Believe it or not, there was a world before the smart phone, and indeed, before the iPhone. Apple (AAPL) profoundly changed our daily lives with its pocket-sized window into the internet, and AI has the potential for its own “iPhone moment.” ChatGPT and all of the other machine learning AI assistants it has inspired are just the start, with tech firms that are poised to benefit available in cloud computing ETFs like the WisdomTree Cloud Computing Fund (WCLD).

Cloud computing companies were already cooking up their own “Apple-like” cloud ecosystems of networked services before AI entered the public eye so dramatically. The FAANG companies each have the capacity and the vision to not only connect their services with the cloud, but use the cloud and the firms that equip and empower cloud software to train AI and deliver the value of AI software to its networked programs.

Meta (META), for example, has indicated that AI is its biggest investment category in research and development (R&D), according to research from WisdomTree Investments. Alphabet (GOOGL) is also planning to reveal how much it’s spending on AI in its Q1 2023 earnings announcement. The products of those investments, including but not limited to generative chatbots like ChatGPT, will not only engage in machine learning on the cloud, but use the processing power of the cloud to reach new heights.

See more: “This AI Value ETF Is Signaling a Buy“

With billions and billions of dollars of value coming from the so-called “app economy,” AI could be ready for an iPhone moment, thanks to ChatGPT creating an “AI economy,” and the right cloud computing ETF could help take advantage. WCLD could be one such strategy to watch, charging 45 basis points (bps) to track the BVP Nasdaq Emerging Cloud Index.

WCLD hit its three-year milestone as an ETF this past September, investing in cloud computing firm stocks that are equally weighted within its index. Firms included in that index have to meet certain standards, with a revenue growth rate of at least 15% for each of the last two full fiscal years for new constituents or a revenue growth rate of at least 7% in at least one of the last two fiscal years for existing constituents. Holdings also have to meet minimum liquidity requirements.

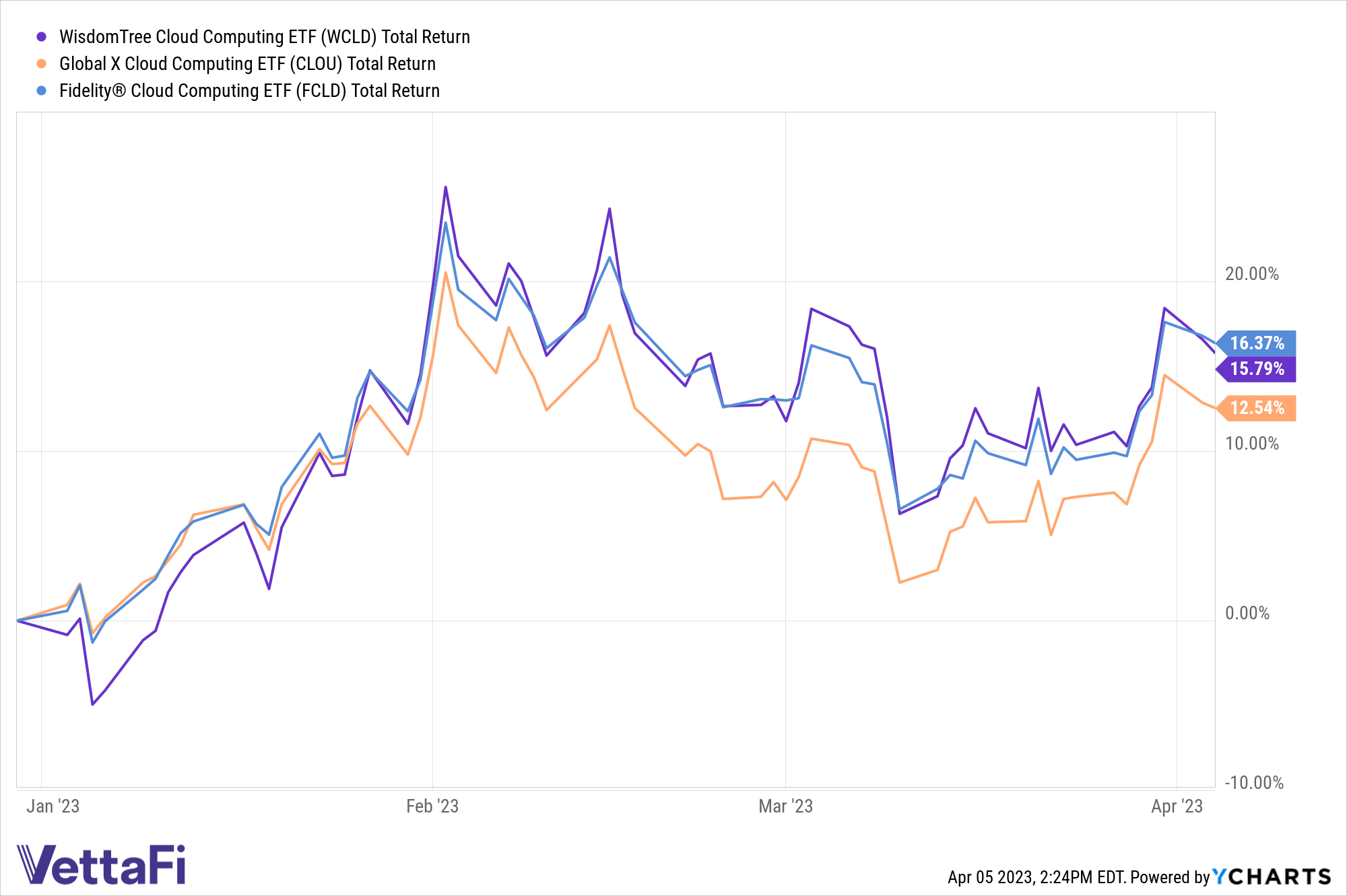

WCLD has outperformed its rival cloud computing ETFs at points YTD, and as of April 5th, it was neck-and-neck with some of its rivals. For those investors and advisors looking for a cloud computing ETF to take advantage of AI and its possible “iPhone moment,” WCLD could be an appealing option to consider given its approach and manageable fee in the weeks and months ahead.

For more news, information, and analysis, visit the Modern Alpha Channel.