U.S. stock ETFs are roaring higher, but that’s not an invitation for investors to ignore international markets.

Nor are those factors cause for clients to embrace excessive risk in international markets. Advisors can help them navigate those waters with the WisdomTree Developed International Multi-Factor Model Portfolio.

“This model uses factor-tilted equity ETFs designed to provide improved risk factor diversification. Our multi-factor models are available in U.S., Developed International, and Emerging Market versions, and can be used as standalone equity models or as complementary sleeves aimed at improving the overall diversification profile of an existing portfolio,” according to WisdomTree.

The model portfolio is worth considering today due to green shoots emerging from Europe, among other key ex-U.S. markets.

“Since the beginning of March, COVID-19 vaccination rates have steadily improved throughout Europe, which is a major component of the international equity region. The trend is promising, with 20% of the four major European economies having received at least one dose. The United Kingdom has had the most success thus far, hovering at nearly 50%,” said WisdomTree analyst Brian Manby in a recent note.

Cyclicals Are Coming Back to Life

As has been widely reported through the first four months of 2021, cyclical value stocks are leading in the United States, but there’s evidence to suggest that phenomenon isn’t solely domestic.

See also: Consumer Discretionary ETF List

“The vaccine momentum leads us to believe there’s potential for a strong revival in cyclical economic sectors, which are key pieces of developed markets relative to the rest of the world,” adds Manby. “We group the weights of the Financials, Industrials, Materials and Energy sectors—those most levered to overall levels of economic activity—together into our Cyclical category, while Growth/Defensives contains the remaining weight.”

