By Jeff Weniger, CFA, WisdomTree

This is the third of a three-part blog post series. Part one lays out why COVID-19 can affect the growth versus value decision . Part two discusses Florida, the hotly contested swing state. Here, we discuss the battle for the Southwest.

Do not get lulled into focusing on just Ohio, Wisconsin and the rest of the Rust Belt. We need to talk about the southwestern swing states.

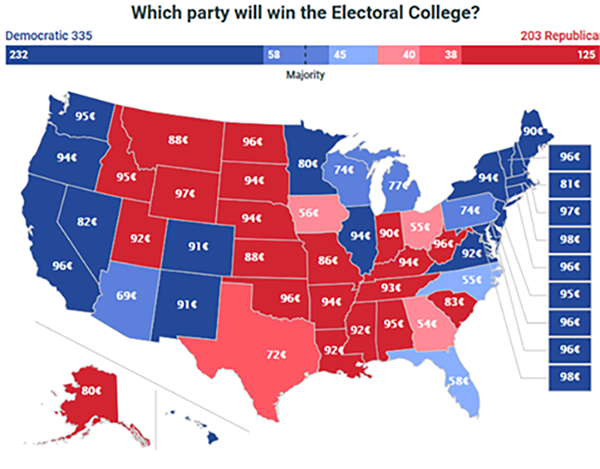

Figure 1 shows the state-by-state pricing for victory by both Biden and Trump on PredictIt, the marketplace for event futures.

At extremes are solidly “blue” states like New York, where Biden contracts cost 94 cents, paying off a six-cent profit when it expires at one dollar upon the Democratic challenger’s taking of New York. On the other extreme, Wyoming, where it costs 97 cents to lay money on Trump taking that state. A three-cent profit looms “if” Trump takes it.

Figure 1: PredictIt Presidential Election Odds

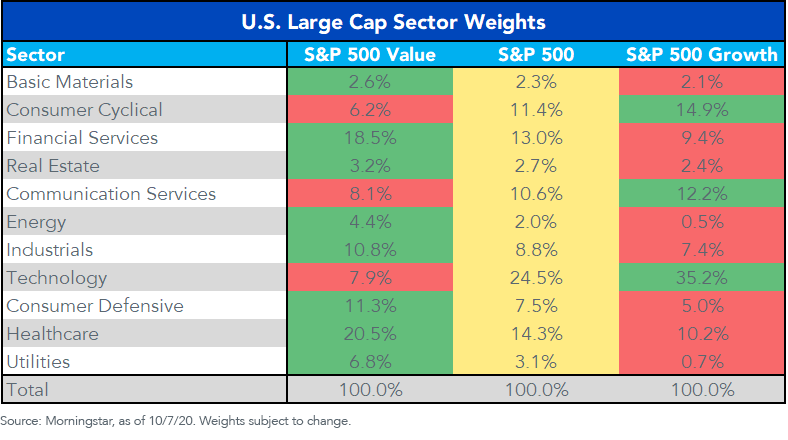

If you think about sectors and asset classes in a Biden versus Trump framework, we keep coming back to the Energy and Financials sectors. Energy is easy enough: a Biden win means a push into alternatives such as solar and geothermal, while Trump is the oil guy. In Financials, Biden is the “reign in Wall Street” candidate, while Trump represents the status quo.

Those two sectors are critical, because they populate value indexes in size (figure 2).

Figure 2: Sector Weights, U.S. Large Caps

Election “Kremlinology” focuses so much on states like Florida, North Carolina and Michigan that it is easy to divert our eyes from what the market believes are two southwestern states that Biden will capture: Arizona and Nevada. At 69% and 82% probabilities, respectively, Biden cannot be faulted for taking his eye off them when there is work to do in the Midwest and East.

But in Nevada, Biden has two forces working against him: first, recent violence on the Las Vegas Strip has gotten national attention, playing into Trump’s “law and order” pitch.

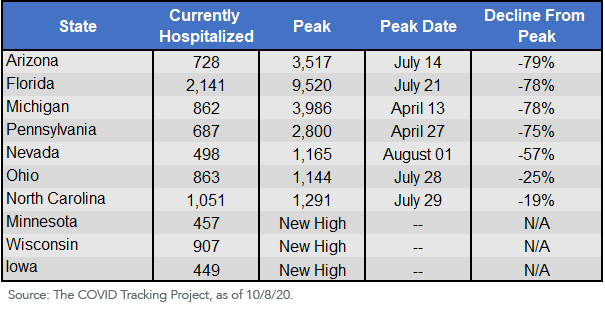

Secondly, Nevada’s COVID-19 hospitalizations have more than halved since early August (figure 2), lifting the urgency for a vaccine and perhaps alleviating some of the public’s sense of helplessness.

Figure 3: Swing State COVID-19 Hospitalizations

If Nevada, which Hillary Clinton took by 2.4 points, ends up being a surprise Trump victory, Arizona will probably tag along, for a few reasons.

