As fixed income investors increasingly fret about the notion of an interest rate hike coming to pass in 2022, some are leaving or reducing exposure to the asset class and parking that capital in cash investments.

The problem is that money market funds, CDs and the like have barely noticeable yields, meaning that investors are taking on some risk by abandoning bonds. One way to solve for rate risk while keeping income on the table is with short-term corporate bonds.

“For those tactically waiting for rates to rise before investing in bonds, there is a cost to that strategy: the opportunity cost of compounding the higher yields that are available today in other high-quality investments,” says Collin Martin of Charles Schwab. “While the yields shown above are low by historical standards, the nearly 1% yield advantage that investment grade corporate bonds offer over short-term Treasury bills can’t be ignored.”

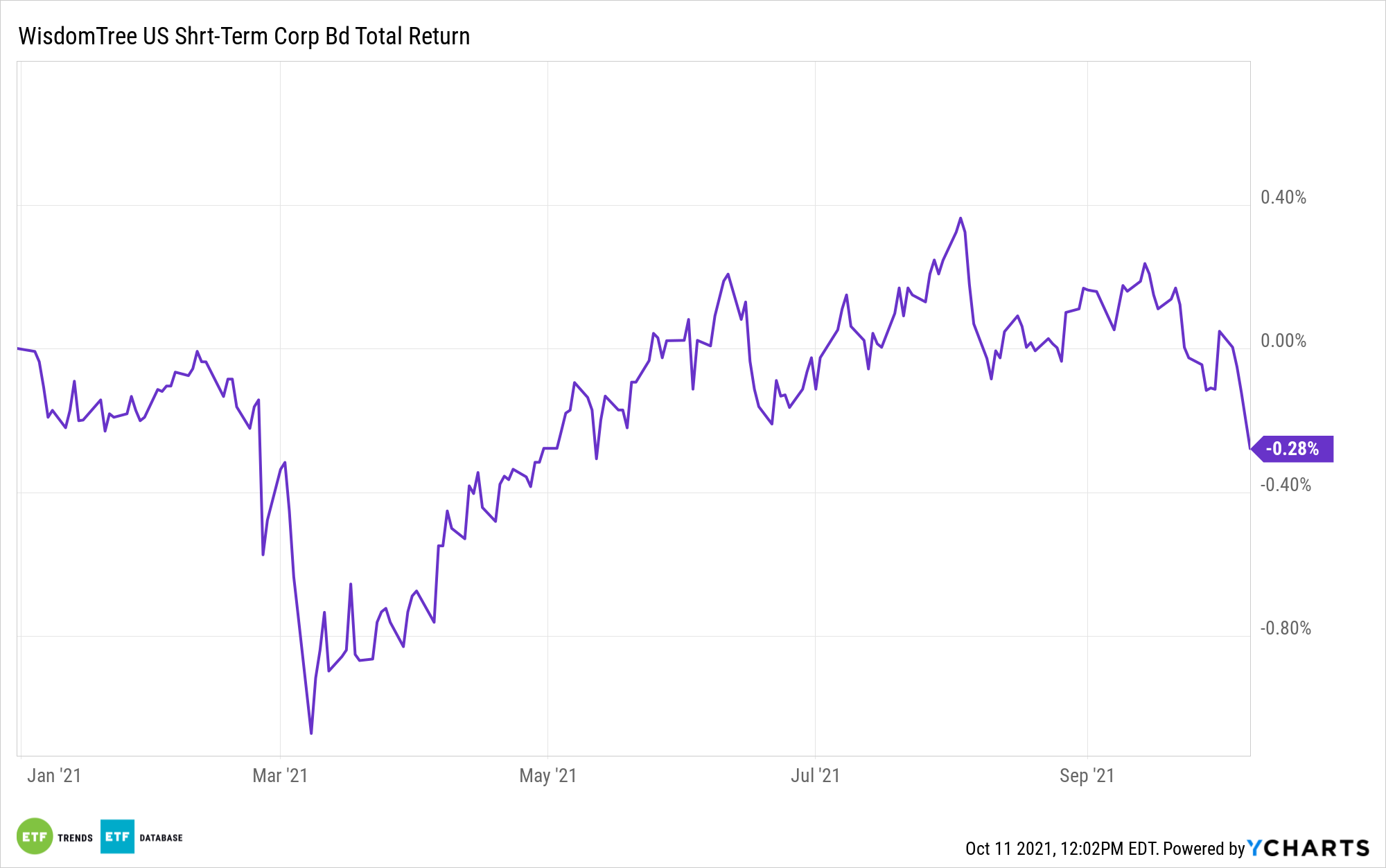

Investors can tap investment-grade corporate bonds with the WisdomTree U.S. Short-Term Corporate Bond Fund (CBOE: SFIG).

Sizing Up SFIG

SFIG has an embedded income yield of 1.14%, which is well above what’s available on cash instruments and better than what investors find with short-term Treasuries. The WisdomTree exchange traded fund has an effective duration of 2.81 years, according to issuer data.

SFIG follows the WisdomTree U.S. Short Term Corporate Bond Index. That’s not an ordinary corporate bond index. Rather, the WisdomTree U.S. Short Term Corporate Bond Index focuses on issues that “have attractive fundamental and income characteristics,” indicating that SFIG comes with some perks beyond low duration risk. Additionally, SFIG may offer some benefits over floating rate notes.

“First, short-term, fixed-rate corporate bonds offer yields that are currently three times as high as floaters on average. The average yield-to-worst of the Bloomberg U.S. Corporate 1-5 Year Bond Index is roughly 1%, compared with just 0.3% for the Bloomberg U.S. Floating Rate Notes Index,” adds Schwab’s Martin.

Over 39% of SFIG’s holdings are rated AA or A. About 59% of the fund’s components are issued by financial services, consumer staples, and technology companies. Overall, there are some advantages with SFIG, and investors may not want to wait around to embrace those traits.

“Short-term investment-grade corporate bonds offer higher yields than many other ultrashort-term alternatives, but also have relatively low interest rate risk,” concludes Martin. “Short-term corporate bonds with fixed coupon rates appear more attractive than floaters today.”

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.