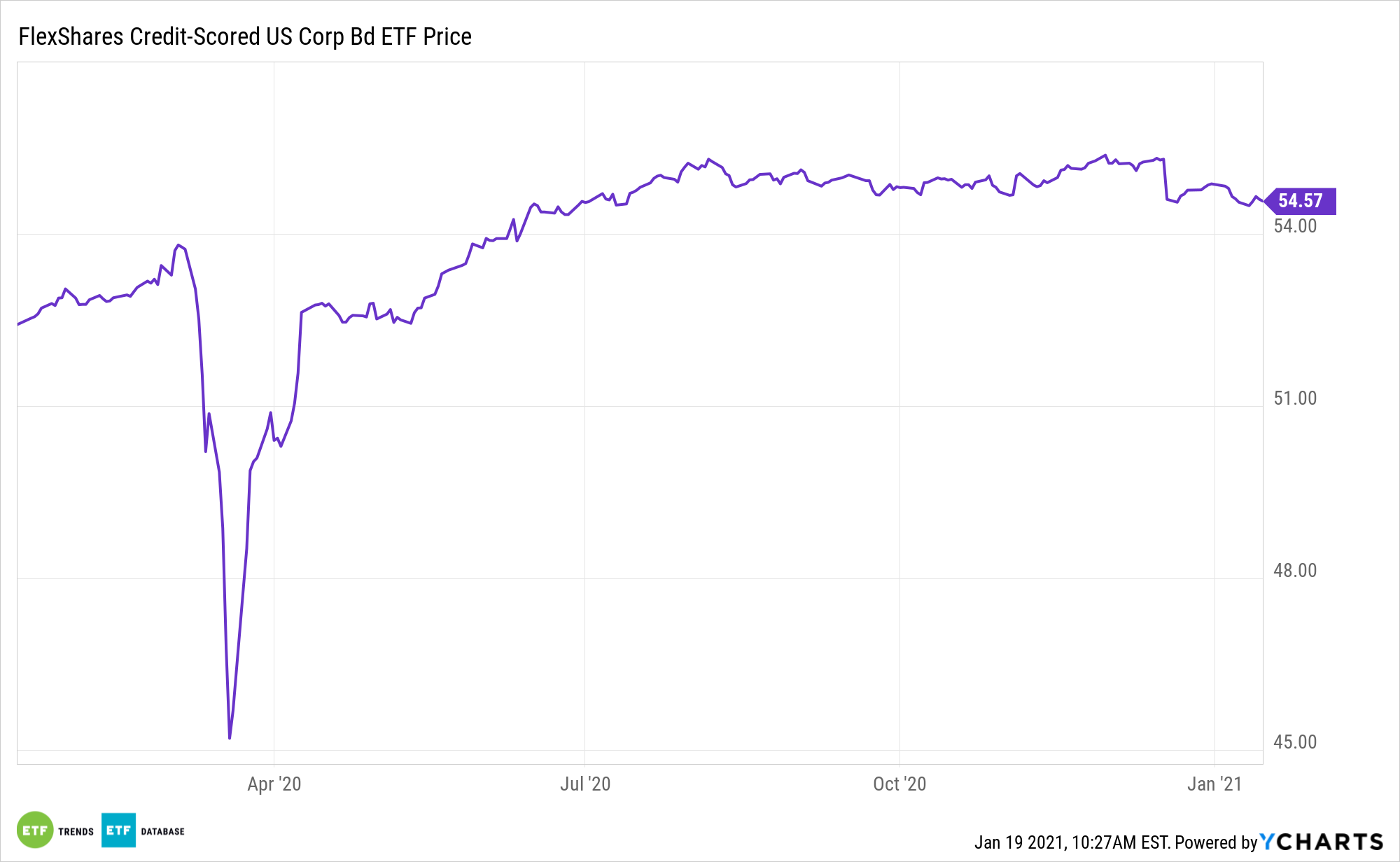

The Federal Reserve provided a vital backstop to the corporate bond market last year. Now, some analysts see the market supporting itself again, spelling opportunity for the FlexShares Credit‐Scored US Corporate Bond Index Fund (NasdaqGM: SKOR).

SKOR tracks the Northern Trust Credit-Scored US Corporate Bond Index, which focuses on issues from companies with quality characteristics such as strength in management efficiency, profitability, and solvency, according to FlexShares.

Unless interest rates unexpectedly rise in dramatic fashion this year, SKOR could be a compelling idea for income investors.

“Corporate credit spreads have completely recuperated and are back to pre-pandemic levels–a notable move since it was only March 2020 when they reached their second-widest level in 20 years,” writes Morningstar analyst Dave Sekera. “As such, barring a sharp increase in underlying interest rates, we expect that the corporate-bond markets are setting up to provide a return that’s equal to, or slightly lower than, their current yield.”

Breaking Down the SKOR ETF

SKOR’s scoring methodology indicates the fund is appropriate for a broad swath of investors, including those looking to reduce risk.

“The FlexShares Credit Scoring Model addresses the corporate bond liquidity challenge by optimizing a carefully selected subset of all credit issuers of which illiquid, orphaned and small lot names have been removed,” according to FlexShares. “The model also takes into account multiple factors to aid in developing improved corporate bond indexes, including the characteristics of issuers’ total debt structure, minimum exposure percentages, and odd-lot trade restrictions.”

SKOR could further be supported this year by companies learning lessons from the coronavirus swoon in March 2020, where markets repudiated heavily indebted firms.

“Another potential risk to corporate bondholders this year is a resumption in debt-funded acquisitions, which typically result in heightened debt leverage and higher credit risk,” notes Sekera. “However, after living through the free-fall and liquidity constraints of early 2020, management teams will be especially wary of leveraging up their balance sheets too much and will be unlikely to risk credit-rating downgrades. Corporations could be willing to issue debt to repurchase shares and leverage up their balance sheets at the expense of their credit ratings, but we expect those instances to be limited in 2021.”

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.