Much of the talk in financial markets in August has been centered around recession risk. Speculation is high as to how the Federal Reserve will respond to the slowing economy and inflation that appears to be leveling off for now, as indicated through July’s flat month-over-month inflation reading. A recession, or even a significant economic slowdown alongside persistent inflation, could prove to be a challenging investment environment after a first half that has seen near-constant volatility in markets.

Despite this environment of concern about recession, a time when small-cap funds are particularly challenged, the Russell 2000 is outperforming and has offered the strongest performance in all “factor”-based indexes both month-to-date and quarter-to-date according to WisdomTree data.

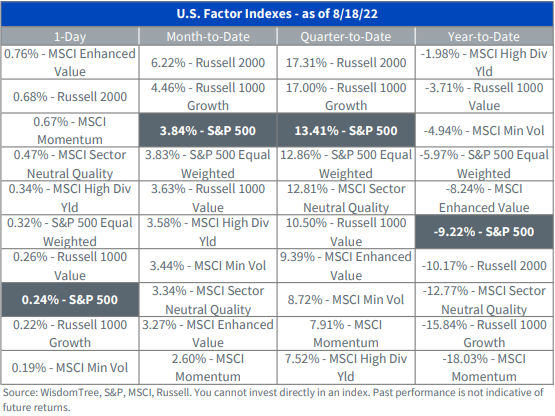

Image source: WisdomTree’s Daily Market Snapshot

As of August 18, the Russell 2000 was up 6.22% for the month compared to the S&P 500’s 3.84% and is up 17.31% quarter-to-date compared to the S&P 500’s 13.41% performance gain.

WisdomTree believes that small-caps have already priced in the risk of recession, reflected in the steep valuation discounts currently exhibited within the space. Small-caps may remain volatile in the near-term as uncertainty continues and economic slowdown grows but historically have exhibited strong growth and outperformance over their large-cap peers once economic recovery commenced.

See also: Small-Caps Pricing in the Recession

EES Screens for Earnings, Outperforms Russell 2000

The WisdomTree U.S. SmallCap Fund (EES) offers broad exposure to U.S. equity small-cap companies and seeks to track the WisdomTree U.S. SmallCap Index. The index is fundamentally weighted based on aggregate earnings of small-cap companies, and companies must have a P/E ratio of at least two for inclusion.

Companies included in the index must have the four most recent consecutive fiscal quarters exhibit positive cumulative earnings and sector representation is capped at 25% (real estate is capped at 15%).

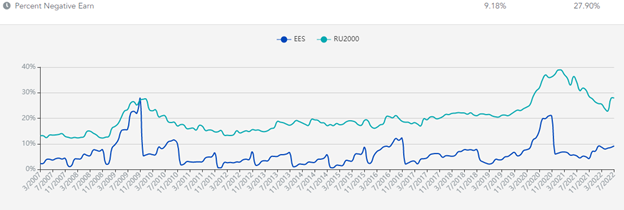

Image source: WisdomTree’s Fund Comparison Tool

This screen has resulted in significantly less exposure to companies underperforming historically, particularly in the challenges of this year. EES has a 9.18% exposure to underperforming companies as of July 31, 2022, compared to the Russell 2000’s 27.90%.

It also has provided greater shareholder yield. As of July 31, 2022, EES had a shareholder yield of 4.69% compared to the Russell 2000’s -0.44%.

Image source: WisdomTree’s Fund Comparison Tool

The fund invests 95% of its assets in the index or similar securities under normal conditions and has an expense ratio of 0.38%.

For more news, information, and strategy, visit the Modern Alpha Channel.