As benchmark Treasury yields continue to flux up and down, investors may want to give active management a closer look to be able to bend with the debt market.

It wasn’t too long ago that rising yields were dousing the capital markets with a large bucket of volatility. Now, yields are starting to flatten.

“The bond market’s mood turned downcast on Wednesday as traders questioned the U.S. economy’s ability to handle a potential rise in interest rates by the Federal Reserve next year and the Treasury yield curve flattened as a result, with similar moves playing out across the world,” a MarketWatch report noted.

The narrative of rising inflation is also not an isolated issue in the U.S. Markets around the world are fretting over the prospect of prolonged inflation that runs counter to the transitory narrative.

“Investors are concerned that the U.S. and other developed-market economies won’t be able to handle higher interest rates to counter higher inflation unleashed by the pandemic,” the report added. “Flattening yield curves — in which long-term yields are either falling relative to shorter-term rates, or not climbing as fast — are also being seen in the 5- and 30-year spreads of the U.K., Germany, Italy, France, Greece and Australia, based on Tradeweb’s data.”

An Active Option in Bonds

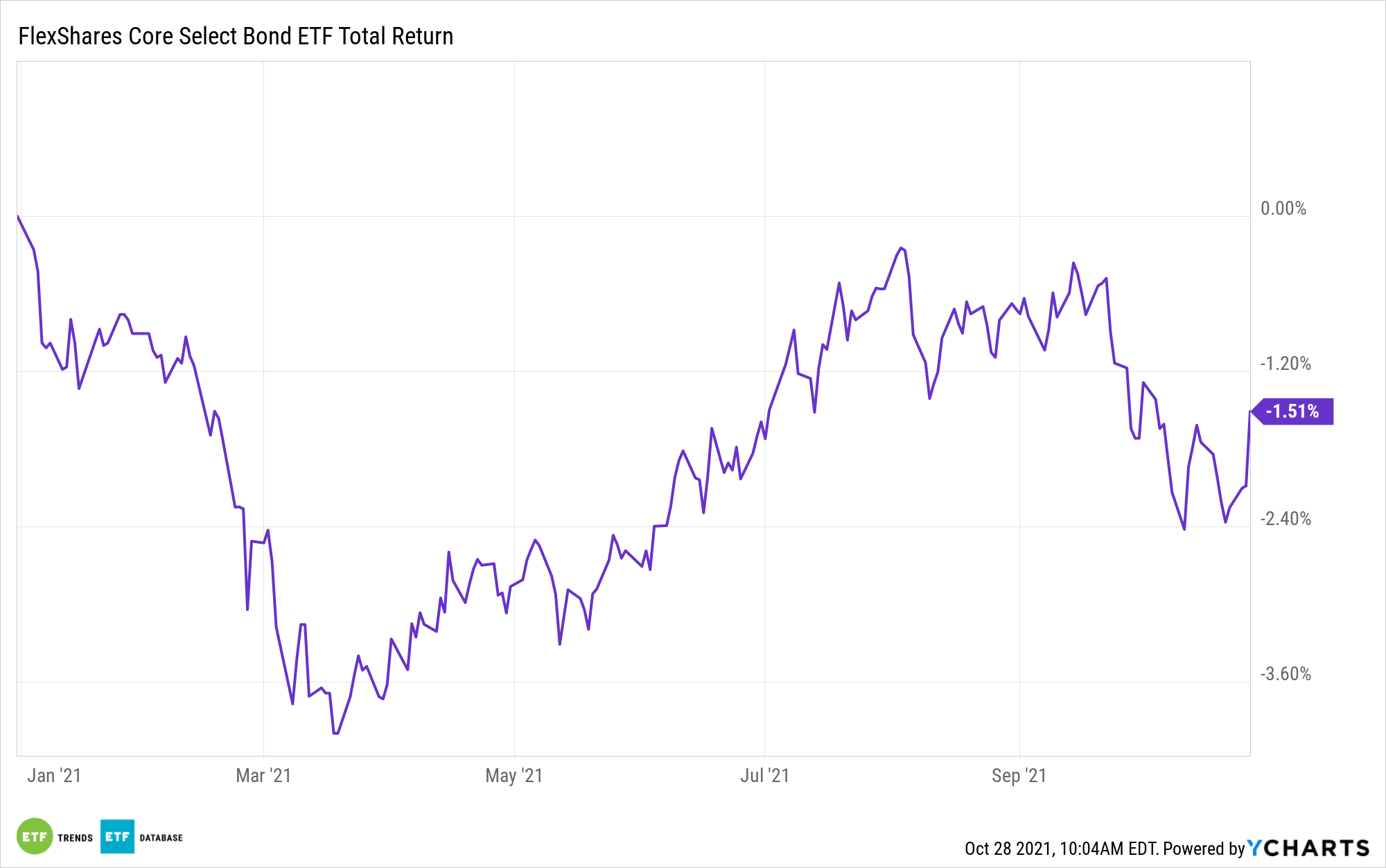

To have the flexibility to move with the markets, ETF investors can look to an actively managed fund like the FlexShares Core Select Bond Fund (BNDC). Active management helps eliminate the guesswork involved in choosing bond ETFs that suit an investor’s portfolio.

BNDC does all the heavy lifting and focuses on investment-grade debt issues to help minimize risk and capture maximum upside. The fund invests at least 80% of its net assets in U.S. dollar-denominated investment-grade fixed income securities either directly or indirectly through exchange traded funds and other registered investment companies.

“The ETF is actively managed by institutional fixed-income managers at Northern Trust, the adviser of the FlexShares funds,” a FlexShares Fund Focus noted. “These managers aim to build a diversified bond portfolio through existing ETFs, using both the FlexShares ETF family and ETFs from other providers, to provide exposure across sectors of the fixed income markets.”

“For example, the Fund captures exposure to the major fixed-income asset classes such as Treasuries, corporate bonds, and mortgage-backed securities (MBS), while also choosing ETFs that offer potentially more refined, value-added exposures to a variety of products such as TIPS,” the Fund Focus added.

For more news, information, and strategy, visit the Multi-Asset Channel.