Advisors are scrambling to locate and generate income for clients – a task being made more difficult by low U.S. government bond yields.

Making matters all the more tricky is that the world is awash in low-yielding sovereign debt. Investment-grade corporate and municipal bonds aren’t setting the world ablaze in the yield department. Yet advisors looking to fill the income void have several compelling options, among them the WisdomTree’s series of model portfolios.

For equity income, the Global Dividend Model Portfolio is a practical idea in an environment favoring the quality and value factors and with dividend growth coming back into style.

“Many corporations are reinitiating or increasing their dividends and stock buybacks following the pandemic-induced cutbacks, so the yield from equities may improve over the course of the year,” said Scott Welch, WisdomTree chief investment officer – model portfolios. “We also think corporate balance sheets are in good shape, so default rates should be reasonably low, and investors can probably feel safe about their coupons.”

Surviving (and Thriving) in a Tough Bond Landscape

Depressed bond yields make equity income all the more appealing, but advisors may want to mix things up among asset classes on clients’ behalves. The Global Multi-Asset Income Model Portfolio answers that bell.

That model portfolio features an array of income-oriented assets ranging from basic equity and fixed income exposures to preferred stocks, covered call strategies, and energy infrastructure. The Global Multi-Asset Income Model Portfolio could be an avenue for advisors looking to rejuvenate clients’ income profiles while muting the impact of what could be sub-par bond returns in the years ahead.

“The total return picture for fixed income is not great, and we certainly would not recommend ‘stretching for yield’ by taking on excessive duration or credit exposure,” adds Welch. “That defeats one of the primary purposes for owning bonds to begin with—to hedge equity risk.”

Siegel-WisdomTree Model Portfolios developed with the issuer’s Senior Investment Strategy Advisor— Dr. Jeremy Siegel, Professor of Finance at Wharton School – are comprised of a pair of model portfolios.

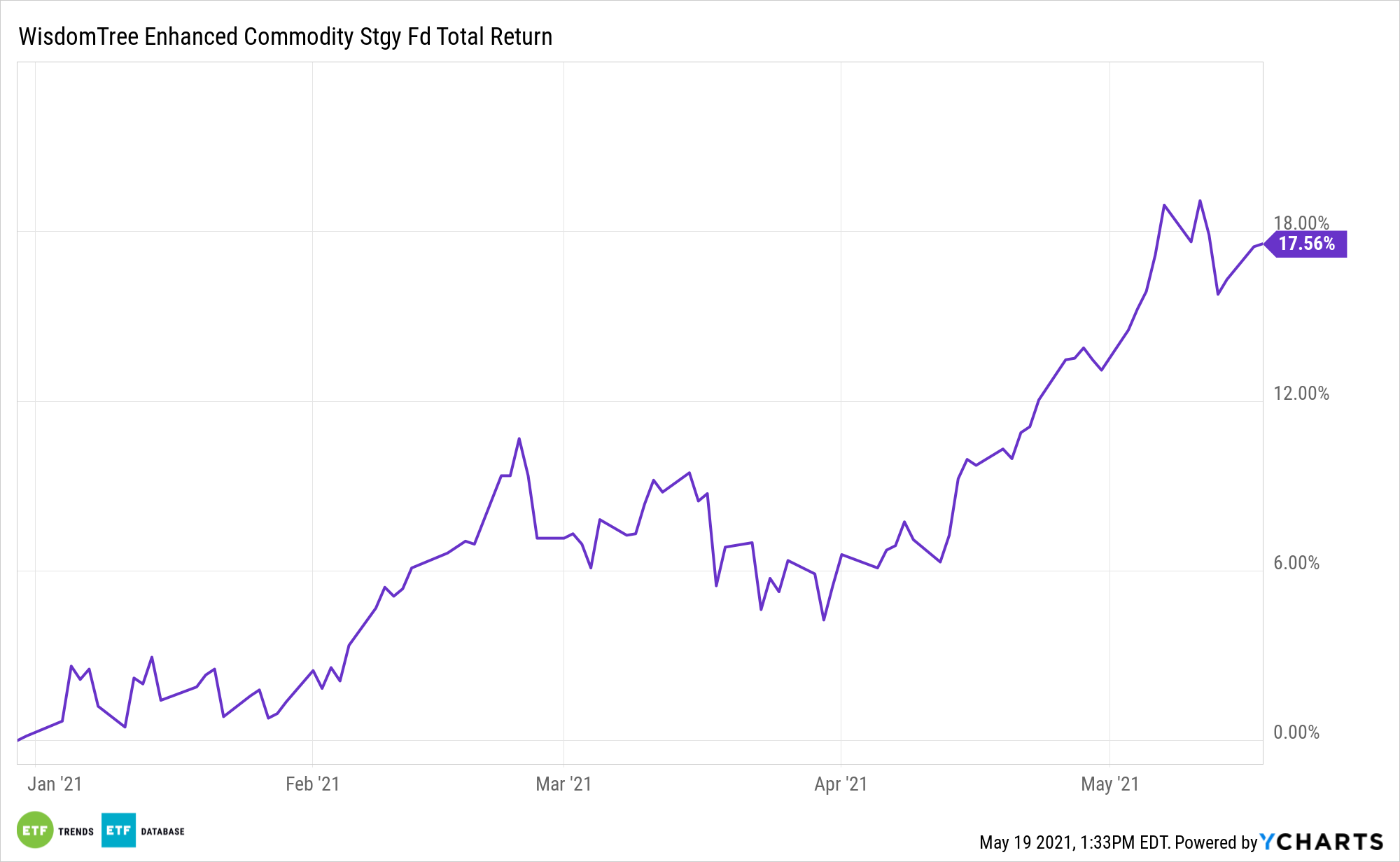

The Longevity Model Portfolio has some inflation-fighting avenues as well. It allocates 6% of its weight to commodities strategies, including the WisdomTree Enhanced Commodity Strategy Fund (GCC). GCC is a broad-based commodities exchange traded product with exposure to base and precious metals as well as agriculture and energy commodities.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.