Exchange traded funds dedicated to virtuous investing principles are having a moment this year, a theme that’s expected to continue in 2021 as more asset allocators embrace environmental, social, and governance (ESG) investing principles.

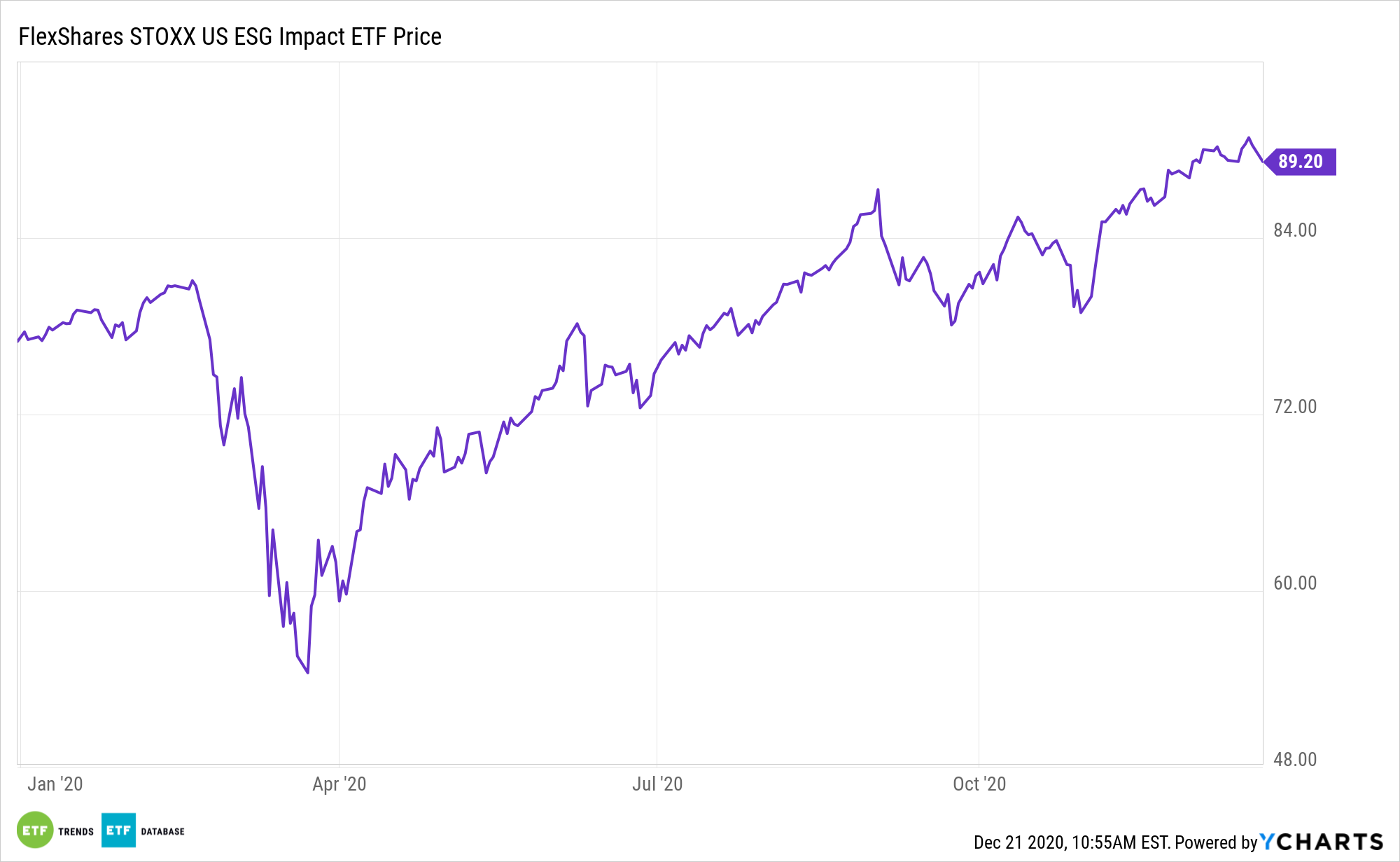

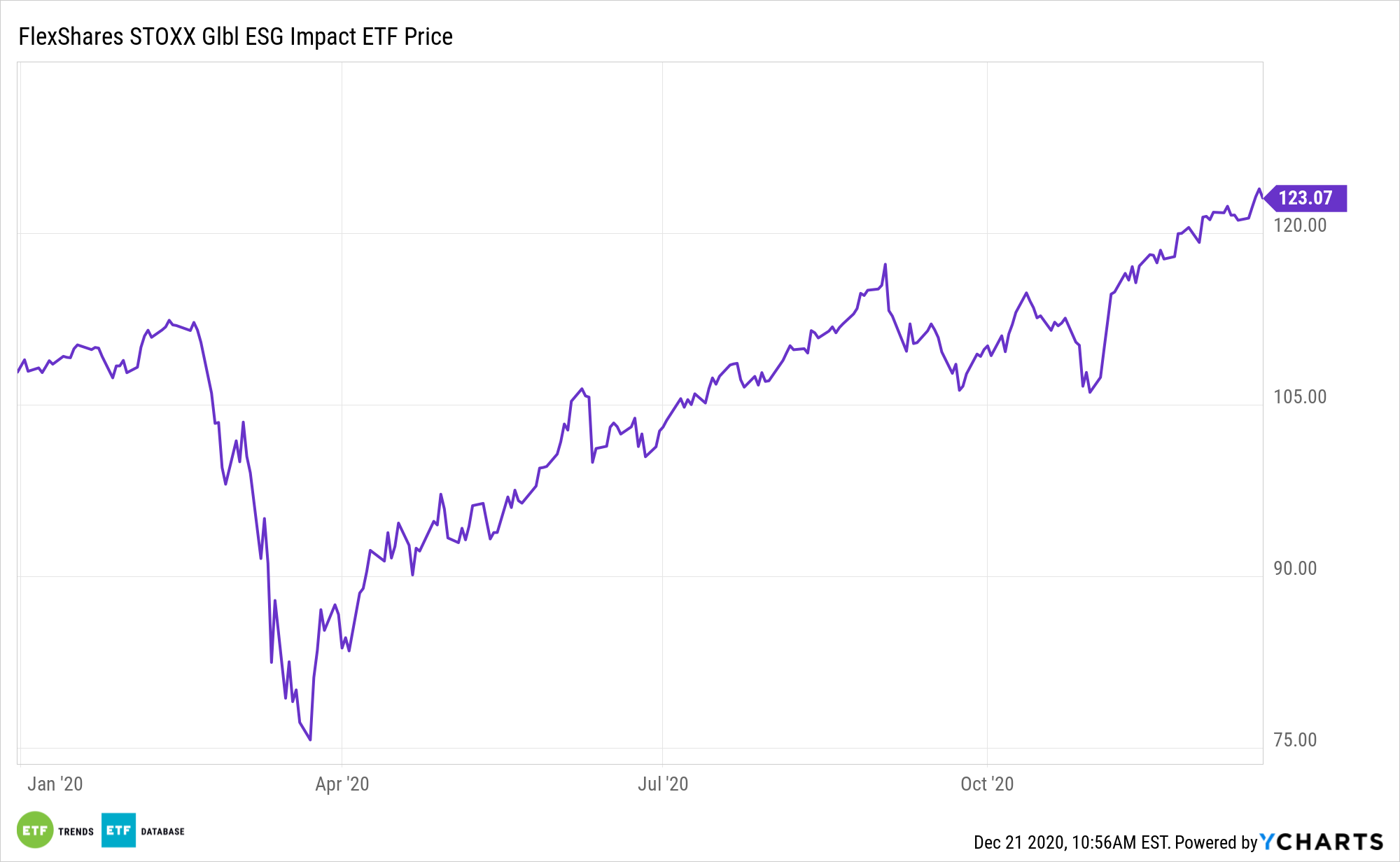

That movement is good news for ETFs such as the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG).

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.- incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

“This year investors have put a record $27.4 billion into ETFs traded in U.S. markets that say they focus on environmental, social and corporate governance, or ESG, practices, according to data from FactSet, doubling the size of the sector,” reports Michael Wursthorn for the Wall Street Journal.

ESG, ESGG, and the Future of a Growing Industry

Embracing ESG is a growing trend among the investment community. Global sustainable index mutual funds and ETFs saw assets under management double over the past three years, to $250 billion, according to a Morningstar report.

In a year marked by a Covid-19 outbreak and social unrest, we have seen a spike in interest in issues like corporate governance, climate change, and racial justice.

“The surge suggests ESG investing has staying power, answering those who had questioned whether investors would give priority to goals such as promoting clean energy over simply picking the best-performing stocks regardless of companies’ principles,” according to the Journal. “Expectations for new legislation aimed at combating climate change under a Biden administration are likely to stoke demand for ESG funds over the coming years, and several asset managers are rushing to meet that demand.”

The growth of the ESG may be associated with more people investing with their core values. Three-quarters of global individual investors and 71% in the U.S. noted that it is important to align investments with their values and ethics. While there is a feel-good component to the category, ESG or sustainable investments may also enhance a long-term portfolio.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.