The Fed has given clear messaging that it’s not backing down from interest rate increases any time soon while inflation persists and the jobs market remains robust. As recently as today, Federal Governor Christopher Waller spoke in support of a potential 0.75% increase at the Fed meeting later this month, according to CNBC.

Soaring inflation and rising interest rates have taken their toll on equities and bonds alike, with growth stocks hit the hardest as advisors and investors turn to value and dividend-yielding companies, a play that has traditionally rewarded investors during times of economic downturn.

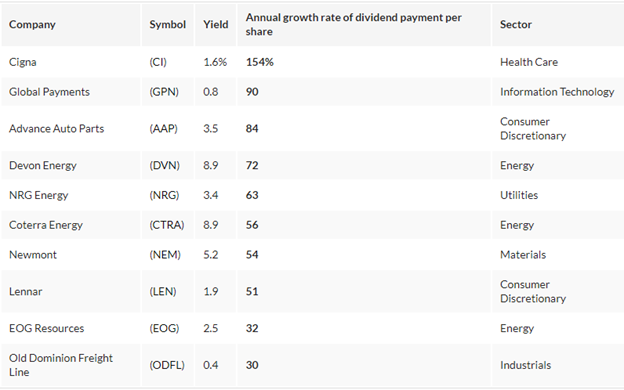

It hasn’t been all doom and gloom: there are a host of companies within the S&P 500 that are growing their annual dividend payment rate aggressively, with the top company, Cigna, increasing at a rate of 154%. Other companies, such as Advanced Auto Parts, have an annual dividend growth rate of 84% this year, with companies across sectors such as energy and utilities also clocking high dividend growth.

Image source: Investors.com

At a time when dividend plays have become much more popular and are experiencing a surge in investor interest, the WisdomTree U.S. Value Fund (WTV) offers exposure to dividend companies as a value play. It is an actively managed fund that combines investment in buybacks with dividends that can be stronger performers in a market downturn. Cigna is the second highest allocation of the fund at 1.67%, and Advance Auto Parts is also carried within the fund.

It invests primarily in U.S. equity securities with high total shareholder yield and demonstrates strong quality characteristics such as profitability and returns on equity.

The fund utilizes a model-based strategy that focuses on long-term investment and performance by investing in around 200 companies with high total shareholder yield created through dividend distributions or buybacks and quality characteristics. It invests primarily in large- and mid-cap companies in the U.S. or listed on U.S. exchanges and has no exposure to share diluters.

WTV carries an expense ratio of 0.12%

For more news, information, and strategy, visit the Modern Alpha Channel.