As the number of coronavirus cases grows globally, there’s a correlative equivalent in the corporate bond markets—the growing number of downgrades. Based on data from BofA Global Research, the pace of corporate bond downgrades has increased over the last couple of weeks.

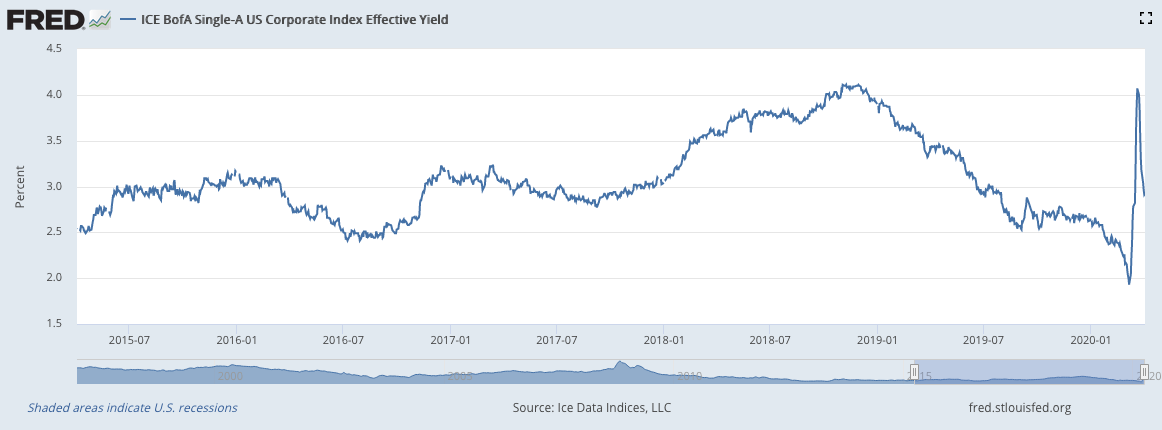

Per a Wall Street Journal report, “the ICE BofAML U.S. Corporate Index, has suffered $569 billion in downgrades since March 16, said Bank of America. Credit-ratings firms downgraded a net $560 billion of investment-grade corporate bonds in the index last month, the bank added.”

“While total downgrades remained lower than at the same point during the financial crisis, the pace accelerated in recent weeks as ratings firms and investors reassessed the ability of borrowers to repay their debts,” the report added further.

Nonetheless, it doesn’t mean exchange-traded fund (ETF) investors should avoid corporate bonds altogether. Looking at investment-grade options will help investors with obtaining quality debt issues with a lesser likelihood of default.

Try these three funds:

- Vanguard Short-Term Corporate Bond ETF (NASDAQ: VCSH): VCSH tracks the performance of a market-weighted corporate bond index with a short-term dollar-weighted average maturity–the Bloomberg Barclays U.S. 1-5 Year Corporate Bond Index. VCSH debt holdings mirror those found within the index, so U.S. dollar-denominated, investment-grade, fixed-rate, taxable securities issued by the industrial, utility, and financial companies comprise the debt portfolio. Furthermore, in order to curb volatility in the bond markets, maturities are relatively short-duration issues–between 1 and 5 years until maturity.

- SPDR Portfolio Short Term Corp Bd ETF (NYSEArca: SPSB): SPSB seeks to provide investment results that correlate with the Bloomberg Barclays U.S. 1-3 Year Corporate Bond Index. Once again, O’Leary would benefit from the reduced exposure to volatility with SPSB’s investment in shorter-duration debt with maturities less than three years. In addition, SBSP minimizes credit risk by constructing a debt portfolio that contains only investment-grade bonds with companies that are less likely to default.

- ProShares Investment Grade—Intr Rt Hdgd (BATS: IGHG): IGHG tracks the performance of the Citi Corporate Investment Grade (Treasury Rate-Hedged) Index so it invests in long positions in USD-denominated investment-grade corporate bonds issued by both U.S. and foreign domiciled companies and short positions in U.S. Treasuries. O’Leary likes to minimize downside risk, so he would probably prefer a corporate bond ETF with a debt portfolio in investment-grade bonds, which is where IGHG invests 80% of its capital. Investment-grade allows investors to mitigate credit risk by allocating capital towards debt issues that are less likely to default versus less-than-investment-grade issues.

For more market trends, visit ETF Trends.