Following a sanguine June, stocks are proving jittery in the early stages of July, and while volatility isn’t yet at alarming heights, some market observers believe the usual summer lull could give way to some bumpy spots for riskier assets.

That doesn’t mean volatility will persist for lengthy periods, but advisors can act prudently to curb volatility in any case. One way to do so is with WisdomTree’s Volatility Management Portfolio.

“This model portfolio is designed as an alternative investment sleeve that exhibits lower correlation to traditional equity and fixed income securities,” according to WisdomTree. “This portfolio’s objective is to complement a more traditional equity and fixed income portfolio, while seeking to increase the number of potential return drivers and improve the overall portfolio risk/return characteristics.”

The model portfolio is comprised of five exchange traded funds, each with weights of 20%. As noted above, the aim is to reduce correlations to traditional assets, such as stocks and bonds. That goal is fulfilled with a lineup featuring several unique alternative strategies that can benefit clients if material volatility moves higher.

One prominent example is the Quadratic Interest Rate Volatility and Inflation Hedge ETF (IVOL). IVOL is particularly relevant today because it takes an offensive posture against inflation while providing a buffer against sudden changes in interest rates.

“IVOL seeks to protect purchasing power, mitigate inflation risk, profit from an increase in volatility and a steepening of the yield curve, and provide inflation-protected income,” according to Quadratic Capital. “At the same time, the fund looks to provide investors with access to the OTC interest rate options market – a market largely not previously available to individual investors – to provide structured solutions that offer an attractive risk/reward profile.”

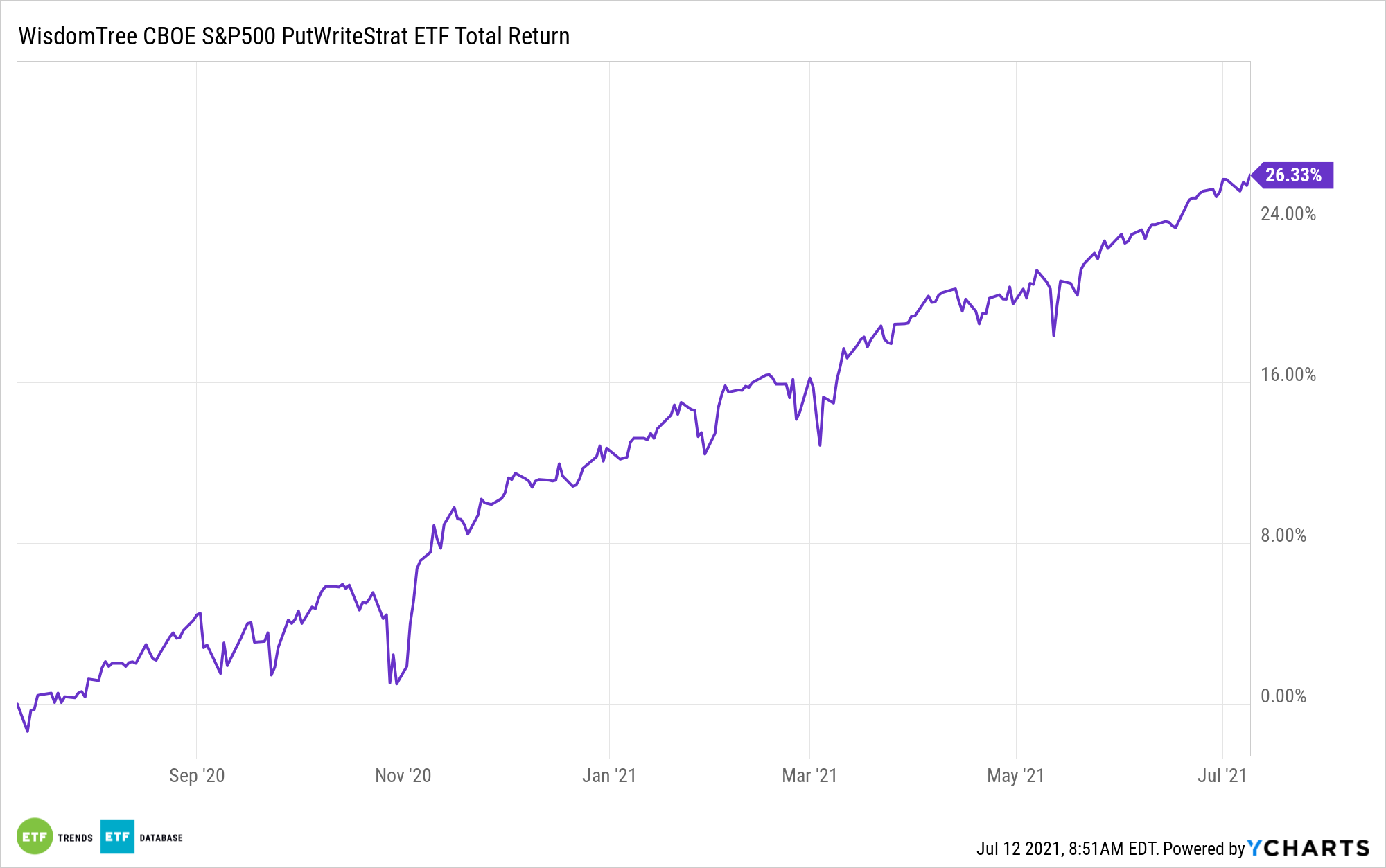

The model portfolio adds to its correlation-reducing and income-boosting credibility with the WisdomTree CBOE S&P 500 PutWrite Strategy Fund (NYSEArca: PUTW). Options writing strategies, including those in ETF form, often thrive when volatility rises because they aren’t highly correlated to equities. Options premiums also often join volatility to the upside, potentially creating more income.

PUTW, which debuted in February 2016, follows the CBOE S&P 500 PutWrite Index and aims to reduce volatility and downside exposure.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.