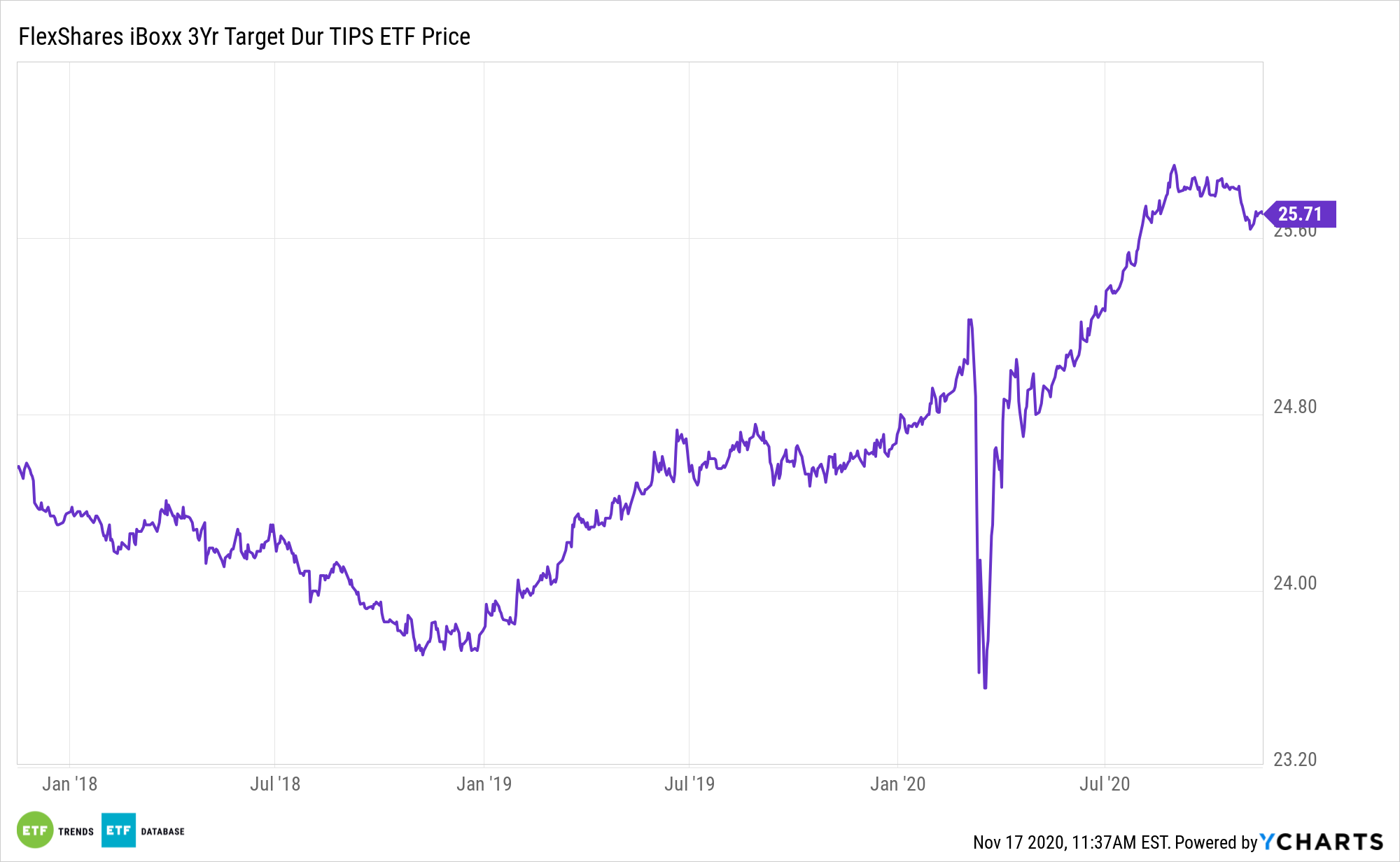

The inflation conversation is gaining momentum. While that’s concerning news, investors can guard against this scenario with a myriad of exchange traded funds, including the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (NYSEArca: TDTT).

TDTT is particularly useful in an environment where inflation data exceeds forecasts, meaning investors should monitor the breakeven inflation rate.

Treasury Inflation-Protected Securities (TIPS) are popular among fixed-income investors looking to protect against the scourge of inflation and ETFs make it easier to access TIPS.

“The pandemic has spurred new structural trends such as a policy revolution that sees greater coordination between fiscal and monetary policy,” said BlackRock in a recent note. “Central banks are showing an increased tolerance for inflation overshoots after persistent inflation undershoots, and the fiscal-monetary coordination is leading to political pressure to keep interest rates low even amid rising price pressure.”

By many accounts, official inflation remains muted, but that ignores an array of price increases across everyday categories. It also ignores other ample signs of rising inflation, putting a spotlight on exchange traded funds such as TDTT.

How Investors Approach Inflation

Investors will typically look at TIPS ahead of an inflationary period since buying TIPS after inflation has gone up means that the security has already priced in the inflation and investors would likely be overpaying for the TIPS exposure.

Investors now argue that the Federal Reserve’s rate cuts this year have bolstered the outlook on inflation, with some even contending that inflation may rise fast enough to force the Fed to hike rates.

There are other reasons to consider TDTT over the near-term.

“Together with rising production costs stemming from the remapping of global supply chains and more focus on sustainability, this points to a higher inflation regime over the medium term. This is a shift that markets are not prepared for, even though in the near term corporates’ cost-cutting effort may help mitigate some price pressure,” according to BlackRock.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.