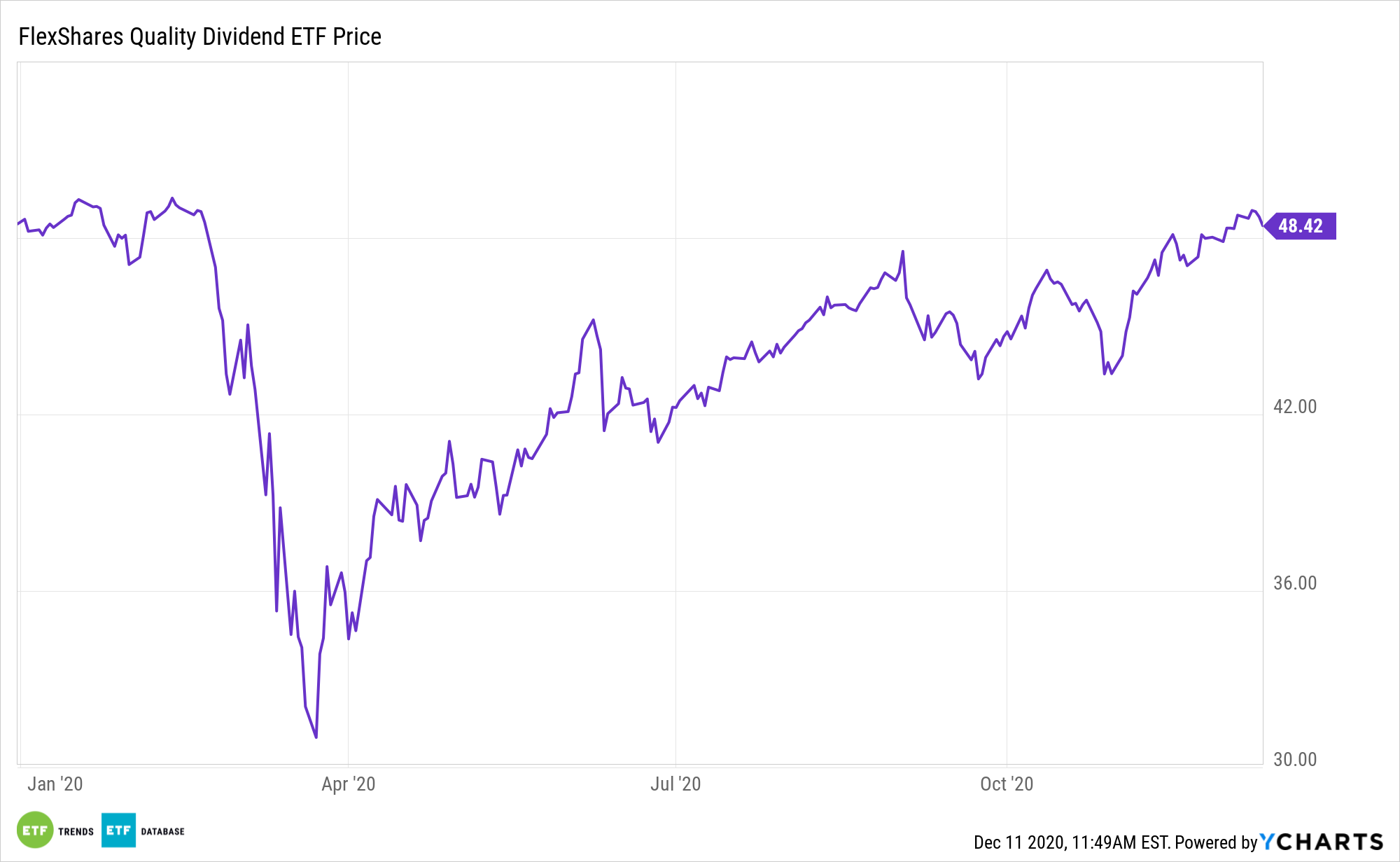

Dividend stocks are bouncing back to close out 2020 and with expectations in place that the asset class is poised for more upside next year, steady strategies like the FlexShares Quality Dividend Index Fund (NYSEArca: QDF) are worth revisiting.

QDF’s underlying benchmark targets management efficiency or quantitative evaluation of a firm’s deployment of capital and its financing decisions. By using a management efficiency screen, the index can screen out firms that aggressively pursue capital expenditures and additional financing, which typically lose flexibility in both advantageous and challenging partitions of the market cycle.

“While realized S&P 500 dividends per share fell by 5.6% year-over-year in the third quarter, many companies such as Darden Restaurants (DRI), Marathon Oil (MRO), and Estee Lauder (EL) that had suspended dividend payments earlier in the year due to COVID-19 impacts have now resumed,” reports Business Insider.

Breaking Down the QDF ETF

Markets are mispricing the probabilities of rising payouts, making a dividend growth strategy like QDF relevant heading into the new year.

“However, the markets have not caught up with the improving reality. The 2021 and 2022 dividend contracts suggest 5% and 6% declines respectively in S&P 500 dividends. On top of that, the dividend yield curve appears inverted in the next decade where every single contract through 2029 trades below 2019 levels,” Business Insider reports, citing Goldman Sachs.

QDF emphasizes the quality factor, of which a company’s ability to generate free cash and dividend growth and stability are integral tenants. Another element that has been critical to QDF’s success is the emphasis on management efficiency and a company’s ability to generate cash.

Dividends are in demand as fixed-income investors face a lower-for-longer interest rate environment. The Federal Reserve is expected to maintain its near-zero interest rate policy to help push inflation up, bolster the economy, and lower the unemployment rate. The Fed has already stated it is willing to let inflation run higher to offset years inflation fell below its 2% target.

Companies are increasingly confident in growing dividends again, even as another surge in Covid-19 cases threatens earnings. According to FactSet estimates, S&P 500 per-share earnings are expected to bounce 22% in 2021—to above 2019 levels.

As a result, companies are feeling better about returning more of their capital to shareholders. S&P 500 dividends are expected to grow 3% in 2021 from 2020, according to FactSet. The payout ratio—the percent of earnings companies use to pay dividends — is expected to fall to about 35% from 42%, but the pure growth in dividend dollars still provides an attractive yield opportunity at current prices.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.