The Biden Administration’s plan to push forward a $3 trillion infrastructure proposal isn’t a done deal yet, but if it comes to life, it will carry significant implications for an array of exchange traded funds.

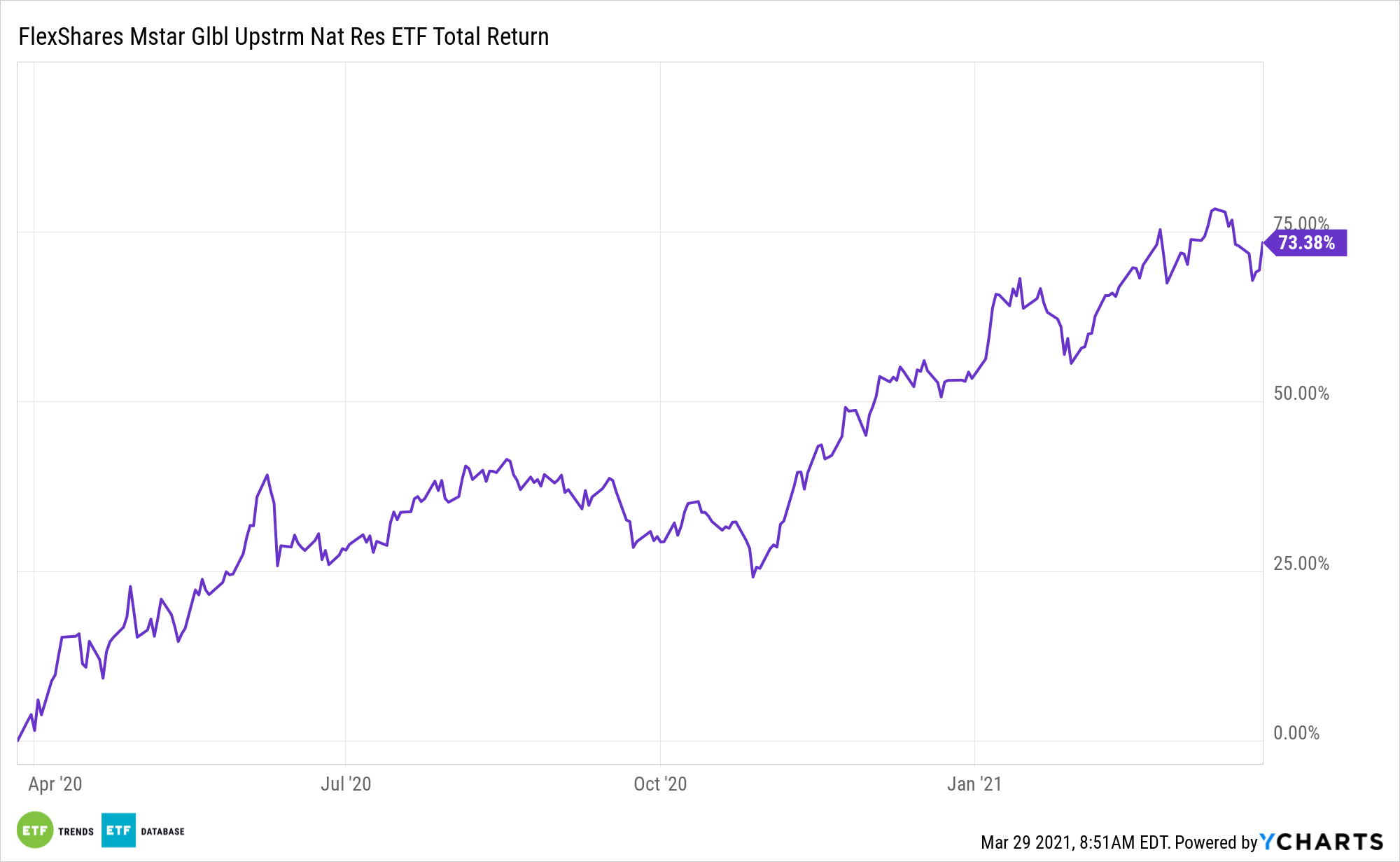

Investors shouldn’t sleep on the FlexShares Morningstar Global Upstream Natural Resource Index Fund (NYSEArca: GUNR).

“U.S. energy producers are aiming to have key industry priorities addressed as President Joe Biden and congressional lawmakers work to draft massive legislation to upgrade the country’s aging infrastructure,” reports S&P Global Market Intelligence. “Energy and mining trade groups hope the plan will tackle a whole host of issues, ranging from the need to ease power transmission permitting to providing support for greater domestic minerals production to feed the clean energy transition.”

GUNR provides exposure to the rising demand for natural resources, and tracks global companies in the energy, metals, and agriculture sectors. It maintains a core exposure to the timberlands and water resources sectors, part of its risk management theme. Translation: it’s a great infrastructure play for today.

Why Go with ‘GUNR’?

“Democrats in Congress have also floated infrastructure proposals that include major climate provisions,” according to S&P Global. “On March 11, Democrats on the House Energy and Commerce Committee proposed a $312 billion infrastructure bill that would devote nearly $70 billion to clean energy and energy efficiency and $48.1 billion to electric vehicle deployment, clean ports and smart cities. The legislation followed the committee’s introduction of a broad climate bill that aligns with Biden’s decarbonization targets.”

See also: With an Infrastructure ‘Supercycle’ Looming, Turn to ‘NFRA’

GUNR specifically identifies upstream natural resources equities based on a Morningstar industry classification system, with a balanced exposure to three traditional natural resource sectors, including agriculture, energy, and metals. With some wild moves in downtrodden energy stocks, the gambling element of energy investing is back, but investors can take some risk out of the equation with GUNR. Last year, GUNR performed less poorly than the Bloomberg Total Return Commodity Index and the S&P Global Natural Resources Index. Over the past five years, GUNR has generated average annualized returns of 4.7%, beating both of those benchmarks.

“A major energy infrastructure buildout could send demand for mined materials through the roof, especially with an increased focus on electrifying the transportation sector through electric vehicles,” concludes S&P Global.

That could be a boon for materials companies in GUNR’s lineup.

For more on multi-asset strategies, visit our Multi-Asset Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.