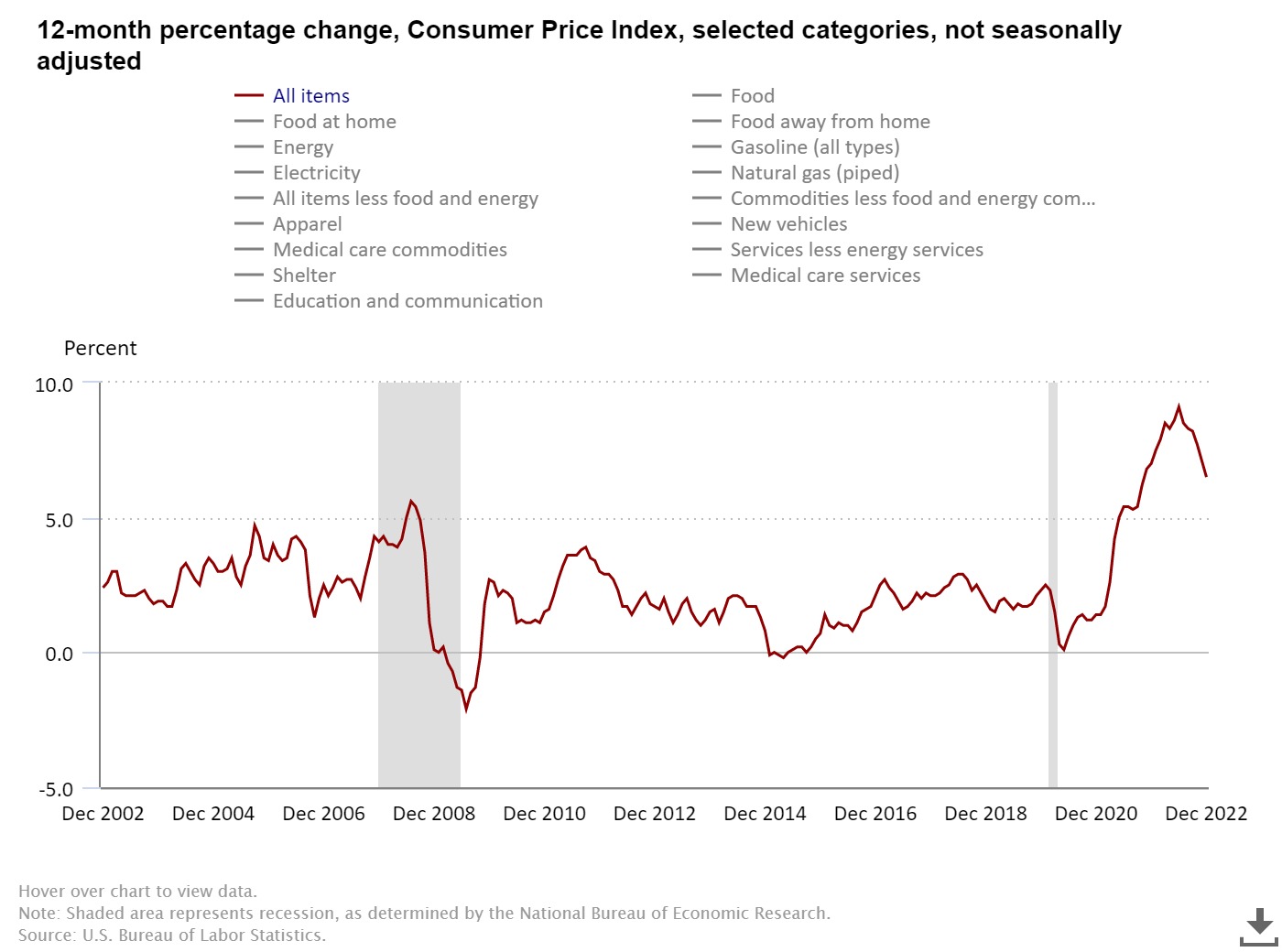

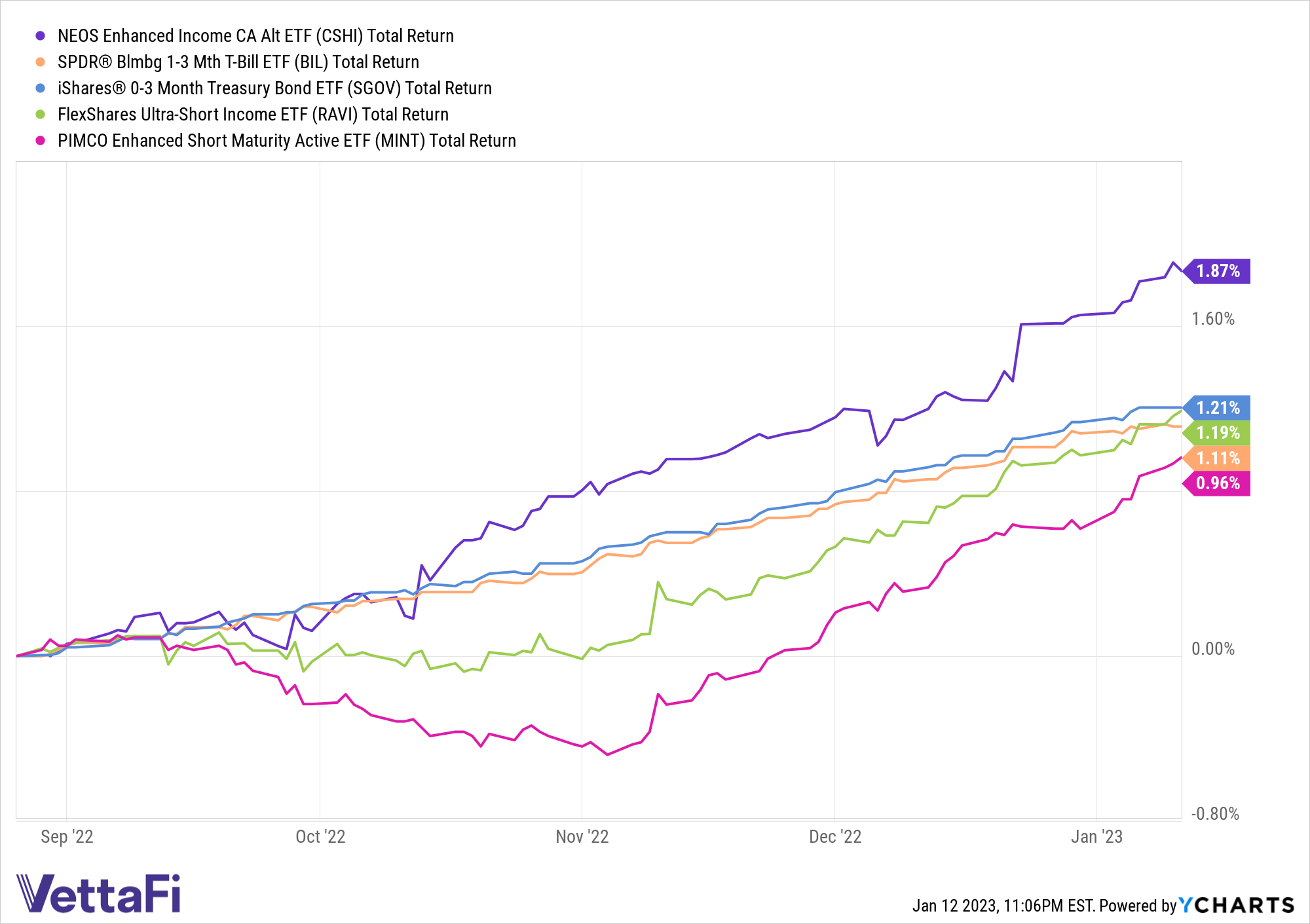

December’s consumer price report revealed marginally cooling inflation but is still up 6.5% over last year. On the heels of Thursday’s hopeful CPI report came bank earnings Friday that resoundingly reflect the challenging economic environment in the months to come. For those advisors and investors looking to position defensively in cash alternatives, the NEOS Enhanced Income Cash Alternative ETF (CSHI) is worth consideration, given its outperformance in the last three months.

Thursday’s markets bounced on the CPI news of a 0.1% drop month-over-month and a 0.3% month-over-month gain in core CPI (excludes food and energy) in hopes that inflation might finally be peaking.

Image source: U.S. Bureau of Labor Statistics

Friday’s fourth-quarter earnings reports from major banks gave a gloomier outlook however, with all banks reporting major financial provisions for credit losses in the quarter as they anticipate rising defaults due to economic hardship. JPMorgan increased its default provisions by 49% quarter-over-quarter to $2.3 billion, well above analyst expectations. Citigroup has set aside $1.85 billion, a 35% quarter-over-quarter increase and also above analyst expectations. Wells Fargo set aside $957 million in the quarter.

Banks are resoundingly positioning for at least a mild recession and for advisors and investors looking to expand or allocate to short-duration cash alternatives, the NEOS Enhanced Income Cash Alternative ETF (CSHI) is an actively managed ETF to consider, particularly given its total return outperformance recently.

CSHI launched in August 2022 and already is garnering attention. It’s an options-based fund that is long 3-month Treasuries and also sells out-of-the-money SPX Index put spreads that roll weekly to account for market changes and volatility. It seeks to deliver 100-150 basis points above what 90-day Treasuries are yielding while also taking advantage of tax loss harvesting opportunities and the tax efficiency of index options.

The put options that the fund uses are not ETF options but instead are S&P 500 index options that are taxed favorably as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value, and, most importantly, any capital gains or losses are taxed as 60% long-term and 40% short-term no matter how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI currently has a distribution yield of 5.06% as of 12/30/2022 and an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.