Last year provided an important lesson for dividend investors: quality matters. And while high dividend strategies are rallying to start 2021, advisors should remain confident that quality is the way to go.

The WisdomTree Global Dividend Portfolio helps advisors put client portfolios on the right side of the dividend trade.

“This model portfolio seeks to provide capital appreciation and high current dividend income, through a globally diversified set of WisdomTree’s dividend income oriented equity ETFs. The model strives to deliver dividend income in excess of the global benchmark of equities,” according to WisdomTree.

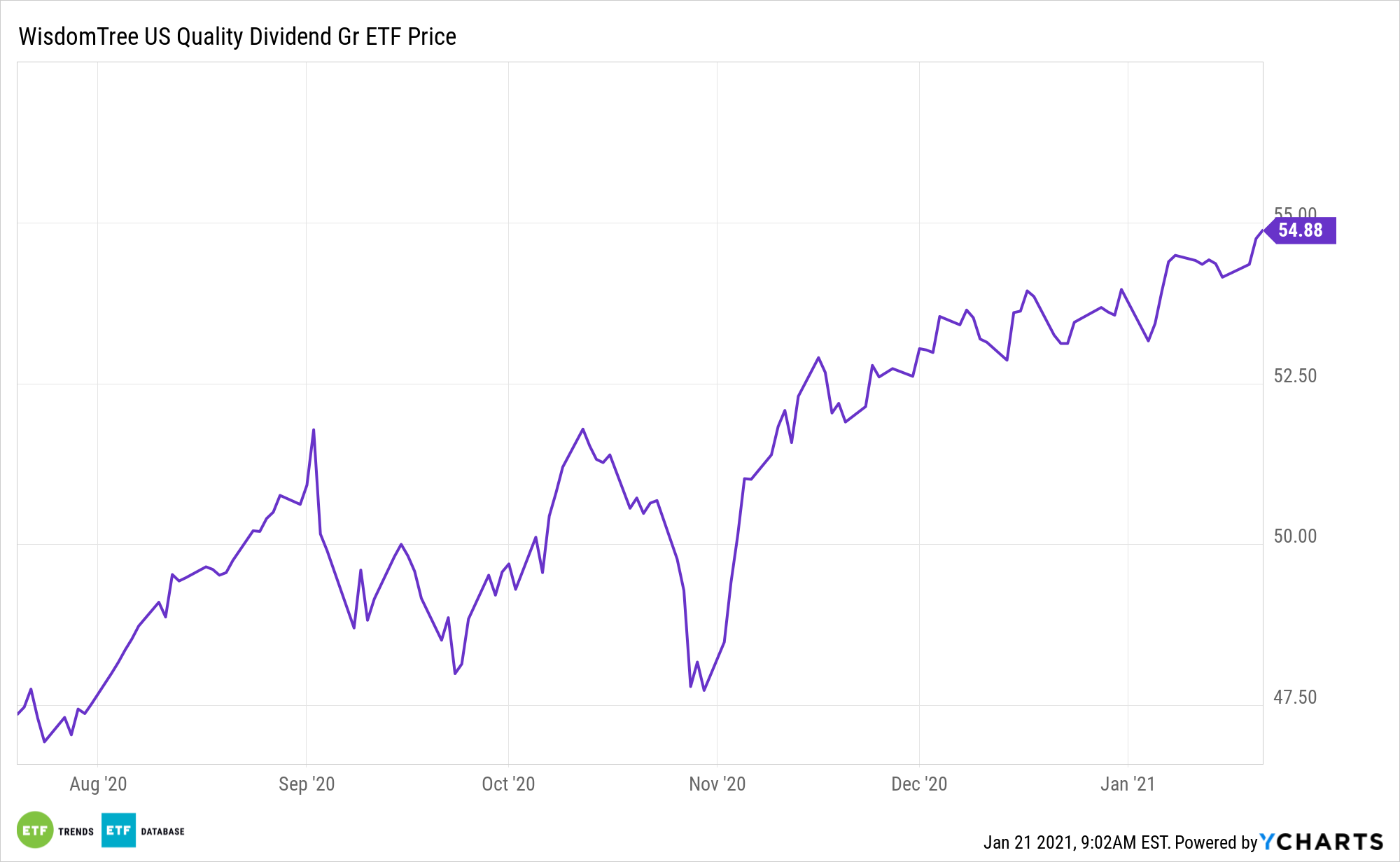

The WisdomTree U.S. Quality Dividend Growth Fund (NasdaqGM: DGRW) is one noteworthy ETF in the model portfolio.

DGRW seeks to track the price and yield performance of the WisdomTree U.S. Quality Dividend Growth Index. The index is a fundamentally weighted index that consists of dividend-paying U.S. common stocks with growth characteristics.

DGRW: Representing a Quality Investing Philosophy

DGRW’s place in the model portfolio is important for a variety of reasons.

“The WisdomTree U.S. Quality Dividend Growth Fund (DGRW), which seeks to track the WisdomTree U.S. Quality Dividend Growth Index (WTDGI), selects companies that look attractive according measures of profitability like return-on-equity (ROE) and return-on-assets (ROA), and earnings growth prospects, and weights them by their dividend stream,” writes WisdomTree Associate Director of Modern Alpha Alejandro Salitel. “This fundamental model has allowed WTDGI to garner exposure to dividend growers and stay away from companies at risk of cutting or suspending dividend payments.”

The quality factor can focus on key indicators such as profitability, management efficiency, and cash flow. Combined with the methodology backstopping DGRW, those traits make for a powerful tool in gauging a company’s ability to maintain and grow payouts.

Quality’s importance is elevated during times of dividend duress. For example, DGRW’s underlying index didn’t hold any of the 10 worst payout offenders in the S&P 500 last year. Actually, DGRW’s quality tilt increased.

“WisdomTree recently implemented a new Composite Risk Screening in the reconstitution process that aims to mitigate exposure to the riskiest dividend payers across our broad Indexes. Because WTDGI already explicitly screens for quality, these additional metrics were more marginal but slightly improved the Index’s overall quality profile,” adds Salitel. “ROA improved from 6.61% to 7.20% and ROE improved over 100 basis points (bps), from 24.12% to 25.57%. Both of these significantly exceed metrics about the S&P 500 Index.”

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.