A blockbuster sales forecast sent Nvidia (NVDA) stock and market cap skyrocketing Thursday. The NEOS S&P 500 High Income ETF (SPYI) provides exposure to the S&P 500 while generating enhanced monthly income. The fund captured the gains that buoyed the major equity index higher and is a fund to consider, particularly in challenging times.

Nvidia is lining up to be the first chip manufacturer to have a market capitalization of over $1 trillion. It would join the likes of other mega-cap companies like Apple, Alphabet, and Microsoft.

Recent upwards revisions meant Nvidia now forecasts $11 billion in sales in the three months that end in July this year. The higher forecast is mainly due to AI demand for processors and Nvidia’s optimal positioning.

Nvidia is “without a doubt in pole position,” Geoff Blaber, CEO of CCS Insight, told FT. This is “because they provide a very comprehensive toolchain that no other company is able to currently.”

The company’s stock soared 24% on Thursday, boosting its market cap to $184 billion. Financial Times reported it as the largest single-day gain ever for a stock in the U.S., according to Bloomberg data.

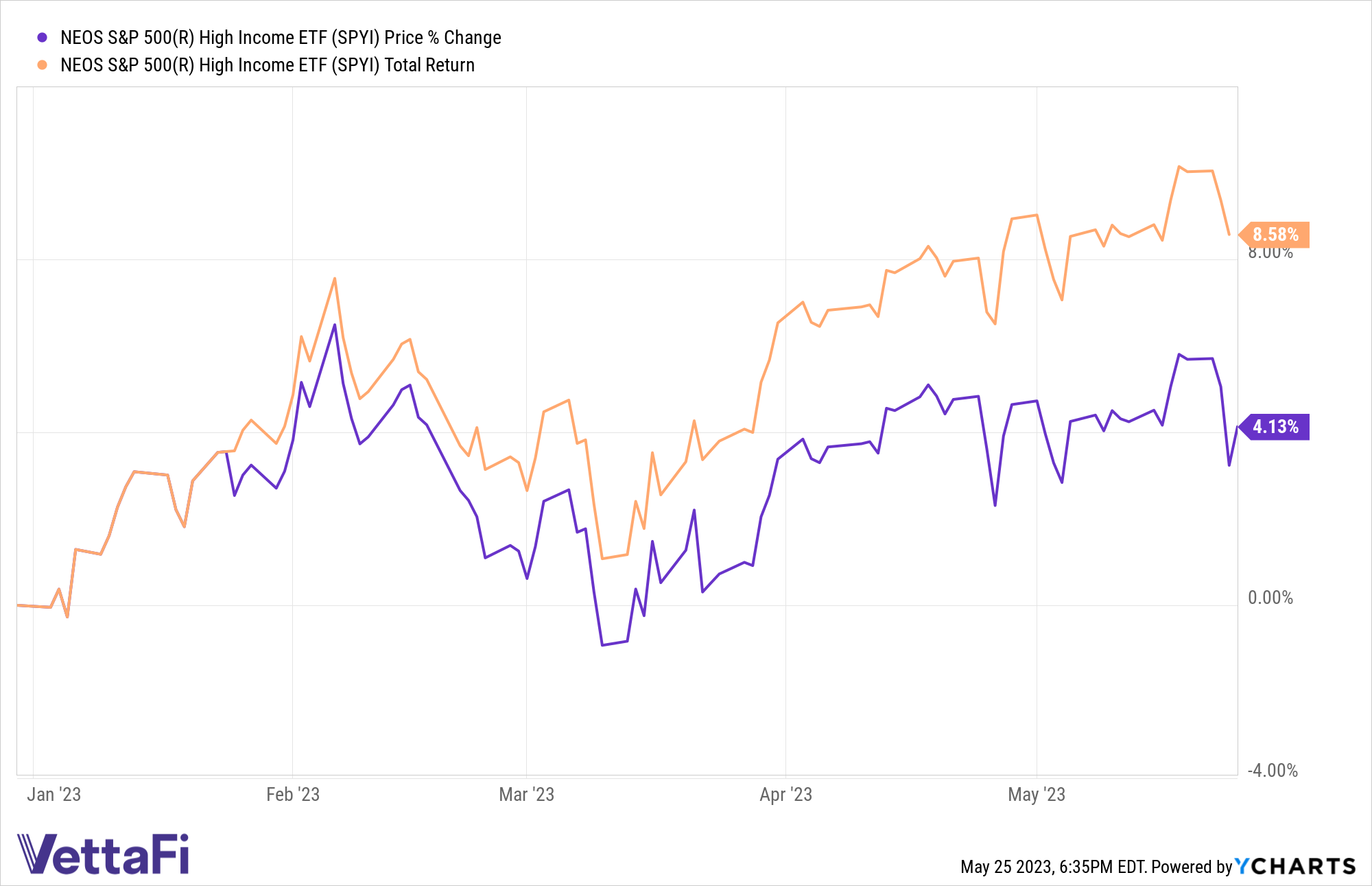

SPYI Captures S&P 500, Nvidia Gains, Offers Significant Yields

The NEOS S&P 500 High Income ETF (SPYI) is an actively managed fund launched last year and seeks to provide high-income opportunities for portfolios within equities. The fund also works to preserve the income generated through its options overlay in times of market stress. Nvidia is carried at a 2.19% weight within SPYI.

SPYI has a distribution yield of 12.31% as of 04/30/23 and a 30-day SEC yield of 1.05% (doesn’t include options income).

See also: “An Advisor’s Guide to Understanding ETF Yield”

The ETF seeks to fully replicate the S&P 500 Index and also utilizes a call options strategy layered on top. Call options give buyers the right but no obligation to buy the underlying asset at a specific price (the strike price) within a timeframe.

Generating Income With Tax Efficient Index Options

SPYI seeks to provide higher income through call options the fund writes that it earns premiums on. It then can use the money earned from the written calls to buy long, out-of-the-money call options on the S&P 500 Index.

An out-of-the-money call option has no intrinsic value. That’s because the current price of the underlying asset is below the strike price of the call. Should equities rise or fall, NEOS can actively manage the call options to capture gains in the underlying assets or minimize losses.

The options that the fund uses are index options, taxed favorably as Section 1256 Contracts under IRS rules. Options held at the end of the year are treated like they were sold on the last market day of the year at fair value. Any capital gains or losses are taxed 60% long-term and 40% short-term, no matter how long investors held them. This can offer noteworthy tax advantages.

The fund’s managers also engage in tax-loss harvesting opportunities throughout the year on the call options, equity holdings, or both.

SPYI has an expense ratio of 0.68%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.