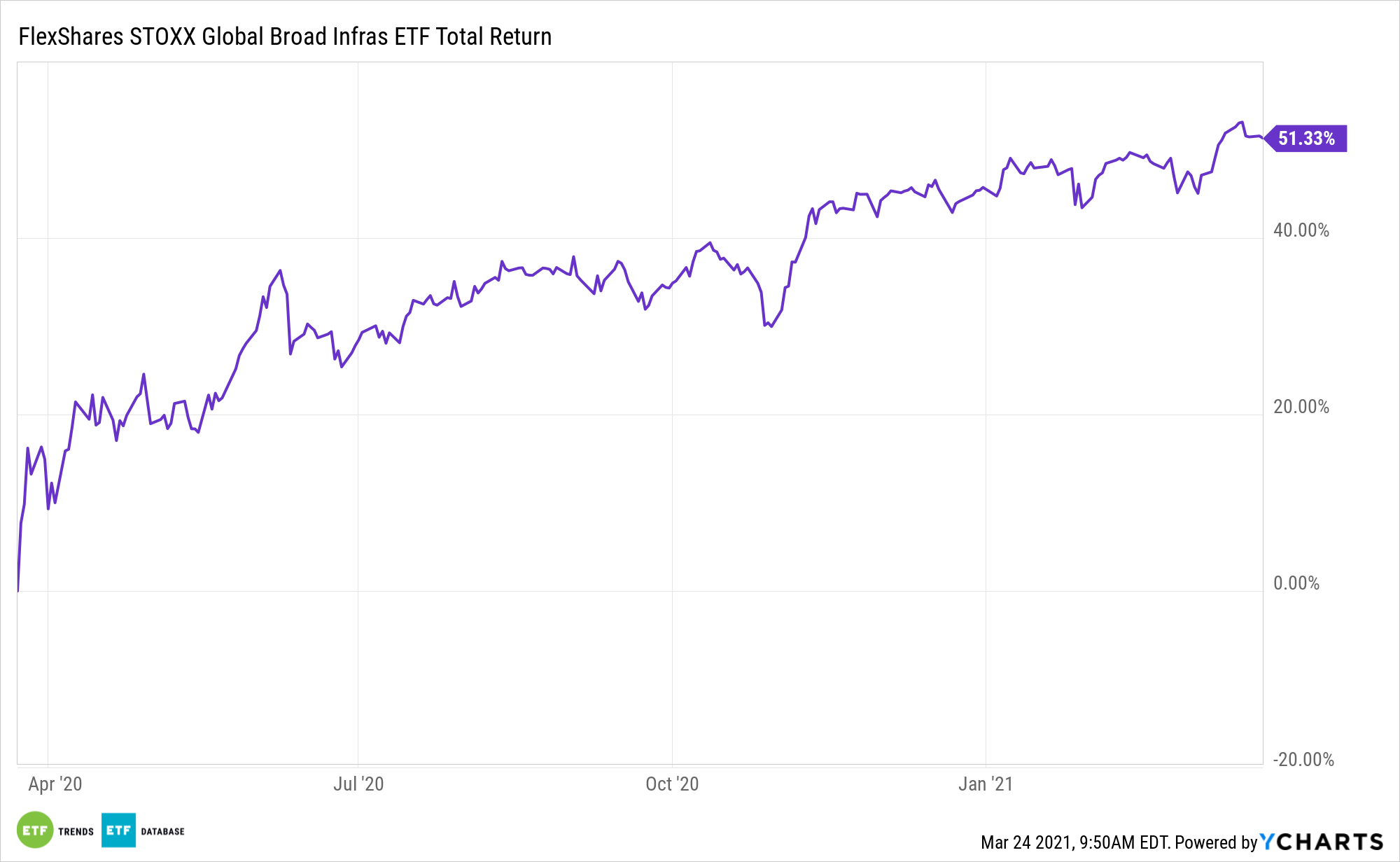

The Biden Administration has ambitious infrastructure plans, and that could put funds such as the FlexShares STOXX Global Broad Infrastructure Index Fund (NYSEArca: NFRA) back in focus for investors.

NFRA tries to reflect the performance of the STOXX Global Broad Infrastructure Index, which identifies equities that derive the majority of revenue from infrastructure business, providing exposure to both traditional and non-traditional infrastructure sectors.

The near-term case for NFRA boils down to the notion that with the $1.9 trillion coronavirus stimulus package in the books, the Biden Administration will turn its attention to shoring up ailing U.S. infrastructure.

See also: Road Is Smoother Than Expected for Infrastructure, Biden Plan or Not

“As President Joe Biden’s infrastructure plans grow, so too does the potential upside for a handful of materials, construction and machinery stocks, according to Goldman Sachs analysis,” reports Thomas Franck for CNBC. “While the brokerage said last week that its infrastructure basket has already made sizable returns since it became clear Democrats would hold majorities in both congressional chambers, Goldman’s calculations were based on the White House floating a plan worth $2 trillion.”

NFRA: Well-Suited for Prescient Infrastructure Questions

NFRA offers investors sound fundamentals and above-average dividend yields, making the asset class appealing in the current market environment.

NFRA’s index focuses on long-lived assets in industries with very high barriers to entry, with at least 50% of their revenue from key sectors with a 3-month average daily trending volume of at least $1 million. The portfolio is weighted based on a free-float market cap with certain constraints to limit exposure in any one security, sub-sector, or country. The fund is rebalanced annually.

Of course, politics play a big role in NFRA’s near-term fortunes.

“Our economists believe that parts of the infrastructure plan may be passed with bipartisan support, but that the majority of the package will eventually pass through reconciliation and rely only on Democratic votes,” said Goldman Sachs Chief Economist David Kostin.

Infrastructure exposure can also help protect against long-term inflationary risks since most infrastructure operators pass through the cost increases of inflation to users per long-term contracts that typically underpin the infrastructure business models. Investors who want to access global infrastructure investments through a liquid vehicle may consider NFRA as an alternative to being forced into the long lock-up periods and high initial investments associated with direct infrastructure exposure.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.