Alternative investments are increasingly alluring at a time when traditional assets just aren’t lobbing off enough income for investors.

One way of ameliorating that scenario is with endowment-style investing, a task made easier by WisdomTree’s series of Endowment Model Portfolios.

“By thoughtfully integrating equities, bonds and alternative investments, WisdomTree has created variations of each model with differing risk profiles. WisdomTree’s bespoke approach seeks to ensure that there is a model portfolio for a range of investors, from the conservative to the aggressive,” according to the issuer.

WisdomTree offers five levels of risk tolerance in this model portfolio series – conservative, moderately conservative, moderate, moderately aggressive, and aggressive.

2 ETFs Aiding in the Search for Income

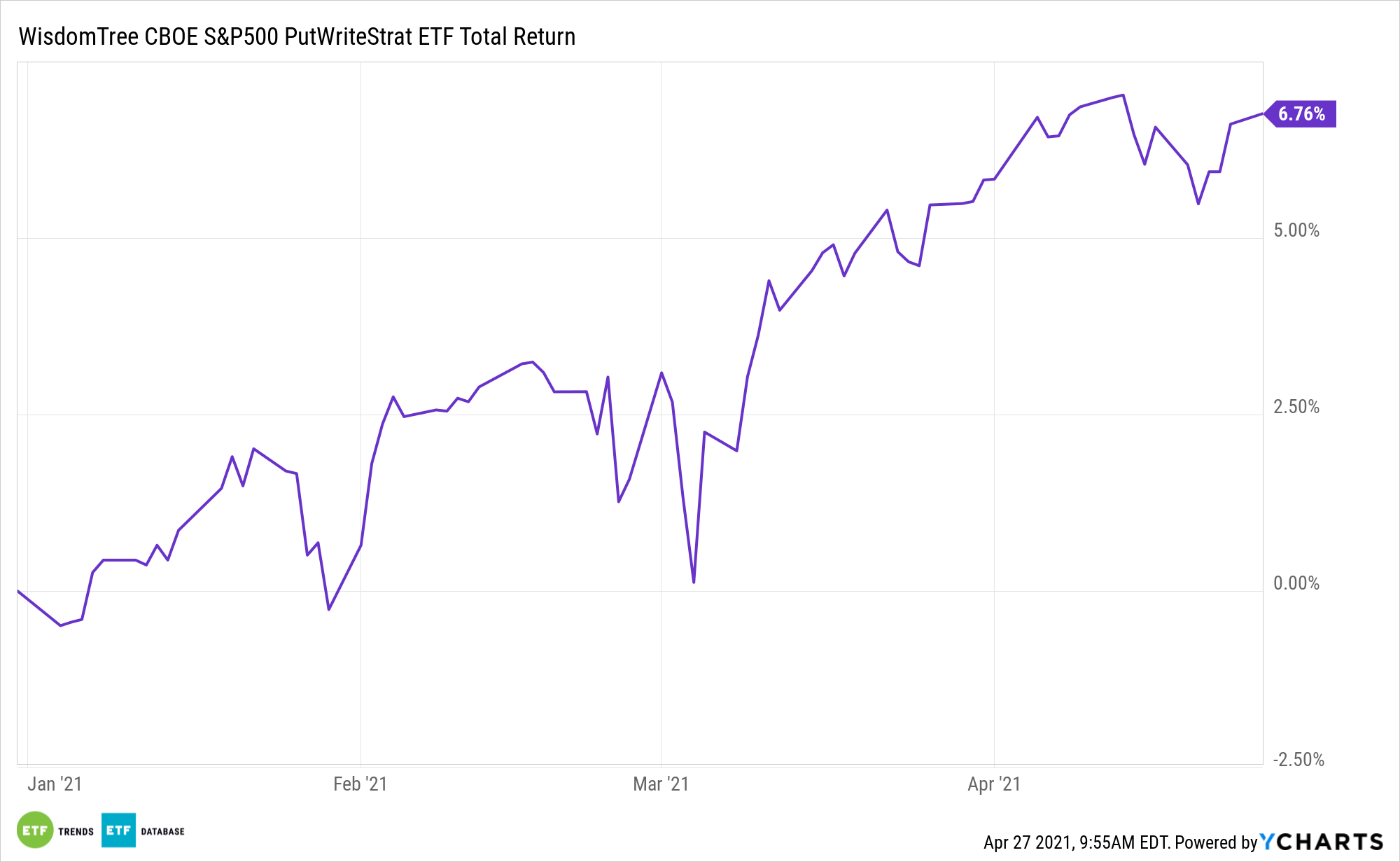

The model portfolio features income-generating assets across its roster, including the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (NYSEArca: PUTW).