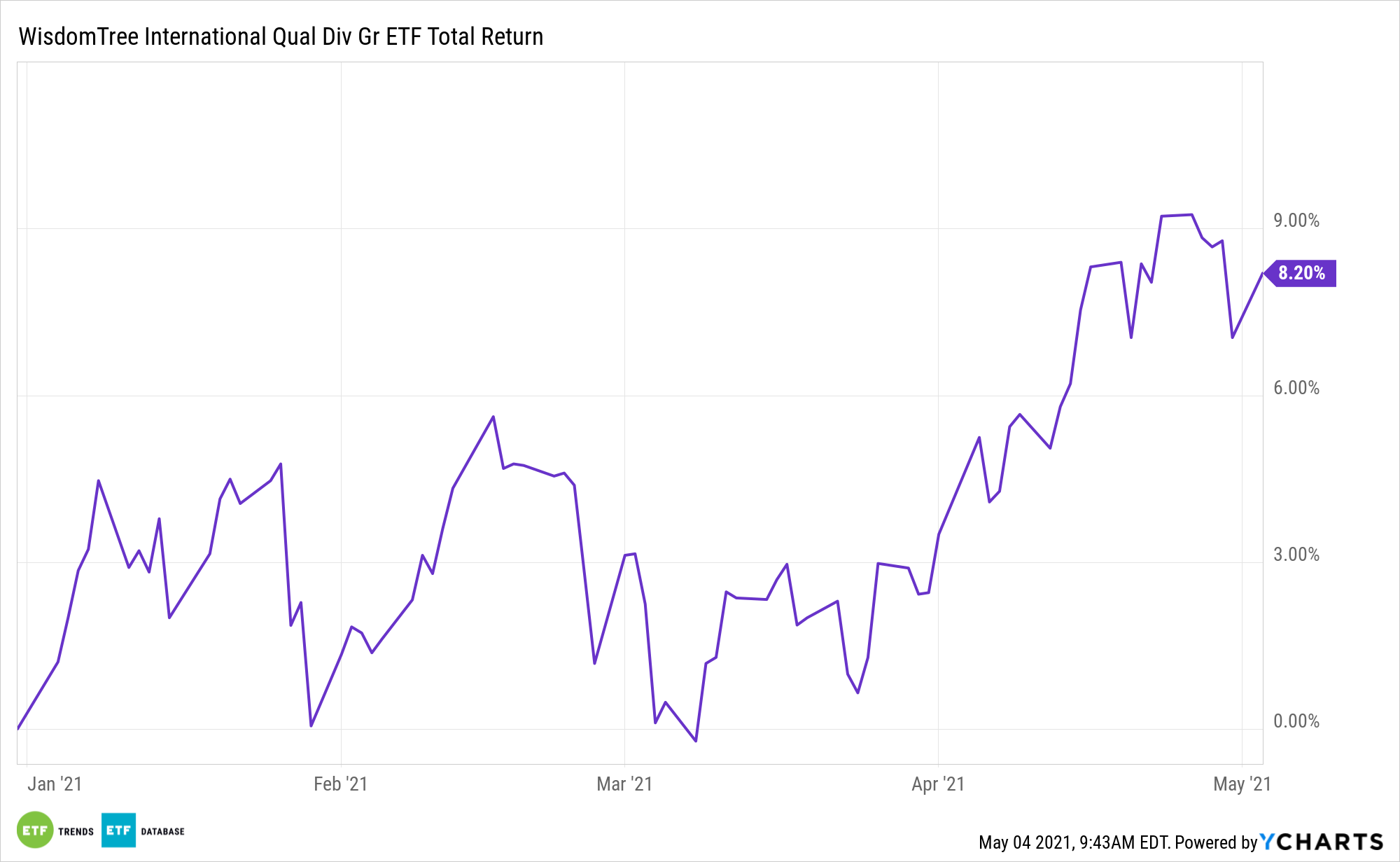

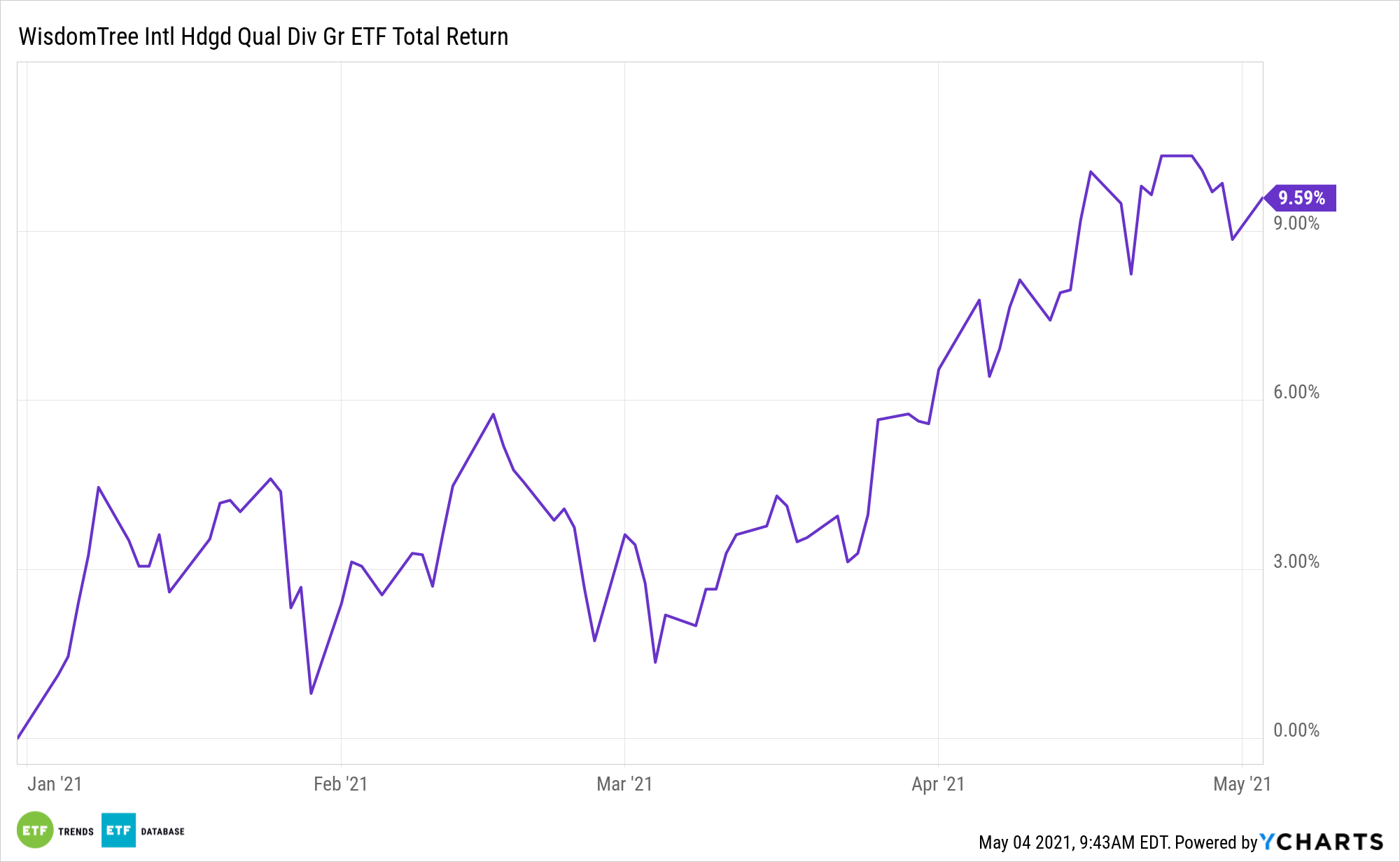

While the current environment may appear to indulge elevated risk-taking, advisors can steer clients toward quality ideas, including the WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG) and the WisdomTree International Hedged Quality Dividend Growth Fund (NYSEArca: IHDG).

“Both Funds track Indexes that employ the same strategy, resulting in exposure to companies with strong earnings, healthy balance sheets and low leverage. They select the top 300 companies from the dividend-paying, international equity universe, ranked by a combination of dividend growth and quality factors. Likewise, the two Funds deliver attractive fundamentals,” concludes Manby.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.