Endowment-style investing, popularized by the late David Swensen of Yale University, was once reserved for endowments, but thanks to Swensen’s stellar long-term track record, more money managers are looking to duplicate these endowment strategies.

More investors seem to be receptive to the idea too, but for advisors, building endowment-style portfolios from scratch is difficult. Model portfolios can ease that burden, and WisdomTree offers a broad suite of endowment model portfolios with varying degrees of risk.

“All-in-one multi-asset portfolios leveraging our Modern Alpha® approach. These strategies are designed for investors who seek to incorporate real assets and alternative investments into a traditional portfolio of U.S. and international equity and fixed income ETFs,” according to the issuer.

WisdomTree’s endowment model portfolios feature five sleeves: conservative, moderately conservative, moderate, moderately aggressive, and aggressive. The higher up the risk spectrum an advisor goes within the suite, the more the portfolio’s equity exposure increases.

Advantages of Investing Like an Endowment

As Scott Welch, WisdomTree chief investment officer, model portfolios, points out, endowment-style investing offers clients myriad benefits. Those include diversification, balancing allocations to active and passive strategies, embracing asset classes with low correlations to equities and fixed income, positioning investors for long time horizons, and “investment discipline through full market cycles.”

“We manage our different risk-banded Endowment Models in exactly this way, and we believe they deserve more attention as long-term solutions for many advisors and end clients,” said Welch.

The aggressive sleeve of WisdomTree’s endowment model allocates 50% to equity-based exchange traded funds, 30% to alternative funds, and 20% to bonds. Holdings include the broad-based WisdomTree Enhanced Commodity Strategy Fund (GCC) and the WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (NYSEArca: AGGY).

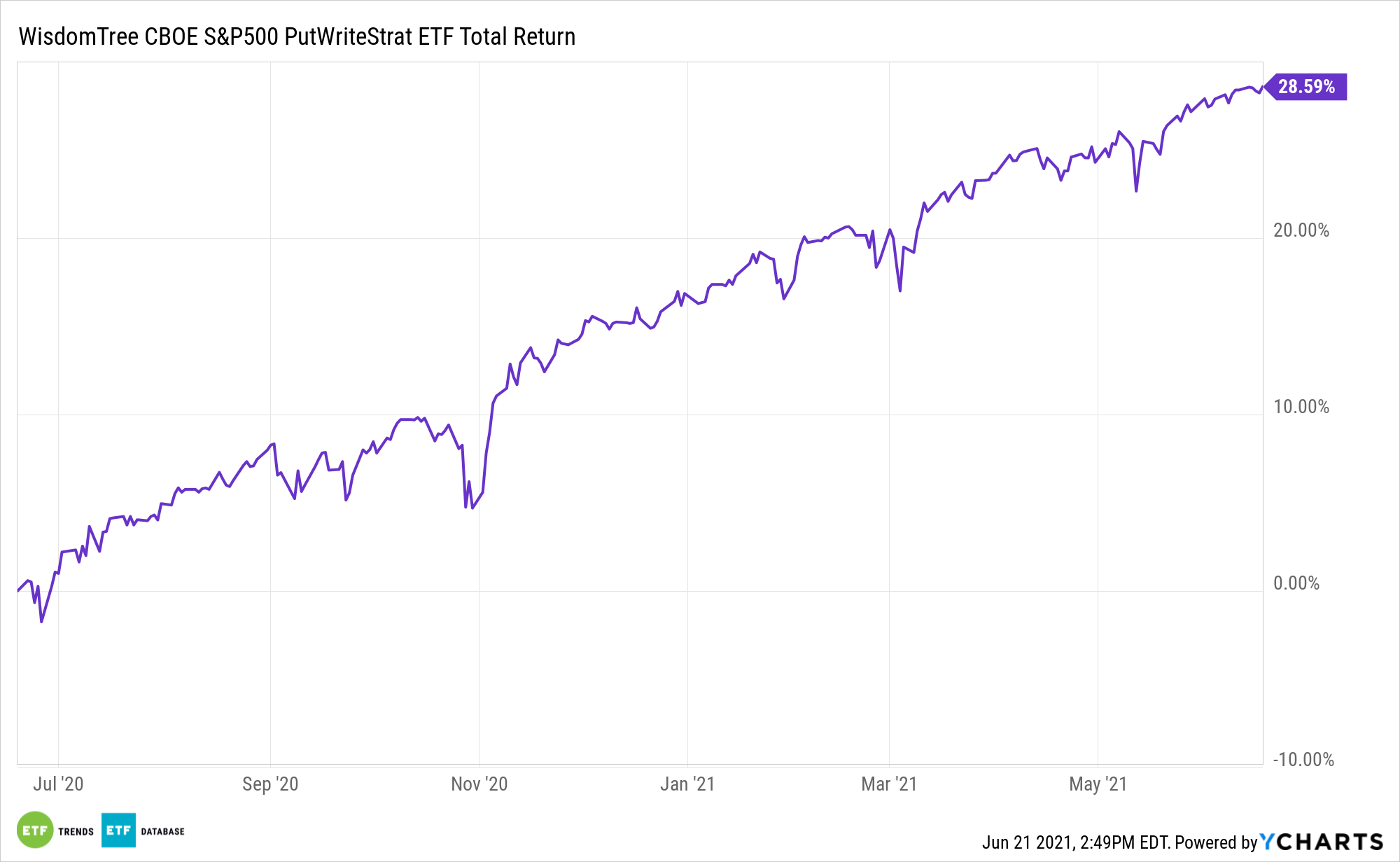

“On the real asset side, we have allocations to energy MLPs, infrastructure and, via our own GCC, a dynamically managed broad basket of commodities,” adds Welch. “On the alternative investment side, we have allocations to a short-biased strategy and two variations of hedged equity strategies, including our own put-writing strategy, PUTW.”

“PUTW” references the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (NYSEArca: PUTW). That WisdomTree ETF augments market volatility and provides clients with needed income by selling puts on the S&P 500.

In addition to MLP exposure and PUTW, the alternative corner of the endowment model portfolio features real estate exposure for elevated income.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.