While U.S. equity markets are down in 2022, advisors have not experienced significant benefits of diversification through international equity markets, particularly if they ignored the small suite of currency-hedged products available. Indeed, the iShares MSCI EAFE ETF (EFA) was down 12% year-to-date through June 8, with the Japan segment of the index down 15%.

Do you remember the commercials on CNBC in 2015 that described how you could take yen out of Japan with the WisdomTree Japan Hedged Equity ETF (DXJ)? The ability for an advisor to easily provide exposure to global companies like Nintendo and Toyota Motor but limit the impact of fluctuations in the yen relative to the U.S. dollar was highly compelling.

However, advisors were also able to obtain exposure to broader developed markets through ETFs like the Xtrackers MSCI EAFE Hedged Equity ETF (DBEF). DBEF owns the same 800-plus constituents in the MSCI EAFE Index, companies like AstraZeneca and Nestle, but mitigates the effects of the movement of 13 currencies, including the yen and euro.

Currency-hedged ETFs were as popular as Crocs and the ice bucket challenge in the middle of the last decade, but also largely fell out of favor. In the past five years, DXJ had $6.8 billion of redemption, while DBEF had $5 billion of net outflows. The iShares Currency Hedged MSCI EAFE ETF (HEFA), which only launched in 2014, had $1 billion of net outflows in the last five years However, in what might be a sign of life, HEFA and DXJ had $230 million and $85 million of net inflows, respectively, in May; DBEF did not experience any such demand.

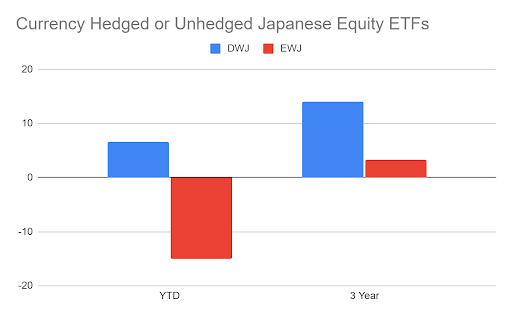

What is surprising about the demand over the intermediate term is that these funds added value when compared to un-hedged alternative strategies. In the three-year period that ended June 8, DXJ was up 14% on an annualized basis, ahead of the 3.3% gain for the iShares MSCI Japan ETF (EWJ). In 2022, DXJ’s 6.6% gain sharply outpaced the 15% loss for EWJ.

As of June 8, 2022

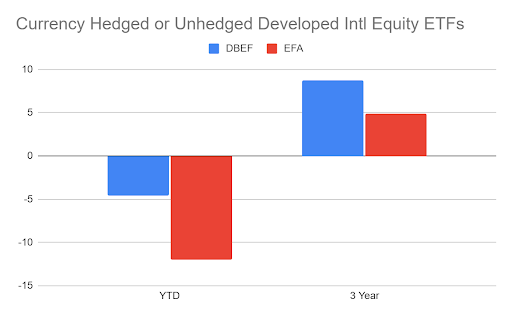

DBEF’s returns have also been impressive. In the past three years, DBEF’s 8.7% annualized return was stronger than the 4.9% for the iShares MSCI EAFE ETF (EFA), While DBEF has lost 4.6% in value in 2022, the currency-hedged offering’s return was approximately 750 basis points narrower than the unhedged product. HEFA, which is a nearly identical peer of DBEF, performed similarly well compared to EFA.

As of June 8, 2022

With $4.2 billion, $3.8 billion, and $2.0 billion in assets, respectively, DBEF, HEFA, and DXJ are smaller in size than they used to be, but they are three of the industry survivors. Indeed, the ETF graveyard is littered with currency-hedged equity ETFs that died too early to demonstrate likely recent performance success.

In 2017, the ProShares Hedged FTSE Japan ETF (HGJP), the PowerShares Europe Currency Hedged Low Volatility Portfolio (FXEU), and others ceased trading; the PowerShares brand was also sent packing in place of Invesco.

In 2018, the iShares Edge MSCI Min Vol Currency Hedged ETF (HEDV), the Xtrackers MSCI EAFE Small Cap Hedged Equity Fund (DBES), and others were shut down.

In 2019, the JPMorgan Diversified Return International Currency Hedged ETF (JPIH), the WisdomTree Global Hedged Small Cap Dividend Fund (HGSD), and others were removed from the market.

In 2020, the IQ 50 Percent Hedged FTSE Japan ETF (HFXJ), the iShares Currency Hedged MSCI Italy (HEWI), and others disappeared.

In 2021, the iShares Adaptive Currency Hedged MSCI EAFE ETF (DEFA) and the FlexShares Currency Hedged Morningstar DM Ex-US Factor Tilt ETF (TLDH) were sent to the graveyard.

It is understandable that asset managers lost patience that demand for currency-hedged equity strategies would return. However, given the recent performances of DBEF, HEFA, and DXJ, we think advisors will start to take a closer look at the strategies to boost their portfolios. Unlike five years ago, there’s fewer choices to consider.

To see more of Todd’s research, reports, and commentary on a regular basis, please subscribe here.

For more news, information, and strategy, visit VettaFi.