What once started as a gentle decline for bonds in 2020 has seemingly hit warp speed this year with the Bloomberg U.S. Aggregate Bond Index down greater than 10% in 2022 following a 1.7% decline in 2021. At a time when equities and bonds are both feeling the squeeze of soaring inflation and rising interest rates alongside a quantitative tightening regime that has hit high gear in September, it’s likely the growthiest stocks that will pay the price according to Jeff Weniger, CFA, head of equity strategy at WisdomTree in a recent blog post.

“2022 has been weird. In ‘normal’ times, bonds would be expected to thrive in a weakening economy. But this year, that old truism has been thrown out the window,” Weniger wrote.

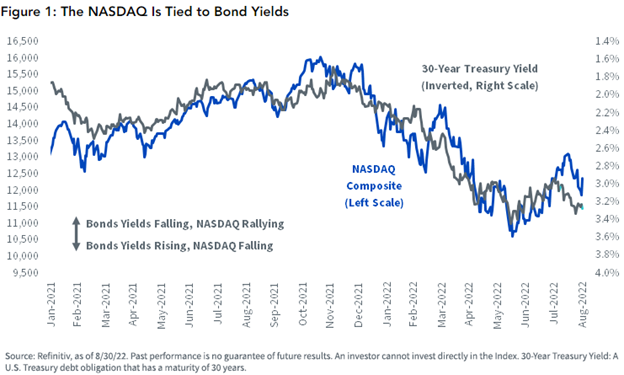

Bonds and equities have been highly correlated this year, and in an interesting turn, indexes that are heavy in growth stock allocations seems to be moving in tandem with the long bond yield: The Nasdaq Composite is down 23% year-to-date, and the S&P Growth Index is down 21% over the same period. For comparison, the S&P Value Index is only down 7% this year.

Image source: WisdomTree blog

“Stock market earnings look suspect. I think that is a problem for the very high beta stocks that tend to populate growth baskets,” according to Weniger.

The New York Federal Reserve’s Q3 Senior Loan Officer Survey reported that a net 14% of U.S. banks have tightened lending standards, a phenomenon that has happened three times in the last 25 years: 2000 (the dot com bubble), 2007 (the financial crisis), and 2020 (the onset of COVID-19).

“Granted, I don’t know if making a comparison to the global financial crisis is warranted at this stage of the game, so take this with a grain of salt. Nevertheless, a scenario that sees S&P 500 earnings growth declining in 2023 is plausible, reasonable and possible,” Weniger wrote.

If such a scenario were to come about, Weniger explained that the whole yield curve could move higher alongside the Fed’s rate hikes while equities take hits from despondent earnings reports.

“In other words, growth stocks are now the anti-diversification, pro-concentration asset class. As the bond market receives its proverbial margin call, there may come that time that every investor dreads: scanning the holdings list for something to sell,” Weniger wrote. “If it’s the Bloomberg Aggregate that gives investors headaches in the coming months and years, it might just be the NASDAQ-style holdings that meet the sell button.”

Seeking Shelter in Dividends

“If the bond market’s action continues to punish growth stocks, our dividend strategies may represent something of a shelter,” explained Weniger.

WisdomTree offers a suite of dividend ETFs for investors looking for exposure to U.S. equities, whether within core allocations or with a value focus. Options include the WisdomTree US Quality Dividend Growth Fund (DGRW), which invests in large-cap U.S. equity companies that are growing their dividends and applies both quality and growth screens to securities, and the WisdomTree U.S. LargeCap Dividend Fund (DLN), which invests in large-cap companies that pay dividends within the U.S. equity market.

The broader WisdomTree U.S. Total Dividend Fund (DTD) invests in companies from all market caps that pay dividends within the U.S. equity market, while the WisdomTree U.S. Midcap Dividend Fund (DON) offers mid-cap exposure, and the WisdomTree U.S. SmallCap Dividend Fund (DES) offers small-cap exposure.

There is also the popular WisdomTree U.S. High Dividend Fund (DHS) that invests in high dividend-yielding U.S. equity companies for investors looking for higher yielding opportunities.

For more news, information, and strategy, visit the Modern Alpha Channel.