The U.K. has been one of the countries hardest hit by the coronavirus pandemic, but some market observers believe British stocks are ready to deliver again.

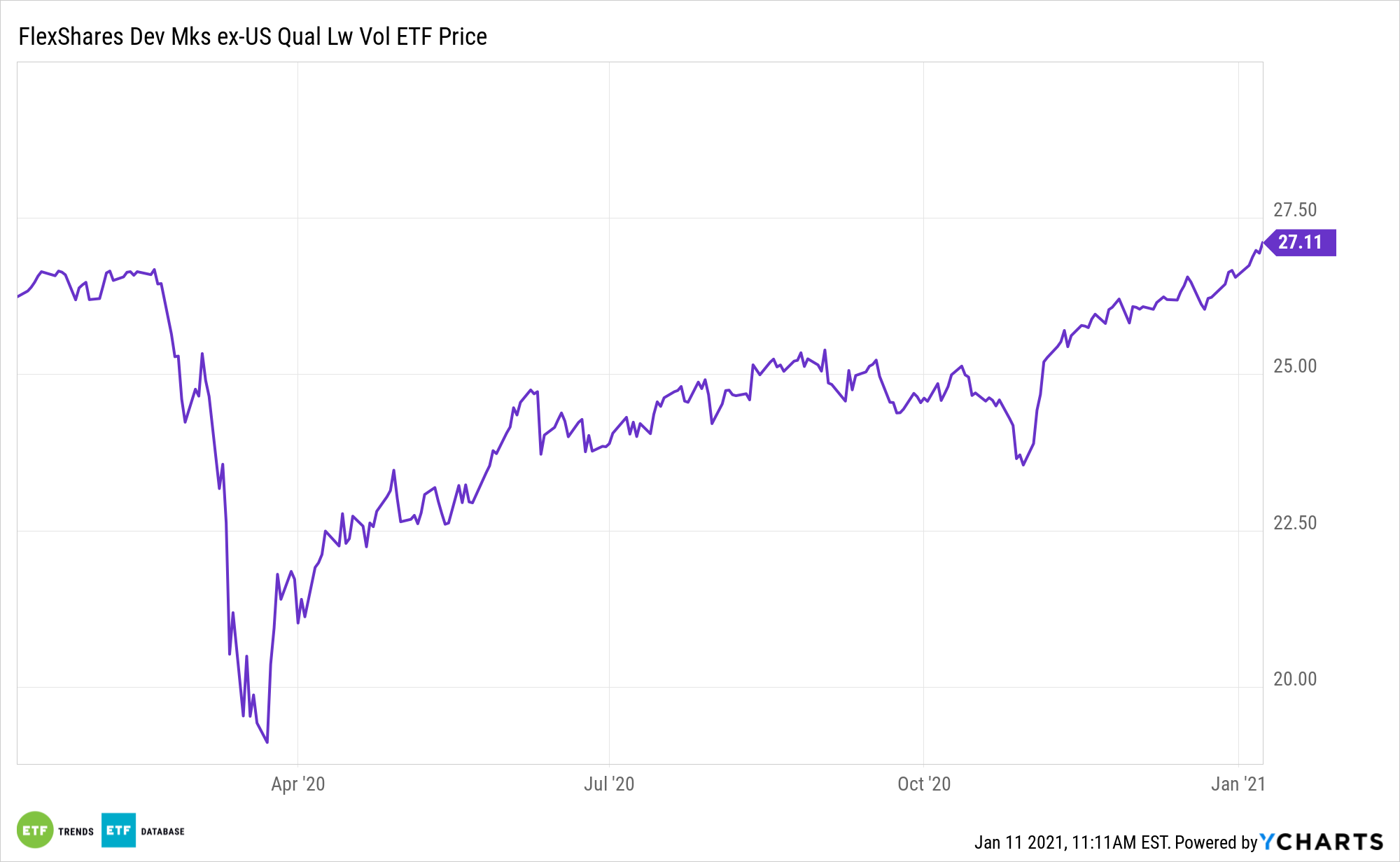

Investors can tap into that theme without the full commitment of a dedicated U.K. exchange traded fund with the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

“Since the Brexit referendum in June 2016, when Britons voted to leave the European Union, stocks in the United Kingdom have been one of the worst- performing major global markets. Uncertainty left valuations for U.K. equities near 20-year lows, relative to Europe,” reports Rupert Steiner for Barron’s.

Why More U.K. Is Good for QLVD

The fate of British stocks is relevant in the QLVD conversation because the country is one of the ETF’s largest geographic exposures. With Brexit nearing conclusion, there’s clarity that could benefit U.K. equities and QLVD.

While a historic trade deal avoided a catastrophic worst-case scenario where the U.K. would break from the EU on Dec. 31 without a trade pact in place, the agreement provides little clarity for financial firms and does not include language on their market access.

Yet “on the upside, vaccine programs offer hope of a return to a normal economic environment, and central banks and governments continue to prop up economies. On Tuesday, the U.K. offered £4.5 billion British pounds ($6.1 billion) in new lockdown grants to support businesses. And the Jan. 20 inauguration of President-elect Joe Biden points to stability from one of the U.K.’s biggest trading partners,” according to Barron’s.

As its name implies, QLVD is a broad developed markets ETF, not a dedicated Europe fund. But it’s exposure to European equities is more than adequate for investors looking some benefits without the full commitment of a European-specific ETF.

Quality should not be conflated with low volatility, but there are times when quality stocks display low volatility traits. That was the case during the March market swoon, indicating that the quality factor can provide some protection during times of elevated market stress. QLVD’s ability to blend both factors gives investors a unique advantage.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.