PUTW can help investors generate income by selling volatility through writing options. PUTW includes one- and three-month Treasury bills and sells or “writes” one-month, at-the-money, S&P 500 Index puts. Options writing strategies such as PUTW are also excellent inflation-fighting tools.

“Put writing has been profitable as implied volatility remains elevated, and our anti-beta holding has performed as expected in a low-quality global equity rally. We think this alternatives sleeve delivers a unique stream of potential return drivers with the benefit of additional risk diversification,” according to WisdomTree research.

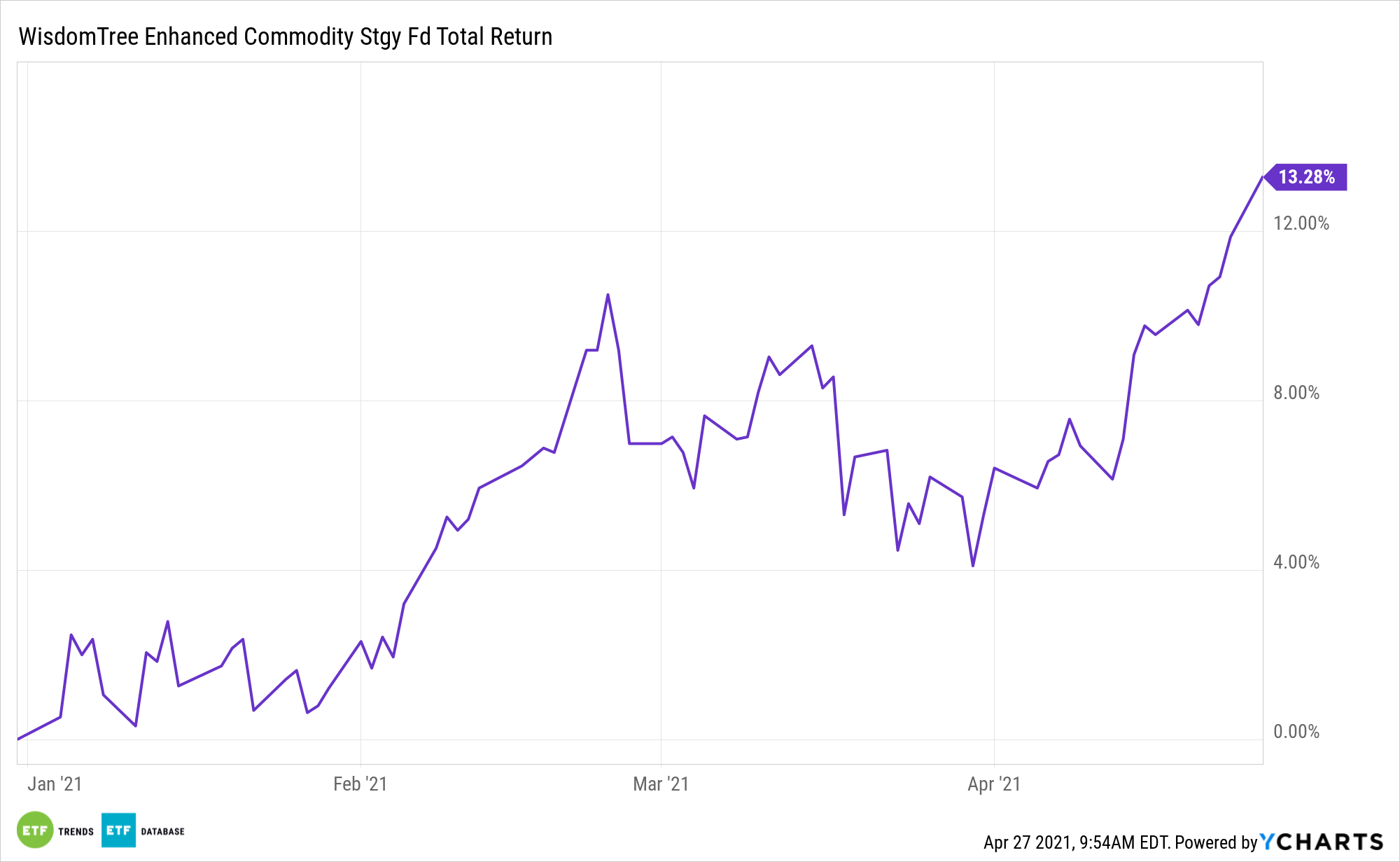

Another way advisors can adapt to today’s inflationary pressures is by tapping commodities. Enter the WisdomTree Continuous Commodity Index Fund (GCC).

GCC seeks to reflect the performance of the index, over time, less the expenses of the fund and the master fund’s overall operations. The master fund invests in a portfolio of index commodities, as well as holding cash and United States Treasury securities and other high credit quality short-term fixed income securities for deposit with the master fund’s Commodity Broker as margin.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.