The invasion of Ukraine, a breadbasket of Europe, by Russia has seen commodity prices that were already rising pushed up even higher. Now, with investors betting on higher long-term inflation than before the war, hot commodity prices could be a deciding factor in Fed interest rate increases for a while, reported Financial Times.

A measure of market sentiment surrounding future interest rates is the five-year, five-year forward rate which measures the inflation forecast over a period of five years, starting five years from today. That percentage rose to 2.5%, where it was 2.1% before commodity prices skyrocketed due to the Russian invasion of Ukraine.

Commodities have soared globally, with Brent crude reaching a 14-year high this week, and natural gas, wheat, and nickel have all seen sharp upward price movement. Investors have been piling into commodities funds more rapidly than before when the concern was simply inflation.

“For the duration of this year, we are going to be looking at very, very high inflation in the US at every upcoming Fed meeting,” said David Mericle, an economist at Goldman Sachs. “I just don’t see them going through a meeting with inflation so far above their target and not delivering a rate hike.”

The Fed faces a difficult task of finding the balance of bringing down inflation, driven further by high commodity prices, including energy costs which negatively impact businesses and consumers, while also not tightening too sharply and staggering economic growth, forcing a recession.

“The Fed is going to be hiking on eggshells,” said Meghan Swiber, a rates strategist at Bank of America.

Investing in Commodities With Diversification

For investors looking to diversify their portfolios in times of inflation and rising interest rates while also capturing any potential increase in commodities pricing, the WisdomTree Enhanced Commodity Strategy Fund (GCC) can be an excellent option.

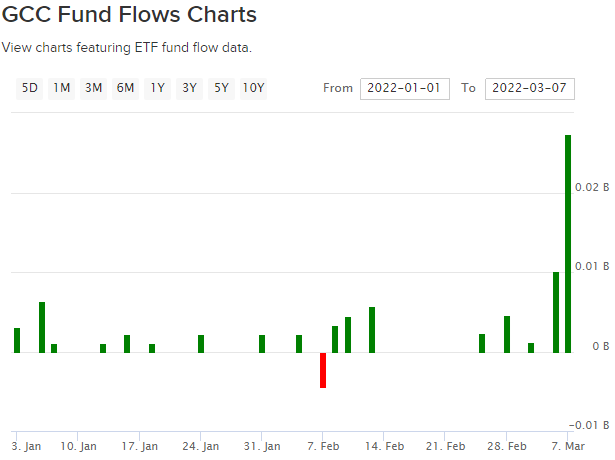

Image Source: ETFdb.com data courtesy of FactSet

GCC has seen net inflows of $75.92 million since the beginning of the year through March 7, with $27.35 million in inflows on March 7.

GCC invests in a basket of commodities and bitcoin futures in seeking diversification in assets that are uncorrelated to most equities and fixed income returns. The fund is an actively managed ETF that offers broad exposure to the following commodities sectors: agriculture, energy, industrial metals, and precious metals, mainly via futures contracts. It can also invest up to 5% of its net assets into bitcoin futures contracts, a regulated space under the purview of the CFTC, but it does not invest directly in bitcoin.

The current weighting of GCC is 32.49% to energy, 22.89% to industrial metals, 18.74% to grains (agriculture), 13.95% to precious metals, 6.07% to softs (agriculture) such as cotton and sugar, 3.47% to livestock (agriculture), and 2.39% to bitcoin futures.

GCC carries an expense ratio of 0.55%.

For more news, information, and strategy, visit the Modern Alpha Channel.