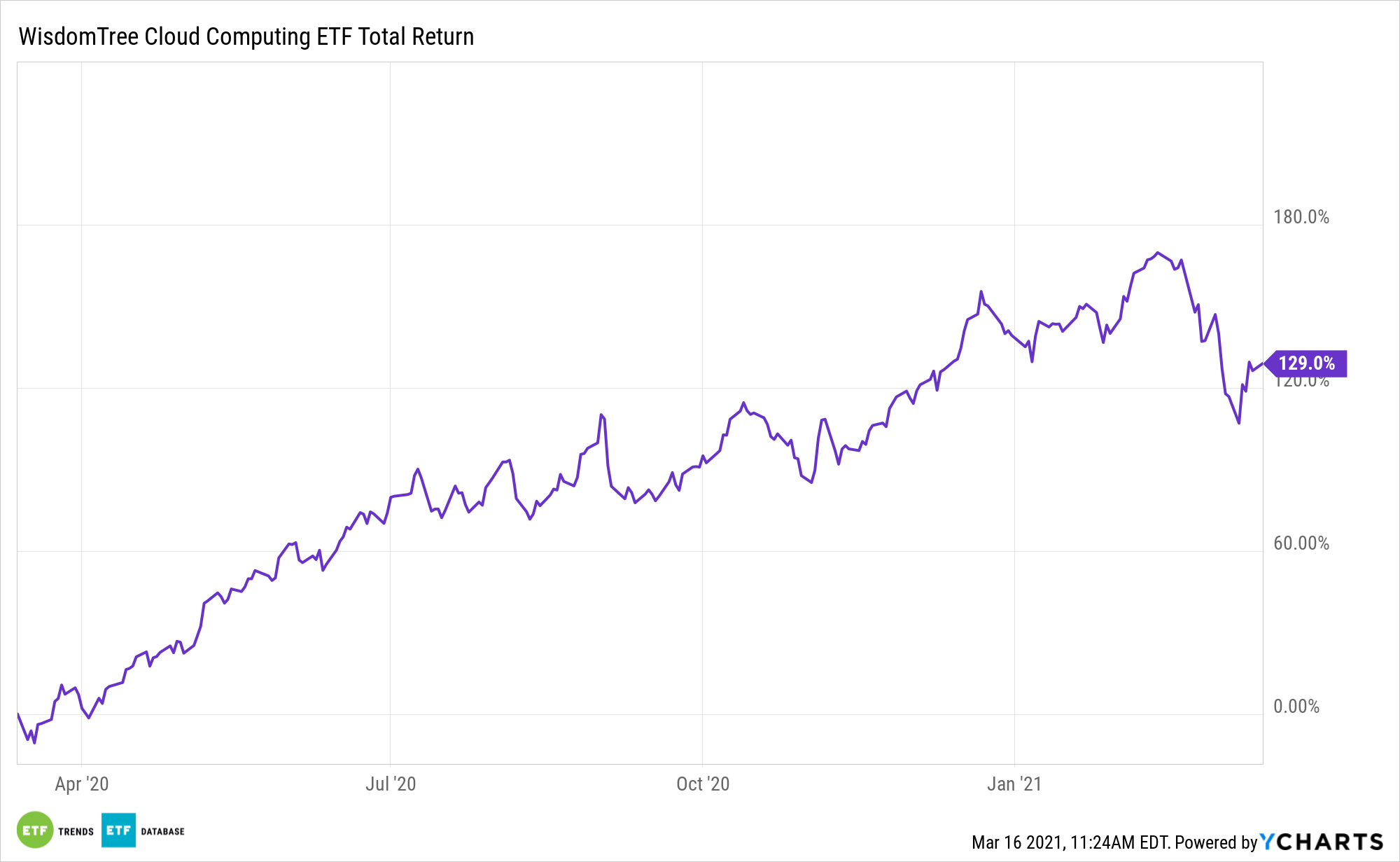

The WisdomTree Cloud Computing ETF (WCLD) was the leader of cloud computing exchange traded funds last year and one of the best-performing technology ETFs of any stripe. The fund’s recent rebalancing could lead to more of the same this year.

The WisdomTree Cloud Computing Fund seeks to track the price and yield performance, before fees and expenses, of the BVP Nasdaq Emerging Cloud Index, an equally weighted index designed to measure the performance of emerging public companies focused on delivering cloud-based software to customers.

A prime advantage of WCLD is that it focuses on pure play cloud companies with fast-growing earnings and revenue profiles.

“Our strategy follows a rules-based methodology that resets constituents and weights back to equal weight in February and August,” writes WisdomTree analyst Kara Marciscano. “It is a simple, yet effective, approach that provides significant exposure to fast-growing, emerging businesses that are often overlooked or diluted in market cap-weighted benchmarks. The semiannual cadence also helps maintain a fresh pipeline of new additions, which we believe is key to sustaining WCLD’s strong performance.”

Is WCLD Poised for an Encore?

The cloud computing industry refers to companies that (i) license and deliver software over the internet on a subscription basis (SaaS), (ii) provide a platform for creating software applications which are delivered over the internet (PaaS), (iii) provide virtualized computing infrastructure over the internet (IaaS), (iv) own and manage facilities customers use to store data and servers, including data center Real Estate Investment Trusts (REITs), and/or (v) manufacture or distribute infrastructure and/or hardware components used in cloud and edge computing activities.

Another perk of WCLD is that it’s flexible enough to add new companies. In fact, many of the fund’s recent additions are companies that went public in the back half of last year.

“As a refresher, new additions to WCLD must meet two key fundamental criteria to be eligible for inclusion: 50% or more of their revenue must be derived from a cloud computing business or service, and companies must be generating at least 15% revenue growth,” adds Marciscano. “The number of newly minted additions to WCLD this cycle attests to the impressive growth and focus that these recent market entrants are exhibiting. Importantly, six of the seven additions to WCLD appeared on Bessemer Venture Partners’ Cloud 100 list prior to going public. Bessemer’s list ranks the top private cloud companies and serves as a measure of the strength of the private cloud market.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.