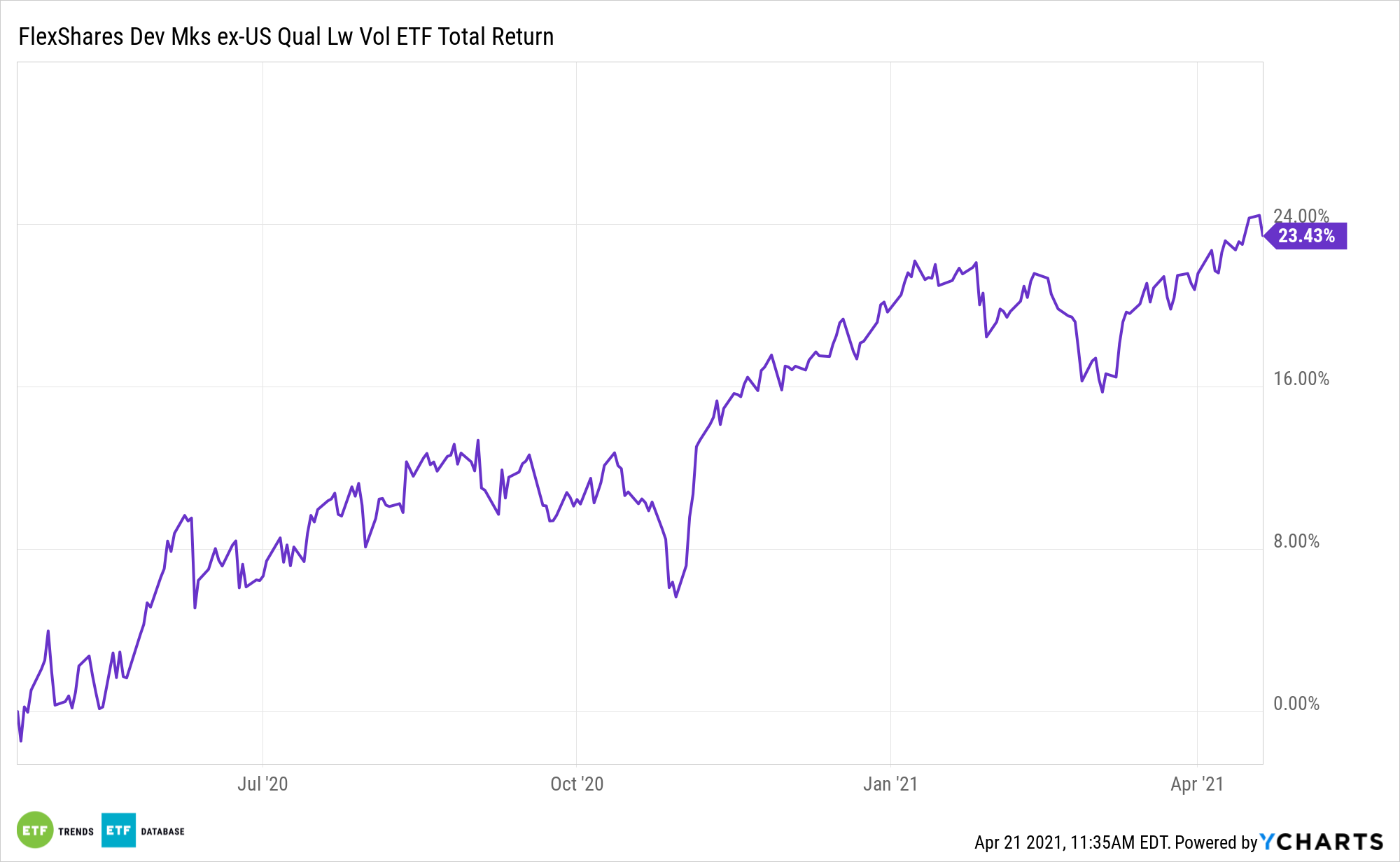

International markets, particularly ex-U.S. developed markets, are where the attractive valuations reside. Investors can get in on the act while reducing risk with the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

That’s a relevant strategy at a time when foreign stocks are some of the best bargains accessible to investors.

“Stocks outside the United States have shown some signs of strength lately. In the fourth quarter of 2020, for example, the Morningstar Global Markets ex-US Index gained 17.4% compared with a 14.2% return for the Morningstar US Market Index,” says Morningstar analyst Amy Arnott. “That quarter was a rare glimmer of hope amid an unusually long performance slump. Over the past 10 years, annualized returns from international stocks have lagged those of their domestic counterparts by more than 7 percentage points per year, on average. The bright side of this long and painful performance slump: While few markets qualify as cheap, non-U.S. markets offer more attractive valuations in relative terms.”

To ‘QLVD’ for the ETF Deals

European stocks are turning in some impressive performances. U.S. investors can participate in that upside without the full commitment with diversified developed markets ETFs like QLVD.

Value-seeking investors can also look to ex-U.S. developing markets like Europe if they want to stay away from the heightened risk posed by investing in emerging markets.

As its name implies, QLVD is a broad developed markets ETF, not a dedicated Europe fund. But its exposure to European equities is more than adequate for investors looking at some benefits without the full commitment of a European-specific ETF.

Quality should not be conflated with low volatility, but there are times when quality stocks display low volatility traits. That was the case during the March market swoon, indicating that the quality factor can provide some protection during times of elevated market stress. QLVD’s ability to blend both factors gives investors a unique advantage.

“On the positive side, the long dry spell for international stocks makes for more attractive valuations. As shown in the chart below, traditional valuation metrics such as price/earnings, price/book, and price/sales are all significantly lower for non-U.S. stocks compared with the domestic market. Japan, some parts of Europe, and the United Kingdom look particularly cheap based on traditional valuation metrics,” adds Arnott.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.