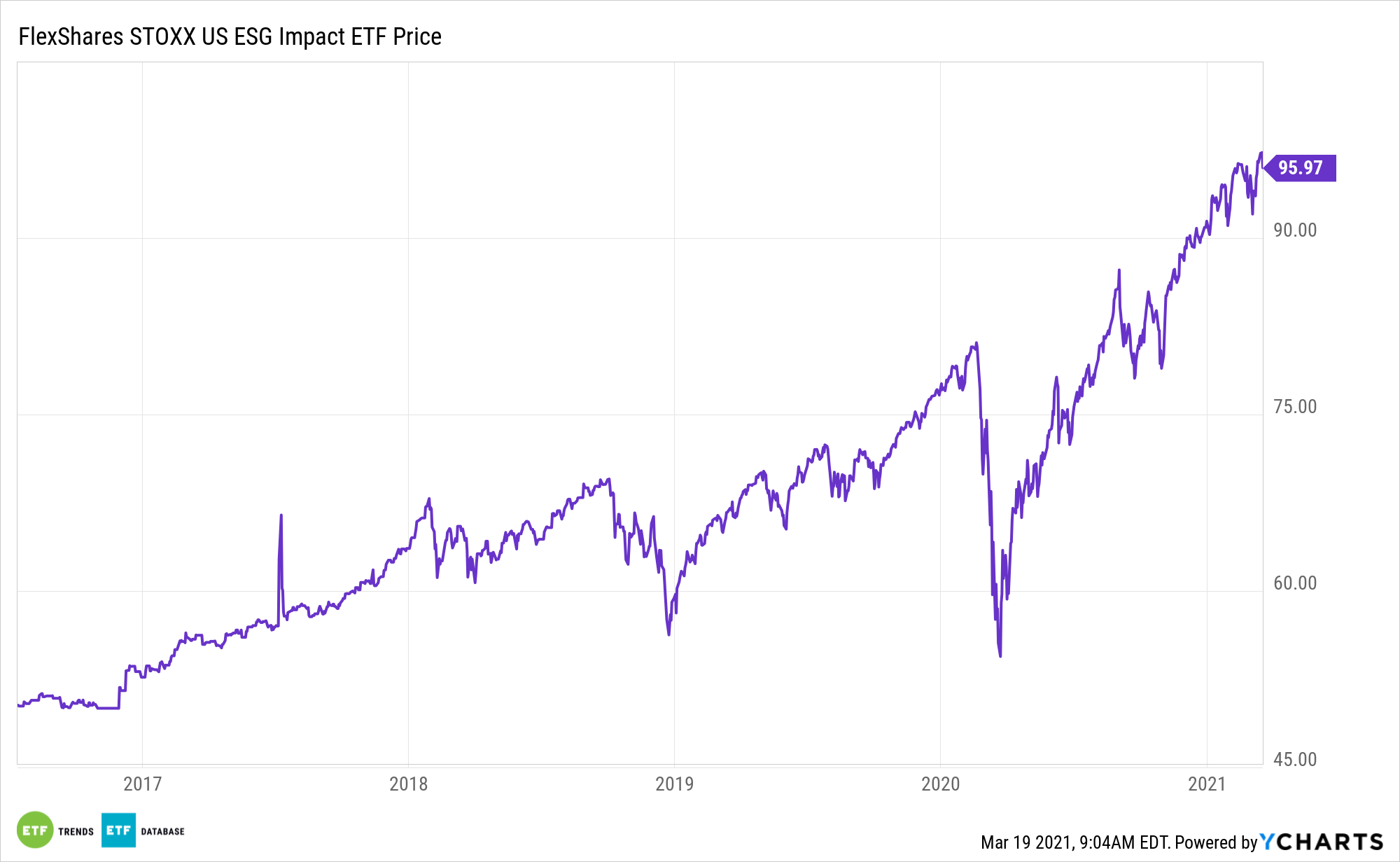

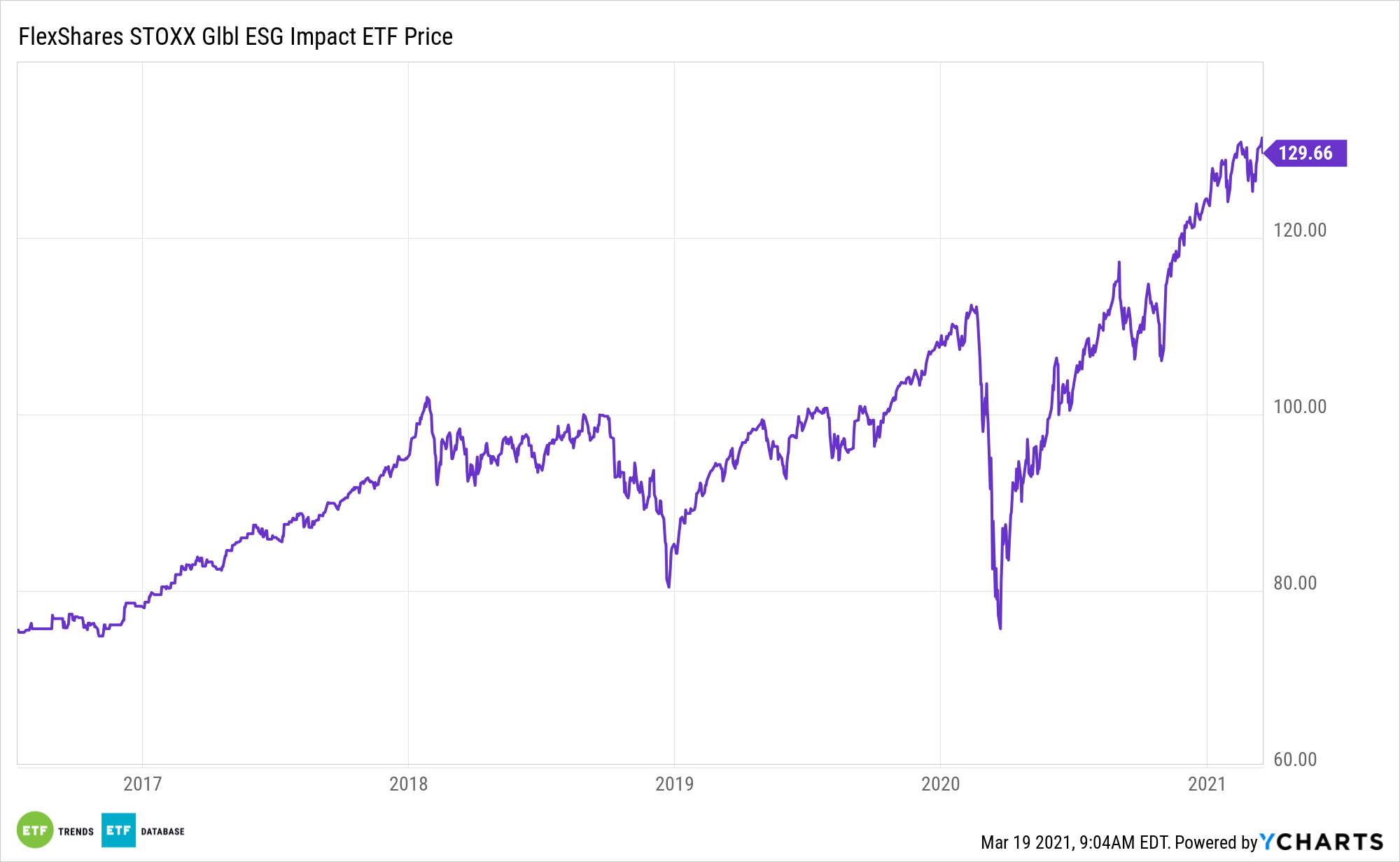

Environmental, social, and governance (ESG) investing is a top priority for both professional asset allocators and retail investors alike. Assets like the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG) are capitalizing on investor enthusiasm.

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

Underscoring the potency of ESG and ESGG in this climate, Cowen estimates that one of every four investment dollars is now allocated to ESG strategies.

“The firm noted that roughly one in four dollars in the U.S. is now invested through an ESG lens. If two equities offer similar expected risks and returns, investors are increasingly likely to choose the name that screens better on sustainable investing scores,” reports Pippa Stevens for CNBC. “Indeed, sustainable funds attracted a record $51.1 billion in inflows in 2020, according to data from Morningstar. That figure more than doubled 2019′s prior record.”

Tailwinds for ESG, ESGG

Investors should consider the diversification benefits of socially responsible investments and how they might enhance a core portfolio position through ESG exchange traded fund strategies.

Experts believe socially responsible investing covers more than just environmental aspects like climate change, protection of natural resources, pollution, and ecological opportunities. It also includes social and governance factors as well.

See also: ESG ETFs Punching Above Their Weight

The growth of the ESG may be associated with more people investing with their core values. Three-quarters of global individual investors and 71% in the U.S. noted that it is important to align investments with their values and ethics. While there is a feel-good component to the category, ESG or sustainable investments may also enhance a long-term portfolio.

“Given societal pressure, government mandates, and shareholder activism among many other factors, companies are beginning to treat ESG trends as a strategic opportunity and no longer as a headache or risk,” adds Cowen.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.