With global dividends rebounding and bond yields sagging, now is an opportune time for advisors to discuss the right dividend strategies with clients.

WisdomTree delivers one in the form of the Global Dividend Model Portfolio, which features nine exchange trade funds spanning domestic, developed international, and emerging markets equities.

“This model portfolio seeks to provide capital appreciation and high current income by investing in a globally diversified set of dividend and yield-oriented equity ETFs. The model strives to deliver current yield in excess of a global benchmark of equities,” according to the issuers.

One of the primary reasons this model portfolio is relevant today is its components’ emphasis on quality and dividend durability.

“Great dividend-income strategies take steps to control their exposure to firms whose dividends might be at risk,” says Morningstar analyst Daniel Sotiroff. “It’s a careful compromise between two competing forces, balancing yield with financial stability. Often the best portfolios land somewhere in the middle. They don’t have the highest yields, nor do they strictly focus on the highest-quality stocks.”

A couple of the model portfolio’s holdings are high-dividend ETFs, but even in those cases, the yields aren’t excessively rich, and neither of those funds have long histories of being home to dividend offenders. On the other hand, many of the model portfolio’s holdings heavily lean into quality, and that’s a plus for clients.

“Well-constructed dividend-income portfolios should have above-average yields and above-average quality characteristics, like high profitability and low or reasonable dividend payout ratio,” notes Morningstar’s Sotiroff.

The model portfolio’s quality focus isn’t confined to domestic stocks. Ex-U.S.-developed market exposures in the WisdomTree model portfolio include the WisdomTree Global ex-U.S. Dividend Growth Fund (NYSEArca: DNL) and the WisdomTree International SmallCap Dividend Fund (DLS).

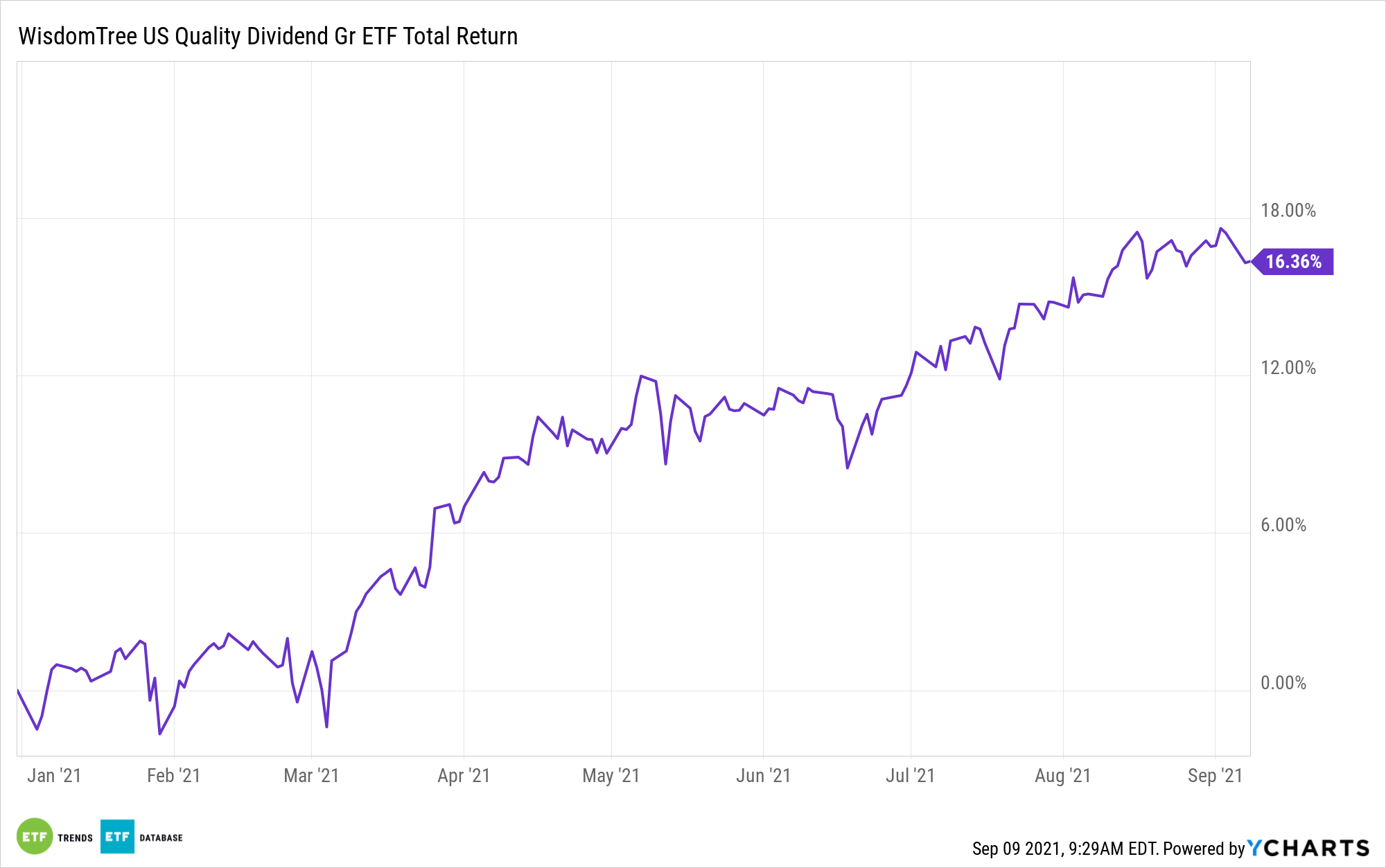

The WisdomTree US Quality Dividend Growth Fund (DGRW), one of the ETF pioneers of quality dividend growth, is one of the model portfolio’s largest domestic holdings. Bottom line: The WisdomTree model portfolio offers up a lot in the way of dividend quality, indicating that it is useful to a wide audience of clients.

“There is no one right way to emphasize quality in a dividend-income strategy, but it should be noticeable and consistent over time. The quality factor itself is somewhat squishy as it can be defined in a number of ways. Many strategies have converged on several metrics, typically some combination of profitability, earnings stability, and low dividend payout ratios, among others,” according to Sotiroff.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.