The quality factor isn’t confined by geography, and for investors looking to add some international diversification to domestic-heavy equity portfolios, that’s a good thing.

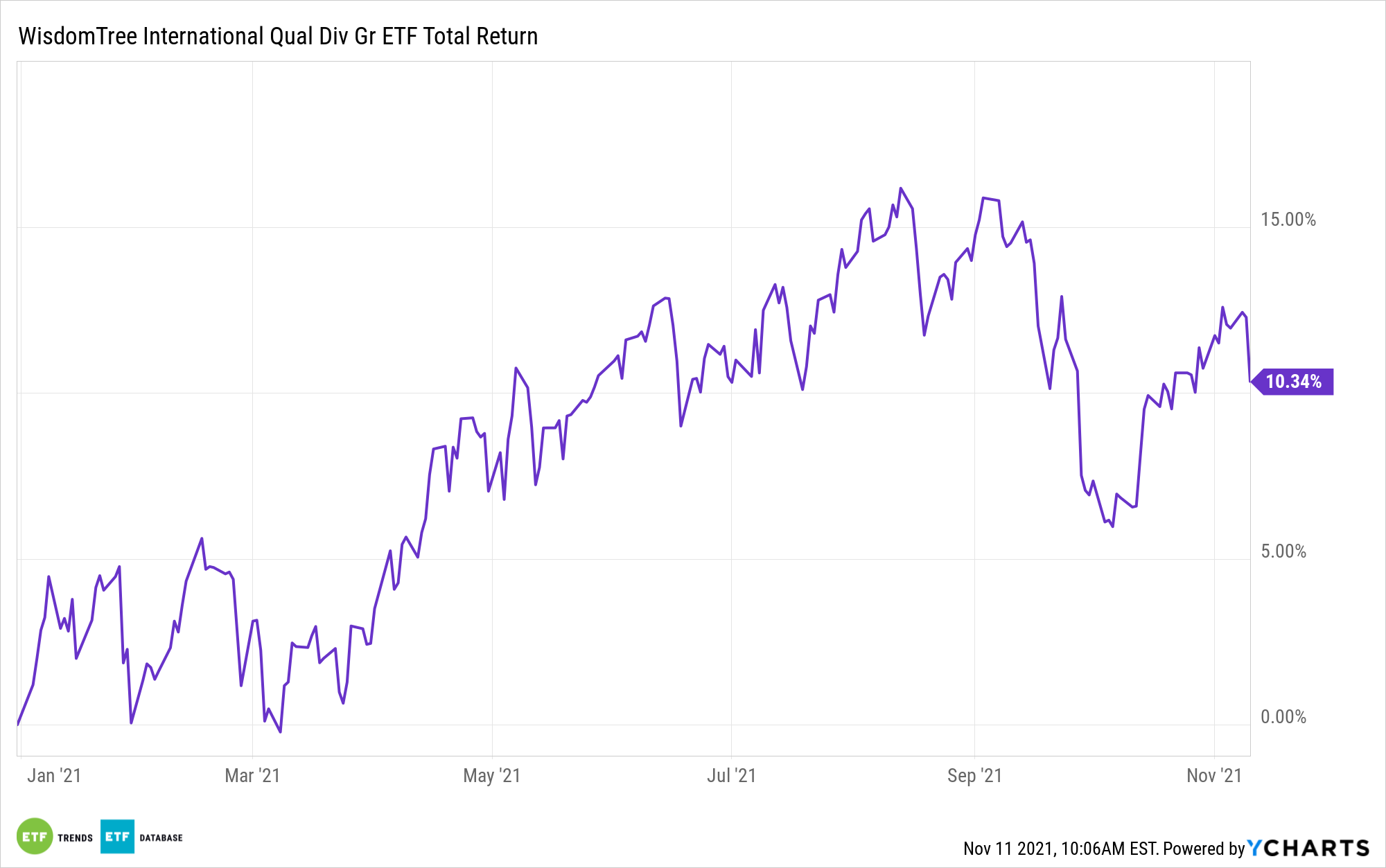

Another positive is that while defining quality is often a matter of interpretation, one of the factor’s hallmarks is dividends. The WisdomTree International Quality Dividend Growth Fund (CBOE: IQDG) taps into that theme while providing investors with high-quality international exposure.

IQDG follows the WisdomTree International Quality Dividend Growth Index (WTIDG), which isn’t any old developed markets benchmark. Rather, IQDG’s underlying index emphasizes favorable traits, such as impressive earnings growth prospects and profitability, with the idea being that those characteristics can be signals of encouraging dividend growth trends.

“WTIDG’s median annual dividend growth over the last three years has been 10.5% compared to 2.8% by the MSCI EAFE Index. During this same period, WTIDG has outperformed MSCI EAFE by more than 400 basis points (bps),” says Alejandro Saltiel, WisdomTree associate research director.

With any international ETF, investors are right to consider geographic exposures. That’s a valid point with IQDG because end users need to know from where reliable dividends are being sourced. For starters, IQDG excludes U.S. and Canadian equities. The fund allocates nearly 16% of its weight to U.K. stocks, which is relevant because dividends there are bouncing back from 2020 trouble spots caused by the coronavirus pandemic.

Japan and Switzerland combine nearly a quarter of IQDG’s roster. In the case of Japan, dividend growth in Asia’s second-largest economy is a relatively new phenomenon, and companies there have the resources to support a lengthy run of shareholder rewards. Regarding Switzerland, that’s long been a beacon of reliable, quality payout growth in Europe.

With IQDG’s index being recently rebalanced, some other country alterations are worth noting.

“Exposures to France, Sweden and Spain were significantly increased,” notes Saltiel. “The largest change from a country perspective was France, whose weight increased 4.04%. This increase was driven by the addition of Consumer Discretionary conglomerates Kering SA and Michelin. Both companies showed a solid rebound in earnings and dividend growth post COVID-19 slowdown. Increases for Sweden and Spain can be largely attributed to the addition of companies in the Industrials and Consumer Discretionary sectors, respectively.”

At the sector level, consumer discretionary was a group that was boosted in IQDG’s index following the rebalance. That’s now the fund’s second-largest sector exposure at 20.11%, trailing only industrials. Healthcare is third at 19.66%.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.