A murky market forecast doesn’t have to be the case when investing in emerging markets (EM). Even if global economic forces remain, getting volatility protection will help deflect the headwinds.

It’s not just emerging markets feeling the pangs of the current inflationary environment but developed countries as well. Certain EM countries were also not as quick to snap back from the economic effects of the pandemic, giving those particular countries a double whammy.

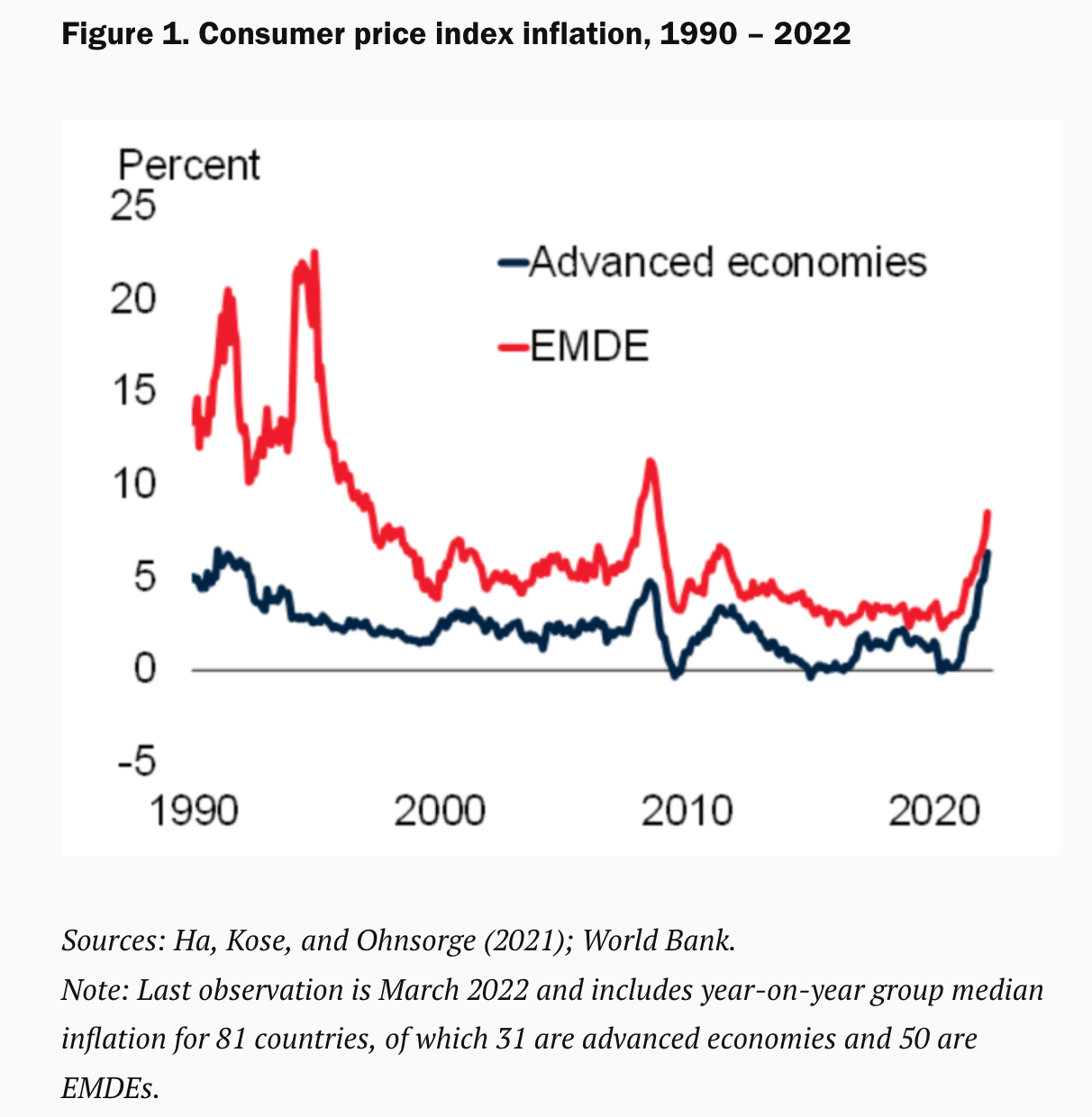

“Many emerging markets and developing economies (EMDEs) have recently been experiencing an unpleasant combination of elevated inflation and rising borrowing costs,” a Brookings Institution article noted. “At 8.5 percent in March 2022, inflation in EMDEs has reached its highest level since 2008 (Figure 1). In advanced economies, inflation is now at its highest level since 1991.”

“Global financing conditions are tightening, as major advanced economy central banks are expected to raise policy interest rates at a faster pace than previously anticipated to contain inflationary pressures,” the article added.

Because EM performance can be tied to the performance of the local currency, a stronger dollar means more downward selling pressure. The U.S. Federal Reserve is fresh off deciding on a 50-basis point rate hike, and more could be ahead through the rest of 2022.

Downside Protection and Upside Growth Potential

EM equities can offer tremendous growth potential despite the current market environment. That said, getting volatility protection can help shield the downside with exchange-traded funds (ETFs) such as the FlexShares Emerging Markets Quality Low Volatility Index Fund (QLVE).

Per its fund description, QLVE seeks investment results that generally correspond to the price and yield performance of the Northern Trust Emerging Markets Quality Low Volatility Index. This index is designed to reflect the performance of a selection of companies that, in aggregate, possess lower overall absolute volatility characteristics relative to a broad universe of securities domiciled in emerging market countries.

QLVE’s country breakdown mainly focuses on Asia. Its top three country allocations, which combine for about 54% as of May 5, are China, Taiwan, and India.

For more news, information, and strategy, visit the Multi-Asset Channel.