Advisors are quickly discovering that traditional fixed income strategies just aren’t cutting it, particularly with significant exposure to long-dated Treasuries.

WisdomTree’s U.S. Conservative Growth Model Portfolio is an option for higher quality income with equity exposure. The model portfolio allocates 60 percent of its weight to fixed income exchange traded funds, many of which aren’t heavily dependent on U.S. government debt.

“These U.S.-focused model portfolios allocate to multi-factor equity and fixed income ETFs across multiple risk profiles leveraging our Modern Alpha® approach,” according to the issuer.

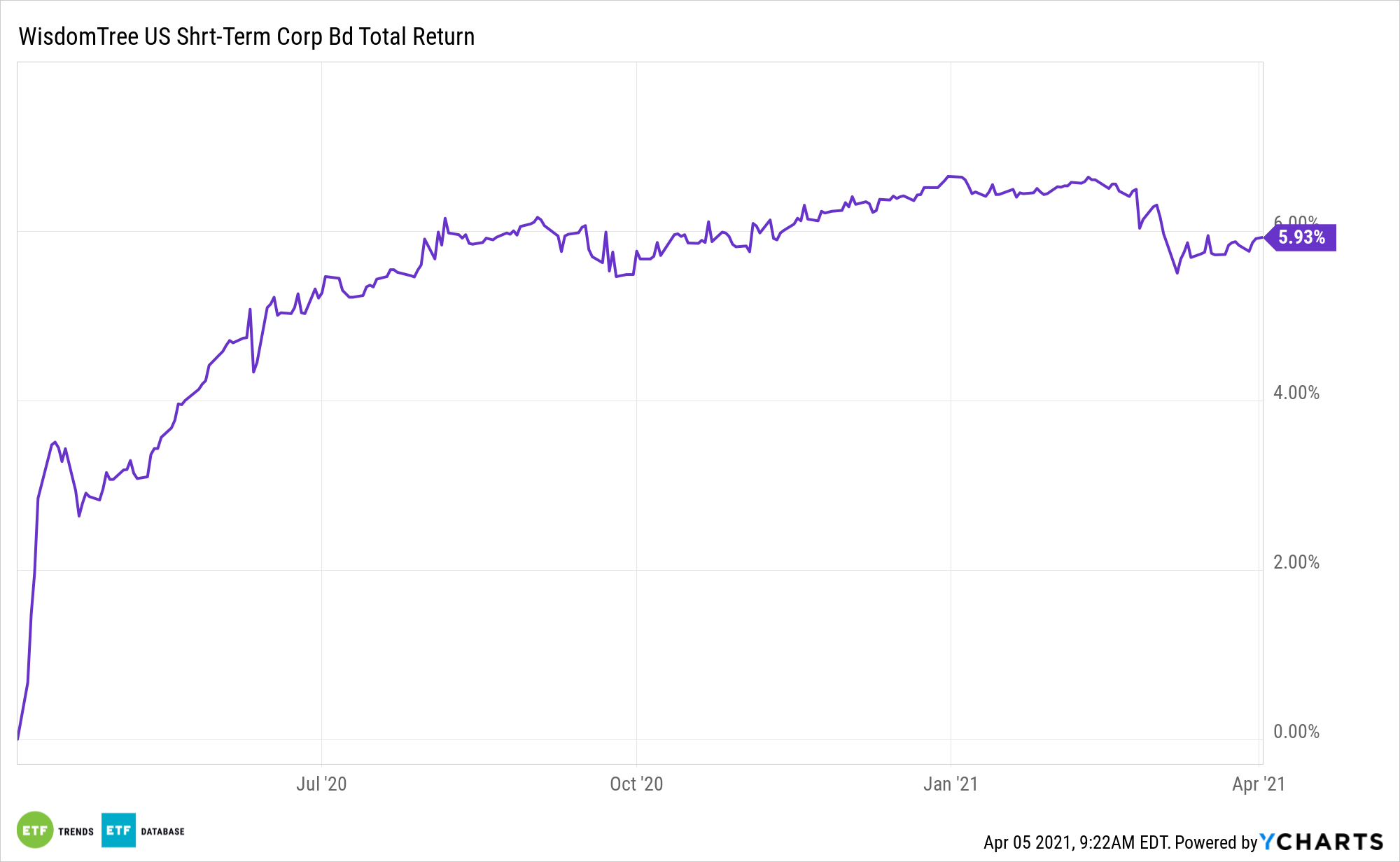

Another advantage of this model portfolio is that it’s not dependent on long duration fare. Within the model portfolio are some shorter duration ideas, including the WisdomTree Fundamental U.S. Short-Term Corporate Bond Fund (CBOE: SFIG).

