By Jeff Weniger, CFA

Head of Equity Strategy

The bond market has had a rough two years.

The Bloomberg U.S. Aggregate Bond index started slipping, albeit gently, in August 2020. Last year the grind continued, with the index declining by a not frightful but annoying 1.7%.

Then came 2022.

With the index down by more than 10% this year, bond investors are bracing for a portent that has been rare, at least for as long as I’ve been in this business: three quarters in a row of red ink in the fixed income page of the brokerage statement. It may or may not come to pass—bonds were down 0.06% in July and August, so a little rally in bonds in September would end the streak.

Nevertheless, 2022 has been weird. In “normal” times, bonds would be expected to thrive in a weakening economy. But this year, that old truism has been thrown out the window.

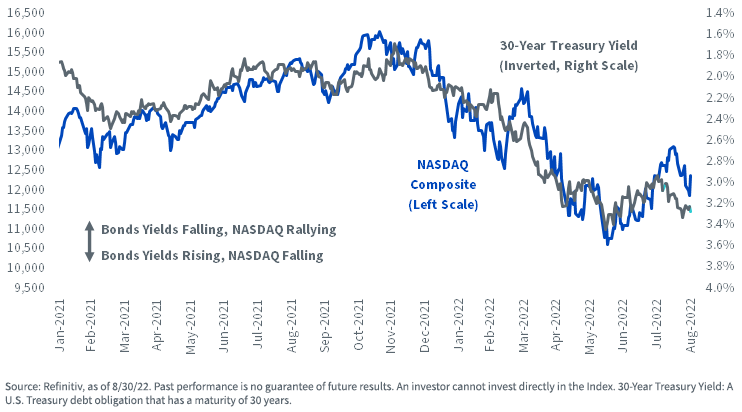

The NASDAQ is taking its cue from the long bond yield. It’s down 23%, and the S&P 500 Growth index is tracking it with a 21% loss. This puts the relative haven status of the S&P 500 Value Index, which is down “only” 7%, into perspective.

Figure 1: The NASDAQ Is Tied to Bond Yields

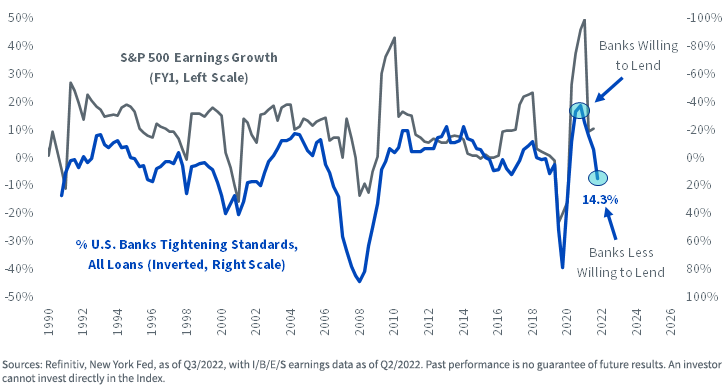

Stock market earnings look suspect. I think that is a problem for the very high beta stocks that tend to populate growth baskets.

Consider this. The New York Fed’s Q3 Senior Loan Officer Survey found that a net 14% of U.S. banks are tightening their lending standards. In figure 2, we can see three episodes over the last quarter-century in which that metric has deteriorated from net easing to a net tightening of this severity. Those episodes were in 2000, 2007 and 2020—all good times to make a prediction that earnings would decline.

Granted, I don’t know if making a comparison to the global financial crisis is warranted at this stage of the game, so take this with a grain of salt. Nevertheless, a scenario that sees S&P 500 earnings growth declining in 2023 is plausible, reasonable and possible.

Figure 2: Tightening of Bank Lending Standards Bodes Ill for S&P 500 Profits

Should that come to pass, we would have a situation where the entire yield curve may be following the Fed higher on rates, while at the same time, equity investors are finding little solace in earnings reports.

We don’t know if current relationships will hold, but it seems to me that if the bond market wants to sell off and S&P earnings want to lay an egg, then growth stocks are a problem child in 2023.

In other words, growth stocks are now the anti-diversification, pro-concentration asset class. As the bond market receives its proverbial margin call, there may come that time that every investor dreads: scanning the holdings list for something to sell.

If it’s the Bloomberg Aggregate that gives investors headaches in the coming months and years, it might just be the NASDAQ-style holdings that meet the sell button. If the bond market’s action continues to punish growth stocks, our dividend strategies may represent something of a shelter.

Unless otherwise stated, data is as of 8/30/22.

Originally published by WisdomTree on September 9, 2022.

For more news, information, and strategy, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.