One of advisors’ primary objectives when managing client portfolios is to reduce risk and volatility. That objective has been historically managed through the 60/40 equity/fixed income split.

However, some model portfolios offer better avenues to managing volatility. Consider WisdomTree’s Endowment Model Portfolios, which include five levels of risk tolerance – conservative, moderately conservative, moderate, moderately aggressive and aggressive.

“Designed for investors who seek to incorporate alternative investments into a traditional portfolio using ETFs,” according to WisdomTree. “Endowment is a reference to including non-traditional assets in addition to stocks and bonds, similar to a strategy that many endowments employ. The strategies may use both WisdomTree and non-WisdomTree ETFs. It typically includes U.S. and international equity and fixed income funds, along with different types of alternative strategies. These model portfolios were previously known as Global Opportunities Model Portfolios.”

A Fresh Take on 60/40: Managing Volatility with WisdomTree

Many 60/40 portfolios rely heavily on domestic large-cap stocks and U.S. government bonds, but the moderately aggressive sleeve of the WisdomTree Endowment Model Portfolio takes a more relevant approach to lead to better long-term outcomes while reducing volatility.

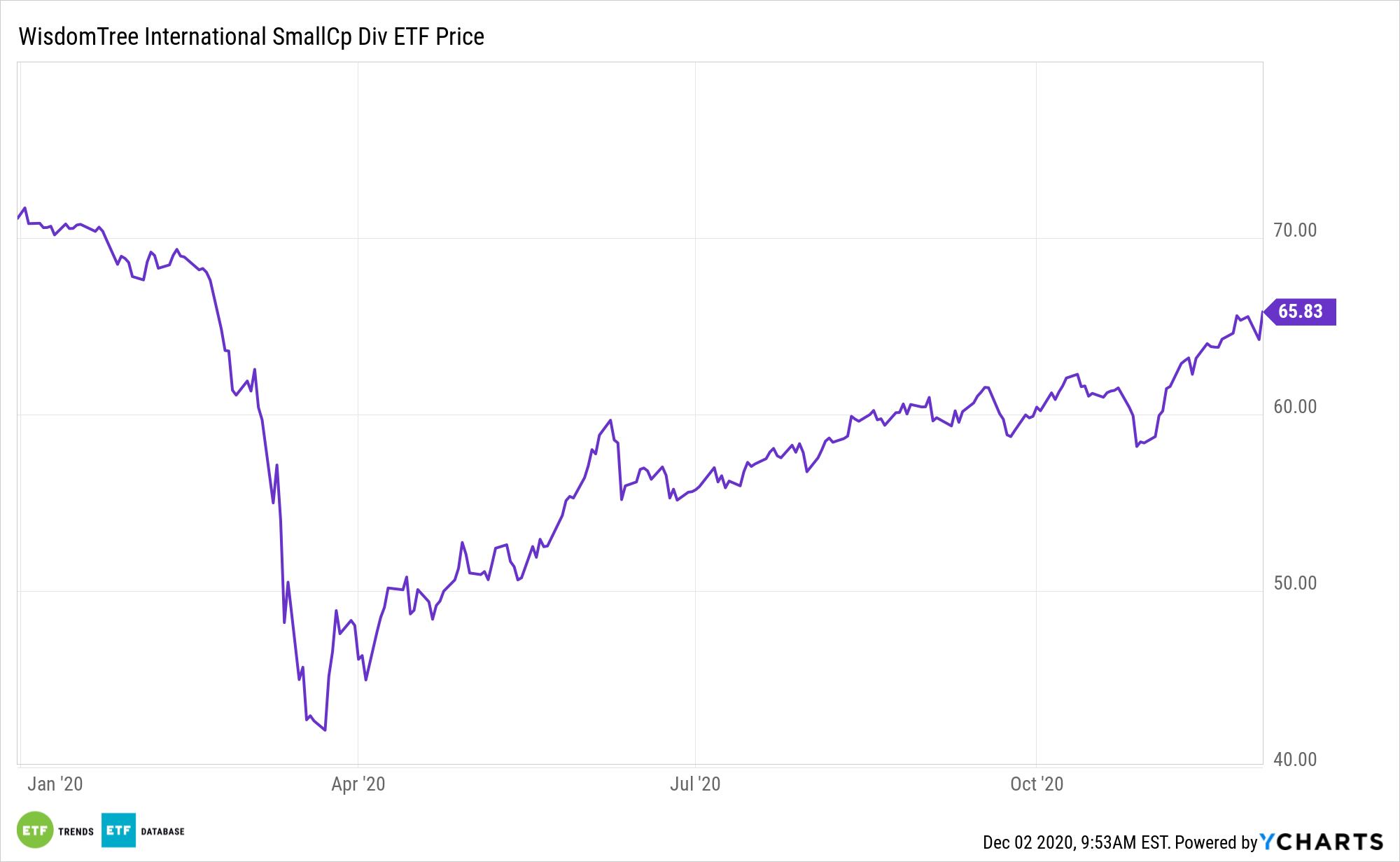

The moderately aggressive model portfolio allocates half its weight to equities, exposures including domestic large- and small-caps as well ex-U.S. developed markets and emerging markets allocations, including the WisdomTree International SmallCap Dividend Fund (DLS).

DLS seeks to track the price and yield performance of the WisdomTree International SmallCap Dividend Index, which is comprised of the small-capitalization segment of the dividend-paying market in the industrialized world outside the U.S. and Canada.

The fixed income portion, which represents 30% of the moderately aggressive sleeve, features a variety of credit qualities and durations. One noteworthy constituent is the WisdomTree U.S. High Yield Corporate Bond Fund (CBOE: WFHY).

WFHY’s fundamentally-weighted methodology could serve income investors well if defaults increase. The fund tracks the WisdomTree U.S. High Yield Corporate Bond Index, which uses a multi-step fundamental screen to steer investors away from the junkiest of the junk bonds. That’s important at a time when many high-yield issuers are under scrutiny due to financing needs.

Across six exchange traded funds, the alternatives portion of the portfolio serves to not only reduce volatility, but enhance income via options selling, MLP, and real estate strategies, among others.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.