Floating Fare

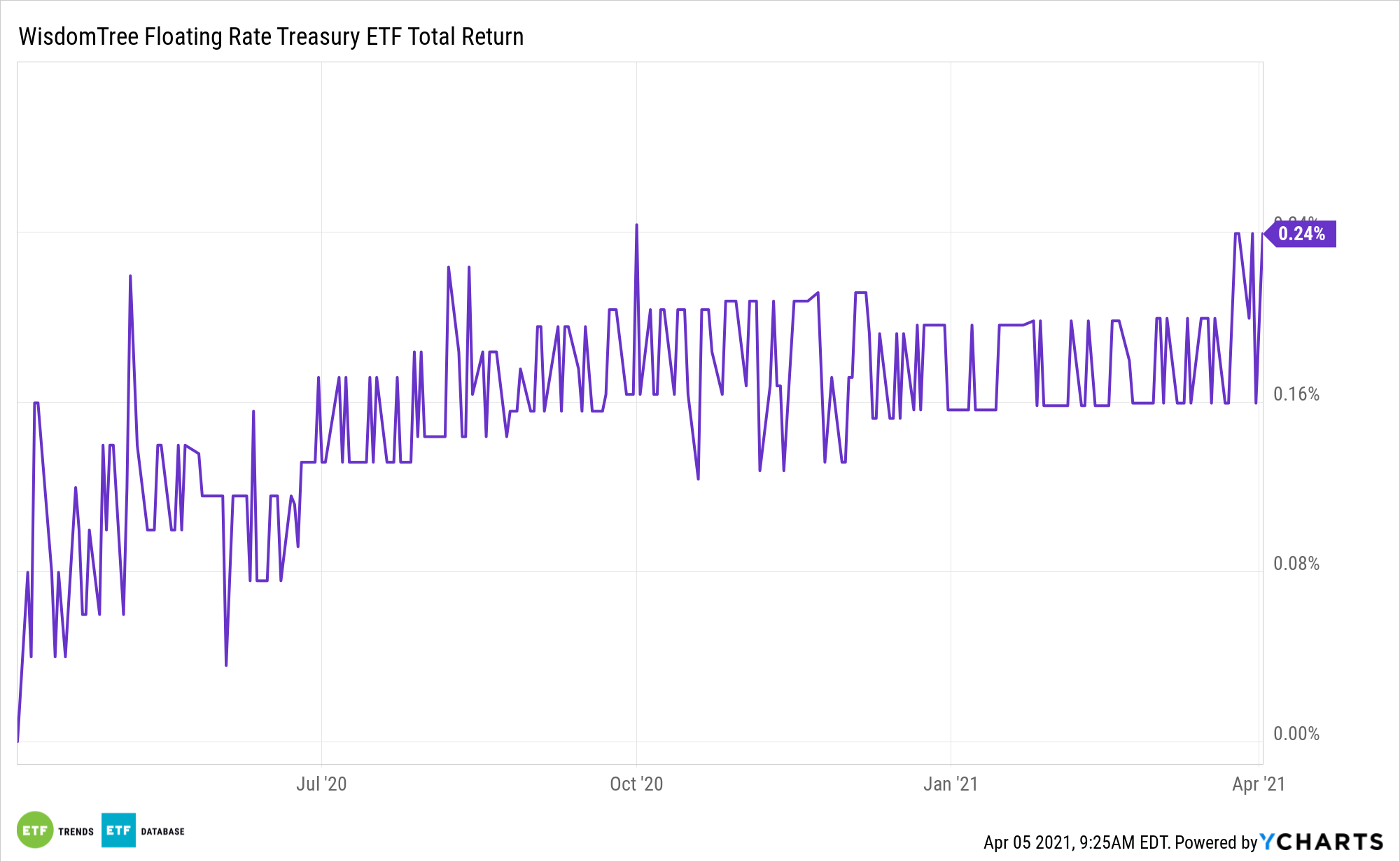

The model portfolio also features exposure to floating rate bonds – a relevant consideration at a time of interest rate volatility.

The utility of floating rate notes (FRNs) and assets like the WisdomTree Bloomberg Floating Rate Treasury Fund (NYSEArca: USFR) remains in place.

Floaters have some advantages that TIPS don’t offer. Floating rate note coupon payments are based on a reference rate (90-day t-bills) plus a spread. Since 90-day bills are auctioned every week, the effective duration of floating rate notes is one week, which allows investors to capture higher rates of income as short-term rates rise. This also provides an opportunity for investors to boost income as the Federal Reserve hikes interest rates.

Looking ahead, the floating rate notes will generate more interest if Treasury prices fall and yields rise further, which should play out if the Fed continues on its interest rate normalization schedule.

Floating rate notes, like the name suggests, have a floating interest rate. Specifically, the notes have a so-called reset period with interest rates tied to a benchmark, such as the Fed funds, LIBOR, the prime rate, or the U.S. Treasury bill rate. Due to their short reset periods, these floating rate funds have relatively low rate risk.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.