As one of this year’s best-performing groups in the S&P 500, energy is giving investors plenty of reasons to be bullish in 2021. Tempting as that may be, many investors remember the oil bear market of 2020 and energy’s reputation for steep declines.

This year, things could be different for energy investors as oil demand bounces back with Americans looking to travel and spend stimulus cash. That could be a favorable setup for the FlexShares Morningstar Global Upstream Natural Resource Index Fund (NYSEArca: GUNR).

GUNR tracks the Morningstar Global Upstream Natural Resources Index. The FlexShares fund is not a dedicated energy sector exchange traded fund. Rather, it’s a broad-based play on natural resources, providing investors with an alternative to “all in” energy strategies.

“As the demand for or prices of natural resources increase, the Fund’s equity investment generally would be expected to also increase. Conversely, declines in demand for or prices of natural resources generally would be expected to cause declines in value of such equity securities. Such declines may occur quickly and without warning and may negatively impact your investment in the Fund,” according to FlexShares.

GUNR’s Energy Upside

Traditional energy bets can be volatile. GUNR is an alternative to consider to still lever to oil upside, which some market observers are saying is coming.

“I think the entire energy complex is a buy,” said Fundstrat’s Tom Lee in a CNBC interview. “Structurally, the industry and also the energy companies are really seeing the best supply-demand alignment in more than 10 years.”

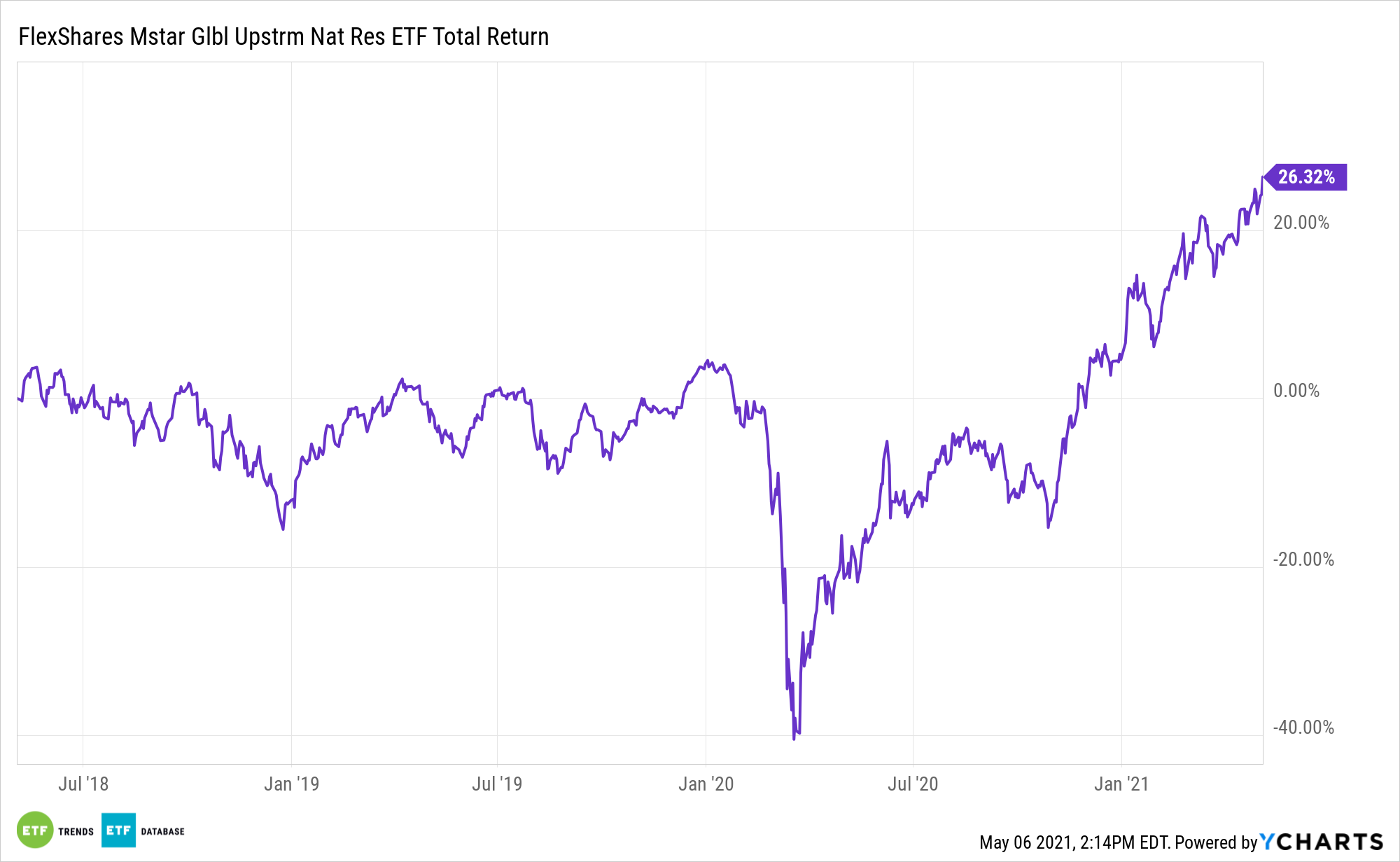

Up 18% year-to-date, GUNR is proving it’s more than adequately exposed to post-pandemic drivers of energy sector upside.

“The energy sector was hit hard by the pandemic, as demand for oil fell amid a sharp reduction in travel. The rollout of Covid vaccines and optimism around the economic reopening has reignited demand, helping push the price of oil higher while lifting the stocks of energy companies,” according to CNBC.

The $5.22 billion asset has other perks. More than 88% of its weight is allocated to metals producers, agribusiness names, and energy stocks. That gives fund not only a pronounced inflation-fighting utility, but also a solid value tilt. Fifty-six percent of the fund’s components are value stocks, exposing it to an ongoing rally by that investment factor as well.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.