It’s no secret that environmental, social, and governance (ESG) assets have become a worldwide phenomenon, and it’s only going to get bigger in the coming years.

“Global ESG assets are on track to exceed $53 trillion by 2025, or more than a third of the $140.5 trillion in projected total assets under management, according to Bloomberg Intelligence,” Bloomberg says. “While Europe accounts for half of global ESG assets, the U.S. is now picking up the fastest and may dominate the category starting in 2022. The next wave of growth could come from Asia — particularly Japan, according to BI research.”

ESG opens up a world of opportunities — literally. Investors can get global exposure and asset diversification as the space starts to see more green bond issuance.

“We’ve raised and will continue to explore customized mission-driven funds to address the diverse needs of our client investors who need to deploy private capital across the globe in this space,” Takashi Murata, co-head of alternative investing in Asia, said in an interview, declining to name the potential partners or the size of the investments. “Our initial ESG investments have been primarily focused on advancing climate transition through clean energy, but our goal is much broader.”

Get Global ESG Exposure

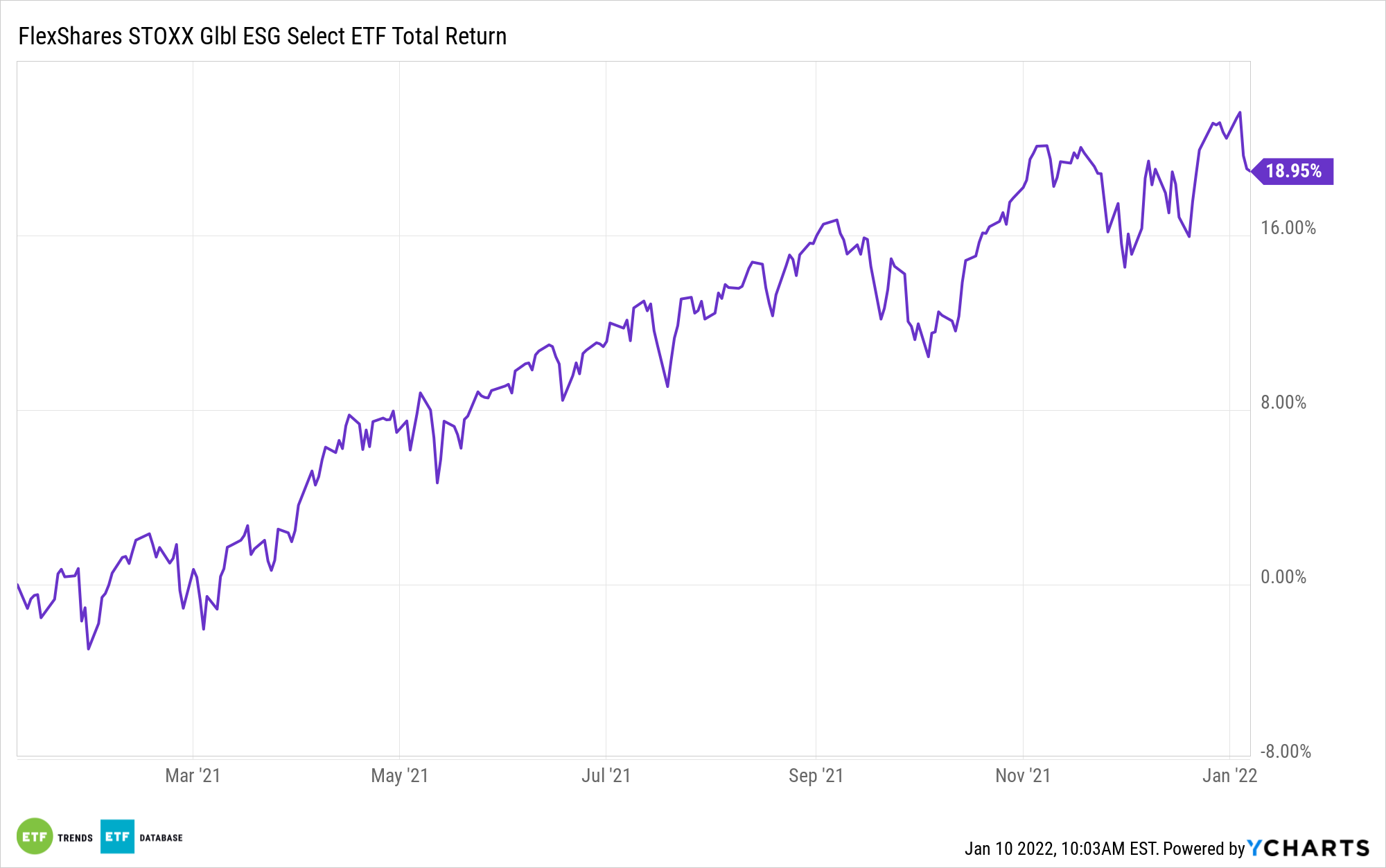

Getting global ESG exposure is possible through a single ETF: the FlexShares STOXX Global ESG Impact Index Fund (ESGG). As of January 7, the sector focus for the fund’s holdings skews mostly towards information technology, consumer discretionary, and financials.

Per the fund’s description, ESGG seeks investment results that correspond generally to the price and yield performance (before fees and expenses) of the STOXX® Global ESG Select KPIs Index. The index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® Global 1800 Index, a float-adjusted market capitalization-weighted index of companies incorporated in the U.S. or in developed international markets.

The fund uses the index as its starting point and then sifts through companies by weeding them out based on the following criteria:

- Companies that do not adhere to the U.N. Global Compact principles

- Companies involved in controversial weapons

- Coal miners

“The FlexShares STOXX Global ESG Impact Index Fund (ESGG) tracks a proprietary STOXX index that rates companies based on environmental, social and governance factors that influence risk and return, such as workplace safety, executive compensation, and board diversity,” an ETF Database analysis says. “The portfolio is weighted in favor of the best performers.”

For more news, information, and strategy, visit the Multi-Asset Channel.