Watch enough media and congressional appearances by Federal Reserve Chairman Jerome Powell and you couldn’t be blamed for thinking each of those events sounds identical.

At least Powell is consistent. In his testimony before Congress last week, Powell reiterated his view that the world’s largest economy is still in solid shape and that inflation is likely to prove transitory.

Nevertheless, advisors still face headwinds when it comes to clients’ fixed income allocations. They can make life a bit easier with the with the WisdomTree Fixed Income Model Portfolio. WisdomTree head of fixed income Kevin Flanagan has some ideas for how advisors and investors can contend with bland Fed speak and a challenging fixed income environment.

“I find myself returning to this question rather frequently in various discussions,” he said in a recent note. “Despite Chair Powell’s unchanged stance, I continue to focus on two overarching themes for the second half of this year and into 2022: keeping duration short and credit over rates.”

Fixed Income Funds to Consider

One fund Flanagan references is the WisdomTree Yield Enhanced U.S. Short-Term Aggregate Bond Fund (SHAG). SHAG isn’t a member of the aforementioned model portfolio, but it is the short-term counterpart to the popular WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (NYSEArca: AGGY). AGGY is the top holding in the model portfolio.

“Following the same strategy as AGGY, SHAG reweights the sectors of the one- to five-year segment of the Short Agg Composite while adhering to two main guardrails: the weight of major and minor sectors cannot deviate by more than 30% from their weights in the Short Agg Composite and duration generally will not be more than half a year of this benchmark,” said Flanagan.

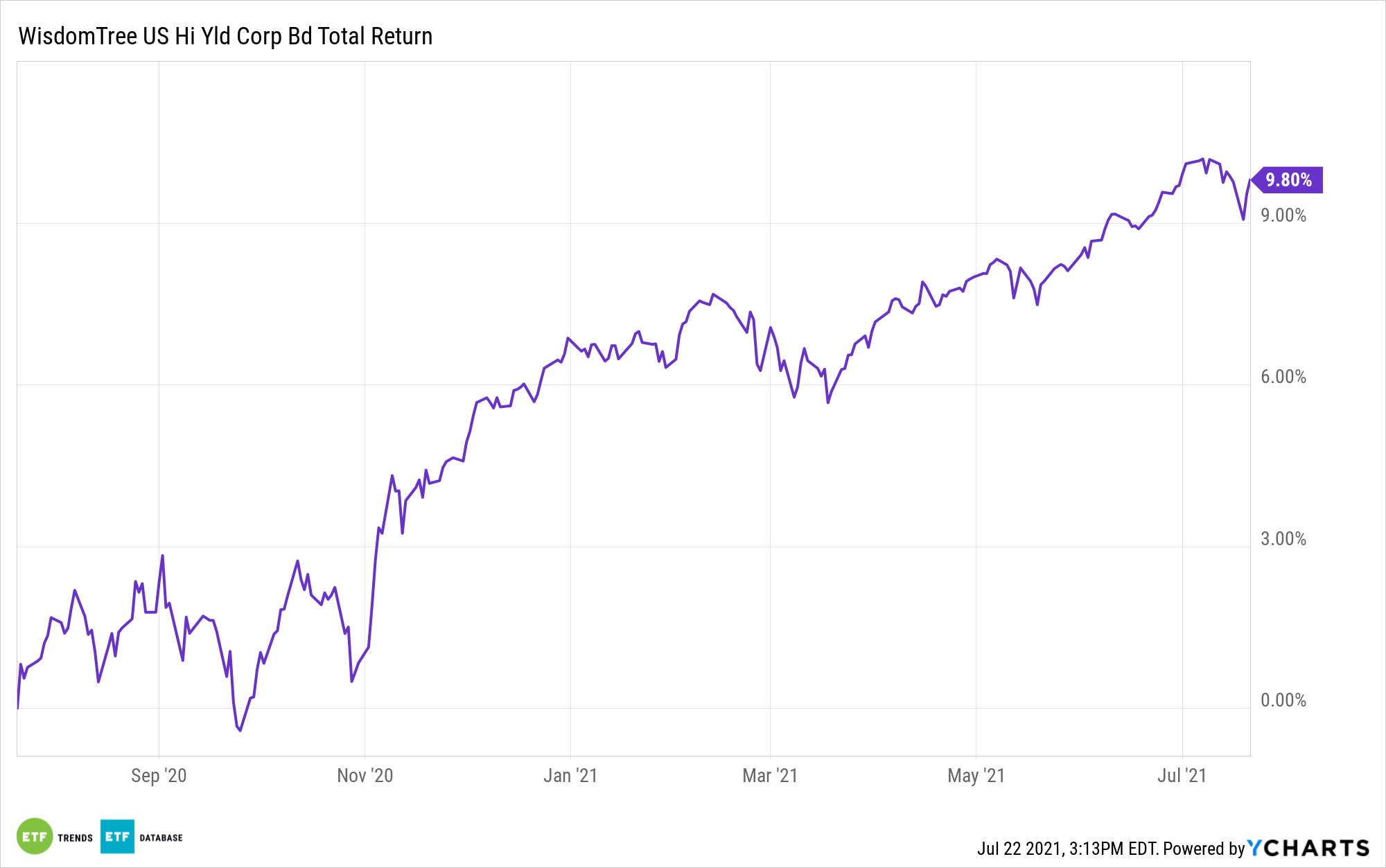

For advisors seeking credit opportunities, the WisdomTree U.S. High Yield Corporate Bond Fund (CBOE: WFHY) is another idea to consider. WFHY features a quality approach designed to mitigate default risk while keeping income elevated.

“The approach behind WFHY is to screen for quality to potentially mitigate the possibility of future default risk. This strategy focuses on only public issuers domiciled in the U.S. and eliminates those with a negative cash flow. We then reweight this remaining universe to tilt weights toward bonds with more favorable income characteristics,” added Flanagan.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.