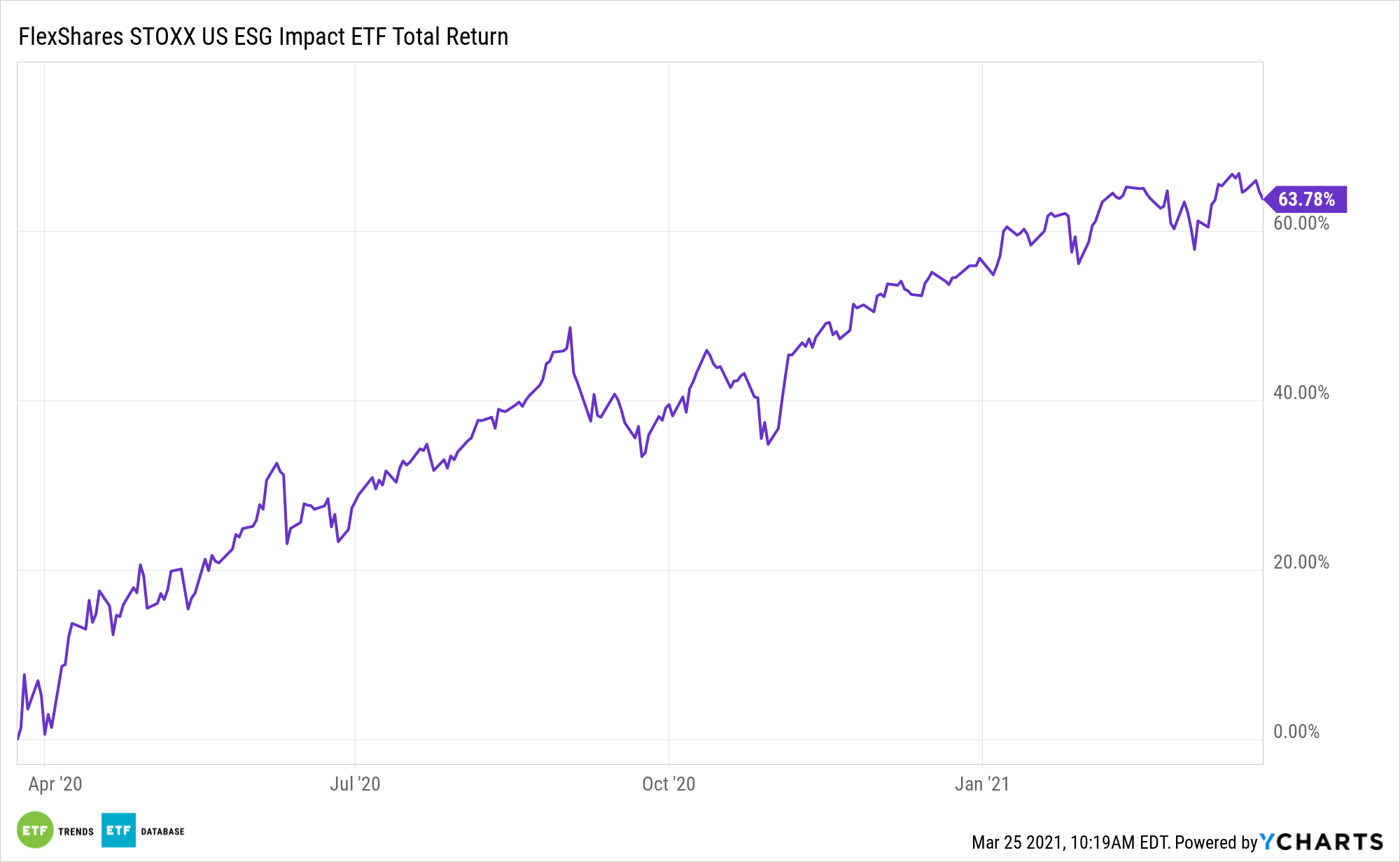

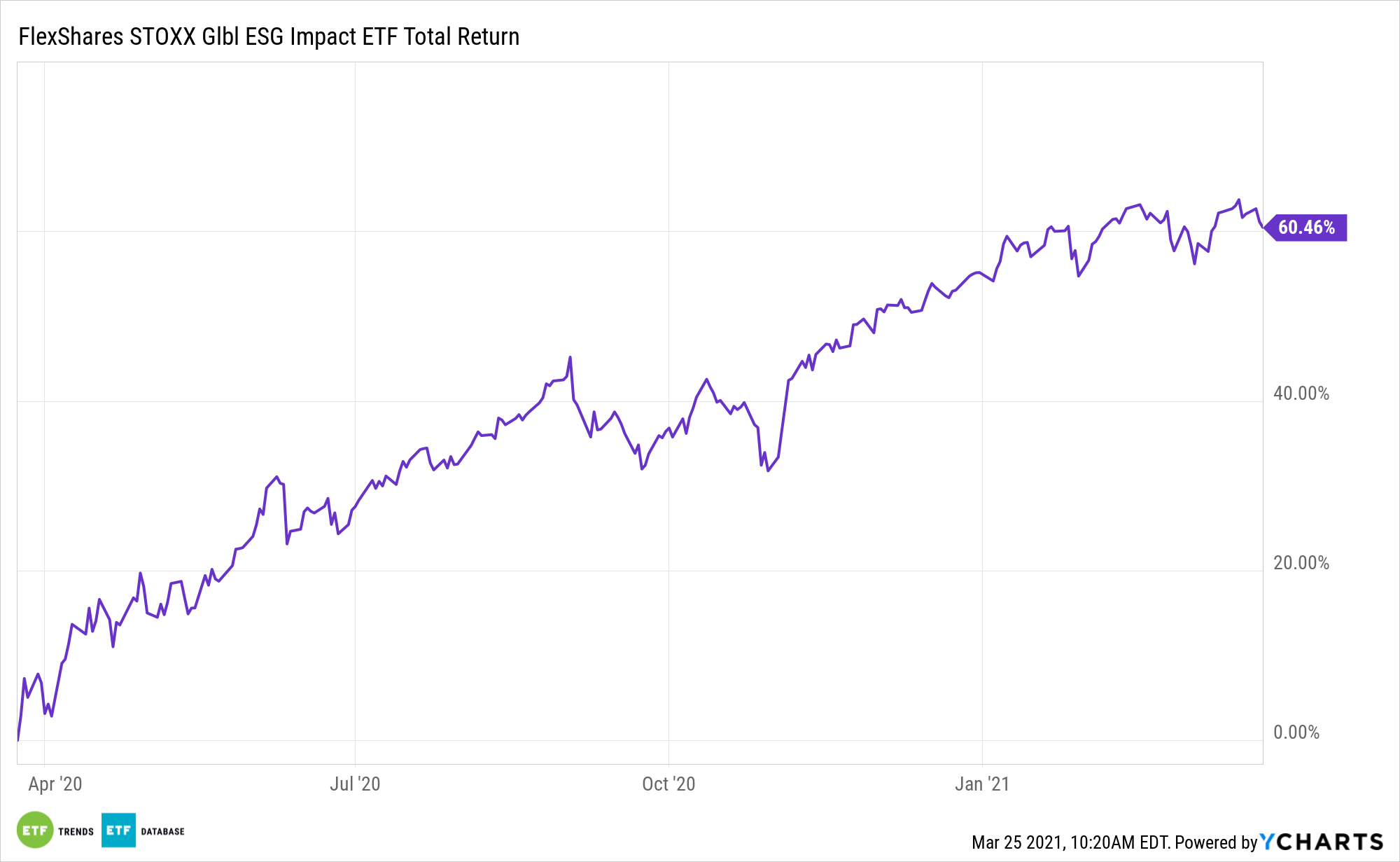

Environmental, social, and governance (ESG) investing is on a torrid pace with funds like the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

“Assets invested in Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally reached a record US$226.75 billion at the end of February,” according to ETFGI, an ETF research firm. “ESG ETFs gathered net inflows of US$20.87 billion during February, bringing year-to-date net inflows to a record US$40.67 billion which is much higher than the US$13.61 billion gathered at this point last year which was the prior record.”

The ESG Movement

More uniformity in ESG criteria can also give ESG and ESGG a boost.

Fund providers like Vanguard Group, BlackRock Inc. and State Street that offer investment products in the European Union will have to follow the new rules that took effect this month, but details are still being finalized, the Wall Street Journal reports.

As interest for ESG-related investments gains momentum, standardized rules on disclosure for traditional funds and those following sustainable strategies will become increasingly important.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%).“ said Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Lastly, socially responsible investments could get a boost from increasing allocations this year.

According to the 8th annual Global ETF Investor Survey conducted by Brown Brothers Harriman, 72% of global ETF investors plan on raising their ETF allocation over the next year with a focus on thematic, ESG, and semi-transparent active ETFs.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.