July was the first month of the second half of 2022 and it was business as usual for the year, with continued market volatility caused by persistently high inflation, aggressive Federal Reserve interest rate hikes, quantitative tightening, and weakened investor sentiment. WisdomTree had two funds that stood out for flows in July, centered around investing in a rising rate environment and seeking income in a challenging time for equities and bonds.

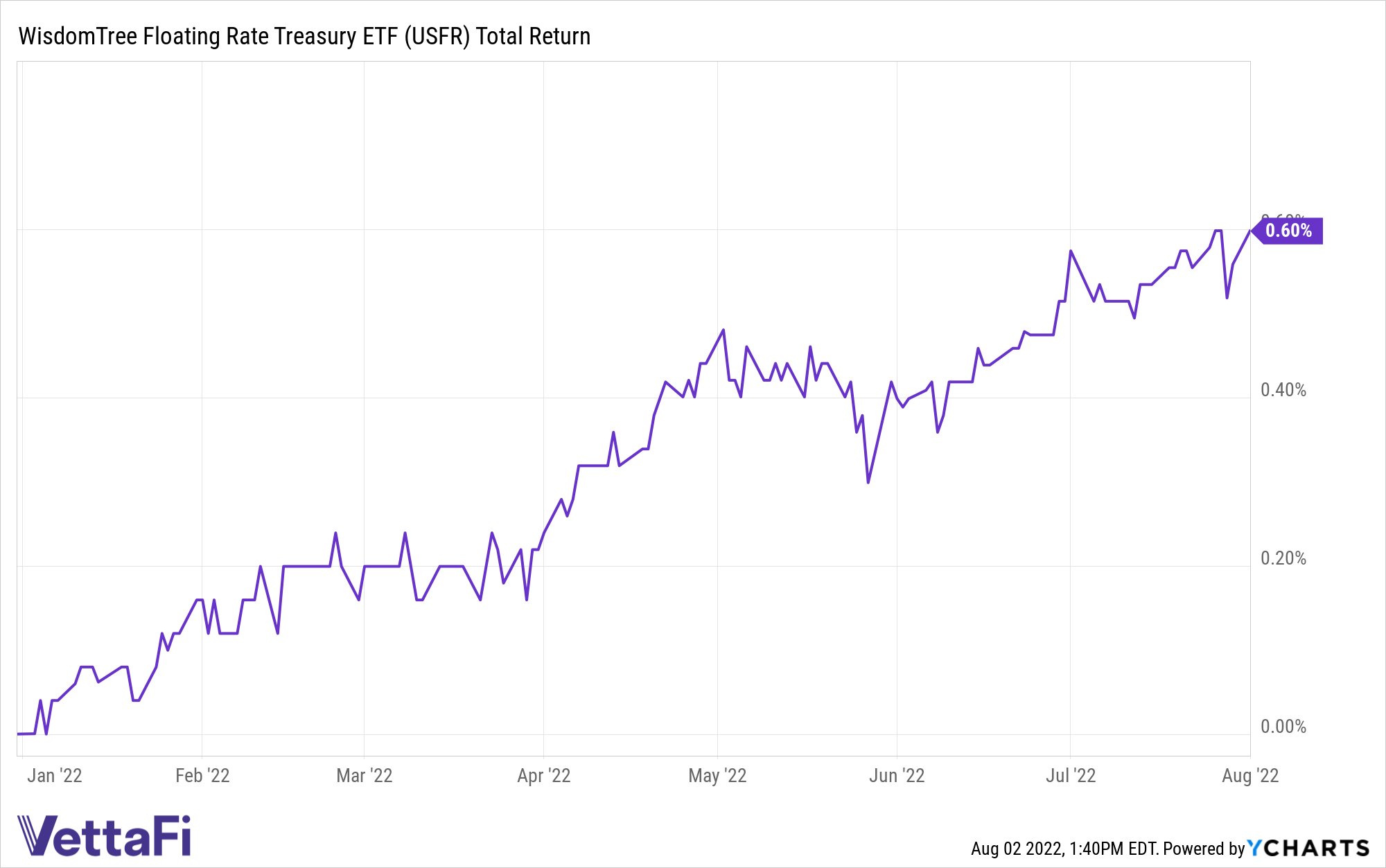

The rate hedging potential offered by the WisdomTree Floating Rate Treasury Fund (USFR) has been enormously popular this year. In July, the fund brought in $713 million in flows, and year-to-date the fund has raked in over $4.35 billion.

The fund capitalizes on the use of floating rate notes by the U.S. Treasury and can be an excellent option for investors looking to limit their amount of credit risk, but still capture higher yield potentials in rising rate environments.

WisdomTree believes that floating rate debt is an important bridge between long-maturity, fixed-rate Treasury Bonds, and short-maturity Treasury bills. By investing in floating rate Treasuries, holders are paid out quarterly and the amount paid is based on a rate that resets daily in reference to a weekly rate. It can be a good option if Treasury bill yields are rising because it provides the opportunity for greater compensation over a fixed rate bond.

USFR seeks to track the Bloomberg U.S. Treasury Floating Rate Bond Index, which measures the performance of floating rate notes of the U.S. Treasury and contains floating rate notes with two-year maturities and a minimum outstanding amount of $1 billion. The index uses a rules-based strategy and is weighted by market cap. The index excludes fixed-rate securities, Treasury inflation-protected securities, convertible bonds, and bonds with survivor put options.

Dividends have been another popular investment choice this year as advisors and investors seek income in a challenging market environment for bonds and equities. The WisdomTree US Quality Dividend Growth Fund (DGRW) invests in large-cap U.S. equity companies that are growing their dividends and applies both quality and growth screens to securities and was the second most popular WisdomTree ETF by flows in July, bringing in $285 million.

The fund seeks to track the WisdomTree U.S. Quality Dividend Growth Index, a fundamentally weighted index based on dividend projections for the next year, which screens companies for long-term growth expectations, return on equity, and return on assets.

The index is made up of the 300 companies from the WisdomTree U.S. Dividend Index that have the best combined rank of growth and quality factors mentioned above. The index is dividend-weighted on an annual basis so that it reflects each company’s aggregate cash dividend shares proportionately, with the highest dividend-paying companies weighted the heaviest.

Securities within the index are capped at 5% individually, and most sectors cannot make up more than 20% — information technology is one exception at a 25% limit, while real estate is the other at a 10% cap.

For more news, information, and strategy, visit the Modern Alpha Channel.