As measured by the S&P Europe 350 Index, European equities are outperforming their U.S. counterparts in what feels like the first time in an eternity.

Advisors may be apprehensive about allocating to European stocks. After all, the asset class has been a long-standing disappointment, and there’s no need to take on international equity and currency risk when U.S. stocks are getting the job done.

Yet there are reasons to believe this year could be different, and for advisors still leery about European equities, the WisdomTree Developed International Factor Portfolio is an idea to evaluate. The model portfolio holds five developed international exchange traded funds, none of which are dedicated European products, in effect limiting some risk in these developed markets.

Still, there are reasons to consider the model portfolio over the near-term because things are looking up for European assets.

“Since the beginning of November, when hopes of COVID-19 vaccines began to boost confidence in the recovery, Eurozone stocks have returned 46.5%, compared with 30.6% for U.S. stocks,” notes Charles Schwab’s Jeffrey Kleintop. “The Eurozone has outperformed even though vaccination programs lagged those in the United States. Ending restrictive lockdowns, ramped up bond buying by the European Central Bank (ECB), and the nearing rollout of Europe’s largest-ever stimulus plan should aid growth heading into the second half of 2021.”

Reasons to Believe

Europe was slower to roll out government stimulus programs than the U.S. and its efforts to effectively distribute coronavirus vaccines have left much to be desired. However, those ominous scenarios could imply that as Europe plays catch-up on the coronavirus relief front, stocks there could have more upside ahead. Some data points confirm things are heading in the right direction in Europe.

“France’s index of business confidence climbed to its highest in three years in May. Similarly, Germany’s IFO survey of business expectations showed its strongest reading since January 2011,” adds Schwab’s Kleintop. “Even more importantly, consumers seem set to unleash pent up demand. Thanks to worker furlough programs relatively few workers lost their jobs in the Eurozone.”

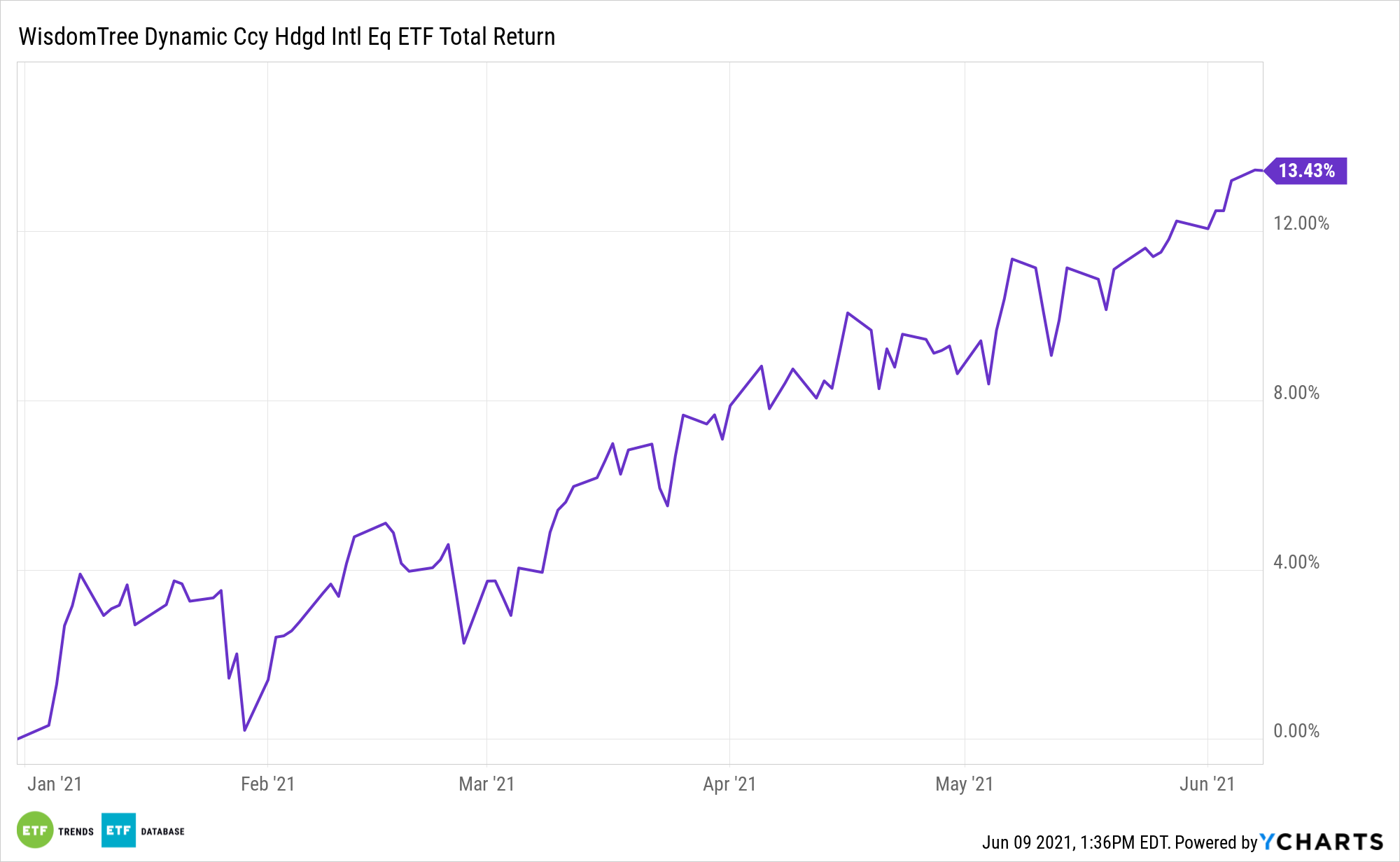

Among the components in the WisdomTree model portfolio levered to a possible European equity resurgence are the WisdomTree Dynamic Currency Hedged International Equity Fund (CBOE: DDWM) and the WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG).

DDWM allocates close to 60% of its geographic weight to European equities, including both Eurozone and non-Eurozone nations. The fund is a currency hedged fund, but it’s not static, meaning it can adjust its currency positions. The $239.68 million IQDG has a Europe weight of north of 60% spread across 13 countries and is a quality play on rebounding ex-US developed market dividends.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.