The grim economic outlook for the U.S. this year has taken a heavy toll on equities and corporate earnings estimates, resulting in the value of holding stocks over bonds hitting lows not seen since 2007. While the equity outlook continues to face challenges from looming potential recession and high inflation, advisors should consider the opportunities happening right now in bonds, and the income potential with the NEOS Enhanced Income Aggregate Bond ETF (BNDI).

The equity risk premium currently sits at about 1.59 percentage points, the lowest level it has been since October 2007, and well below its average difference of about 3.5 percentage points since the Financial Crisis. Equity risk premium is defined by the measurement of the spread between the S&P 500’s earnings yield and the yield of the 10-year Treasury Note as a baseline measurement for equity risk, though this calculation can be broken out to individual stocks.

Image source: WSJ

Recession risk and the added risk of banking crisis has prompted volatility and uncertainty, resulting in an influx of investors into Treasuries, driving down yields which move conversely to prices. With the Fed now having to contend with potential banking sector instability and stress, the likelihood of much more aggressive rate hiking has been significantly reduced. Powell indicated post-FOMC meeting in March that an end to interest rate hikes could be near, opening up the door further for bonds which have languished in an aggressively rising rate environment.

It is worth noting that the long-term average equity premium since 1957 is 1.62 percentage points and that the current equity risk premium aligns more closely with the longer-term norm versus the window since the Financial Crisis when the Fed put created a long bull run for equities in an environment of low risk.

Seek Income Within Bonds with BNDI

Bonds are likely to continue to flourish in an environment of decreasing interest rate risk in the months to come. The NEOS Enhanced Income Aggregate Bond ETF (BNDI) is an actively managed ETF that seeks to offer enhanced monthly income distributions for investors by investing across the broad U.S. Aggregate Bond Market while also implementing a tax-efficient options strategy that generates additional income. The fund invests in the Vanguard Total Bond Market ETF (BND) and the iShares Core U.S. Aggregate Bond ETF (AGG) to gain broad exposure to the U.S. bond market.

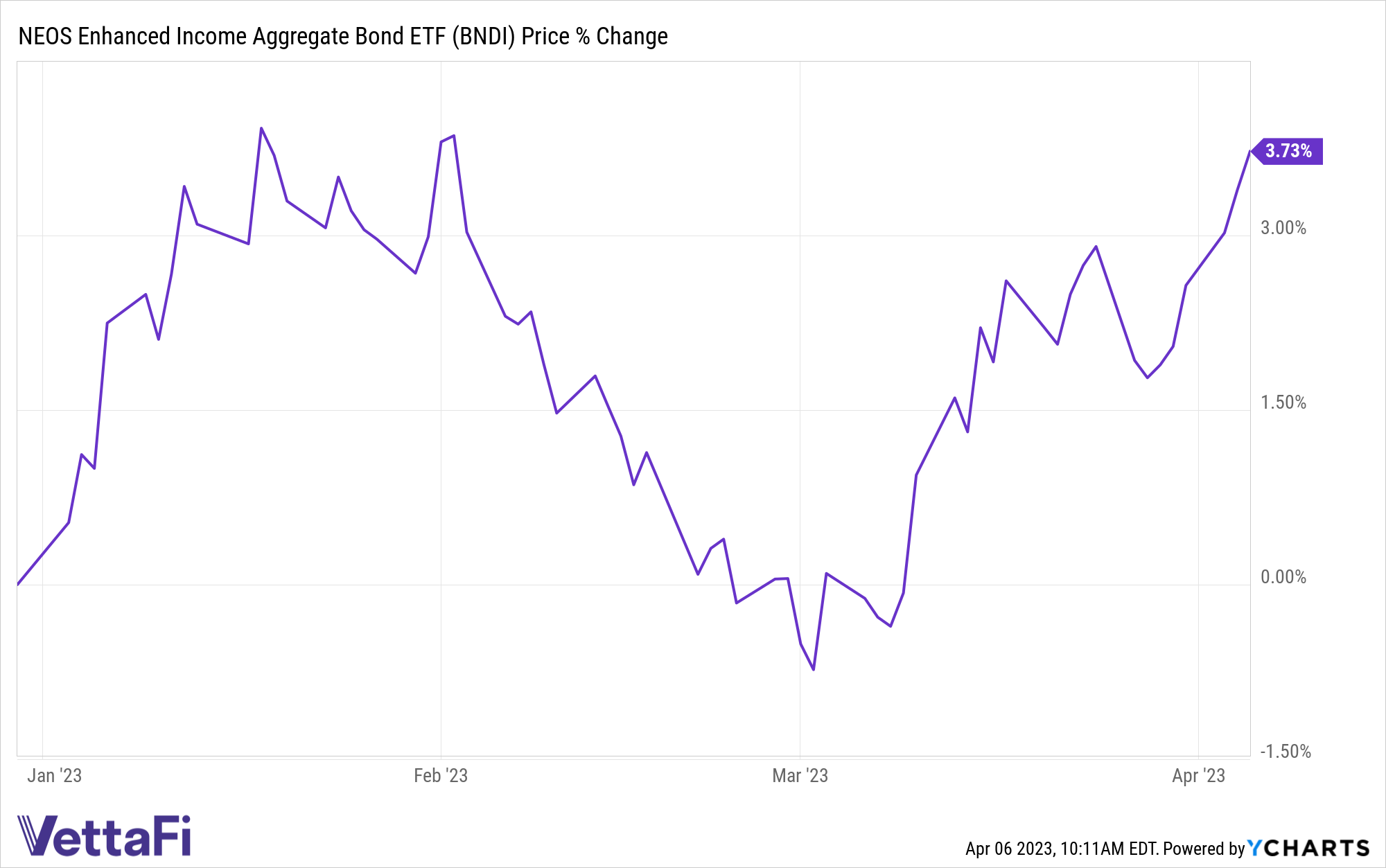

BNDI currently has a distribution yield of 5.14% and a 30-day SEC yield of 1.97% as of 03/31/2023 and is up 3.73% YTD.

The income and capital gains that BNDI receives from its bond allocations are enhanced by the addition of monthly income from the fund’s put-option strategy on the S&P 500, which sells short puts while also buying long puts to protect for volatility.

The strategy is expected to offer positive returns in both flat and rising equity markets and can generate positive returns in moderately-declining equity markets as long as the premium from the puts bought and sold is greater than the cost to close out the positions. Additional benefits of an options-based strategy can mean that the fund may offer a lower correlation to certain risk factors, including duration, credit, and inflation risk.

The put options that the fund uses are not ETF options but instead are S&P 500 index options, which are taxed favorably as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value, and, most importantly, any capital gains or losses are taxed as 60% long-term and 40% short-term no matter how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

BNDI currently has an expense ratio of 0.58%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.