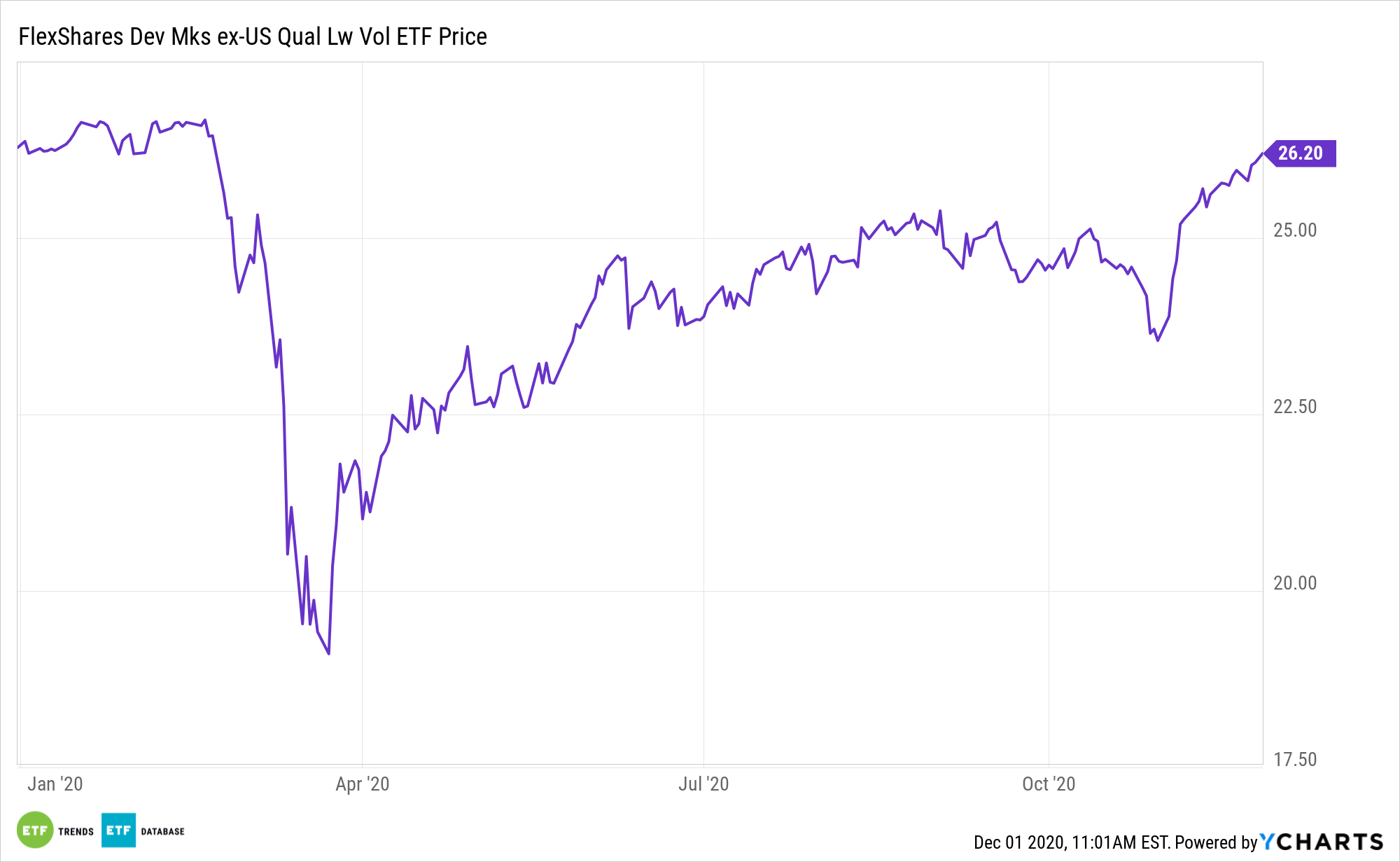

European equities are cobbling together some momentum to end 2020, but after years of under-performance by the asset class, investors are understandably hesitant about embracing these stocks. An idea to consider revisiting Europe without the full commitment is the FlexShares Developed Markets ex-US Quality Low Volatility Index Fund (NYSE: QLVD).

QLVD’s quality screen analyzes a broad universe of equities based on key indicators such as profitability, management efficiency, and cash flow, and then excludes the bottom 20% of stocks with the lowest quality score. The index is then subject to the regional, sector, and risk-factor constraints, in order to manage unintended style factor exposures, significant sector concentration, and high turnover.

QLVD is an alluring idea heading into 2021 as some analysts expect global stocks will finally catchup to U.S. counterparts.

“Investors hoping for more gains from equities next year may be in luck, but if there were ever a time to go global, 2021 will be it,” reports Barbara Kollmeyer for Barron’s. “That is according to a team of JPMorgan strategists led by Mislav Matejka, that has shifted to an overweight or bullish position on eurozone and Japan equities, at the expensive of the U.S., which it has cut to neutral. In the even bigger picture, the team expects emerging markets to dominate over developed.”

The QLVD ETF: The Best of Europe, and Other Developed Economies

As its name implies, QLVD is a broad developed markets ETF, not a dedicated Europe fund. But it’s exposure to European equities is more than adequate for investors looking for that trait without the full commitment of a European-specific ETF.

Quality should not be conflated with low volatility, but there are times when quality stocks display low volatility traits. That was the case during the March market swoon, indicating that the quality factor can provide some protection during times of elevated market stress. QLVD’s ability to blend both factors is a potential advantage for investors.

“European markets are gradually gaining ground, with vaccine hopes being counteracted by US stimulus and lockdown fears,” said Joshua Mahony, Senior Market Analyst at IG. “Meanwhile, the October UK retail sales figure helps alleviate some of the anxiety ahead of a crucial period for retailers. Tentative European gains this morning appear to maintain the ongoing consolidation phase, as markets tread water in the wake of the vaccine boost seen over the past two Mondays.”

One of the enduring themes will be the continued response to the COVID-19 pandemic with stimulus measures implemented by the government.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.