For one, Trump won the state last time, and handily (48.1% to 44.6%). Additionally, the state’s legendary senator and face of the “Never Trump” camp, John McCain, passed away in 2018.

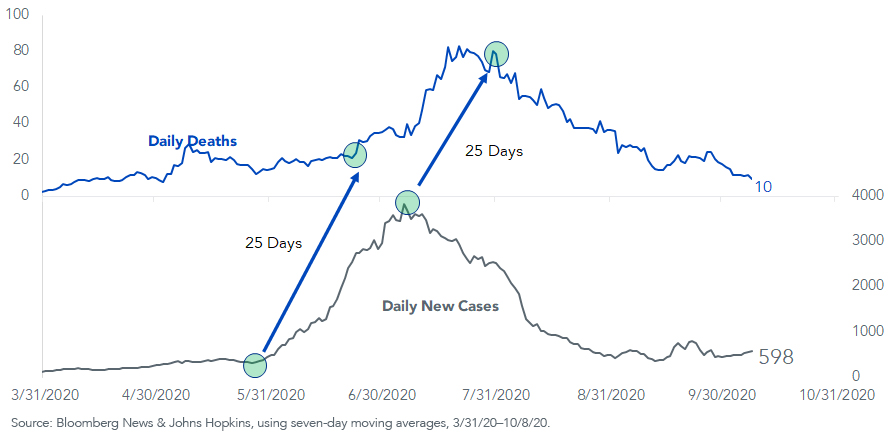

Also, like in Nevada, it appears the worst of the COVID-19 hit may be in the rearview mirror. The state’s daily death and case counts have fallen sharply, though the latter has started to rise again in recent weeks. Nevertheless, with cases leading mortality by 3–4 weeks, it is possible Arizona’s 7.3 million residents could witness single-digit daily deaths before November 3.

Figure 4: Arizona COVID-19 Daily Deaths and Cases

If both states go red this time around—which is not at all the Street’s base case—you have to entertain a thesis where the Republicans retain the Senate and perhaps even take back the House, though the latter is a long shot with 11% probability. Any combination of these outcomes would divert U.S. equity eyes toward Financials and Energy, the two sectors that would benefit most from a swing to the GOP.

This means value stocks. So, make sure to keep an eye on the Southwest. If Arizona and Nevada go for Trump, he is probably looking at reelection.

In large Cap Core, an overweight in Financials is found in the WisdomTree U.S. LargeCap Fund (EPS). For a more decided value tilt with Energy at an 8% exposure (versus 2% in the S&P 500), try the WisdomTree U.S. LargeCap Dividend Fund (DLN).

If Biden prevails, two ideas are the WisdomTree Cloud Computing Fund (WCLD) and the WisdomTree Growth Leaders Fund (PLAT). They are the opposite side of the Energy and Financials trade because of their tech orientation.

Originally published by WisdomTree, 10/12/20

Important Risks Related to this Article

There are risks associated with investing, including possible loss of principal. Funds focusing their investments on certain sectors, such as DLN and EPS, increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility.

Foreign investing involves special risks, such as risk of loss from currency fluctuation or political or economic uncertainty; these risks may be enhanced in emerging, offshore or frontier markets. Technology platform companies have significant exposure to consumers and businesses, and a failure to attract and retain a substantial number of such users to a company’s products, services, content or technology could adversely affect operating results. Technological changes could require substantial expenditures by a technology platform company to modify or adapt its products, services, content or infrastructure. Technology platform companies typically face intense competition, and the development of new products is a complex and uncertain process. Concerns regarding a company’s products or services that may compromise the privacy of users, or other cybersecurity concerns, even if unfounded, could damage a company’s reputation and adversely affect operating results. Many technology platform companies currently operate under less regulatory scrutiny, but there is significant risk that costs associated with regulatory oversight could increase in the future. PLAT invests in the securities included in, or representative of, its Index regardless of their investment merit, and the Fund does not attempt to outperform its Index or take defensive positions in declining markets. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended.

WCLD invests in cloud computing companies, which are heavily dependent on the Internet and utilizing a distributed network of servers over the Internet. Cloud computing companies may have limited product lines, markets, financial resources or personnel and are subject to the risks of changes in business cycles, world economic growth, technological progress and government regulation. These companies typically face intense competition and potentially rapid product obsolescence. Additionally, many cloud computing companies store sensitive consumer information and could be the target of cybersecurity attacks and other types of theft, which could have a negative impact on these companies and the Fund. Securities of cloud computing companies tend to be more volatile than securities of companies that rely less heavily on technology and, specifically, on the Internet. Cloud computing companies can typically engage in significant amounts of spending on research and development, and rapid changes to the field could have a material adverse effect on a company’s operating results. The composition of the Index is heavily dependent on quantitative and qualitative information and data from one or more third parties, and the Index may not perform as intended.

Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.