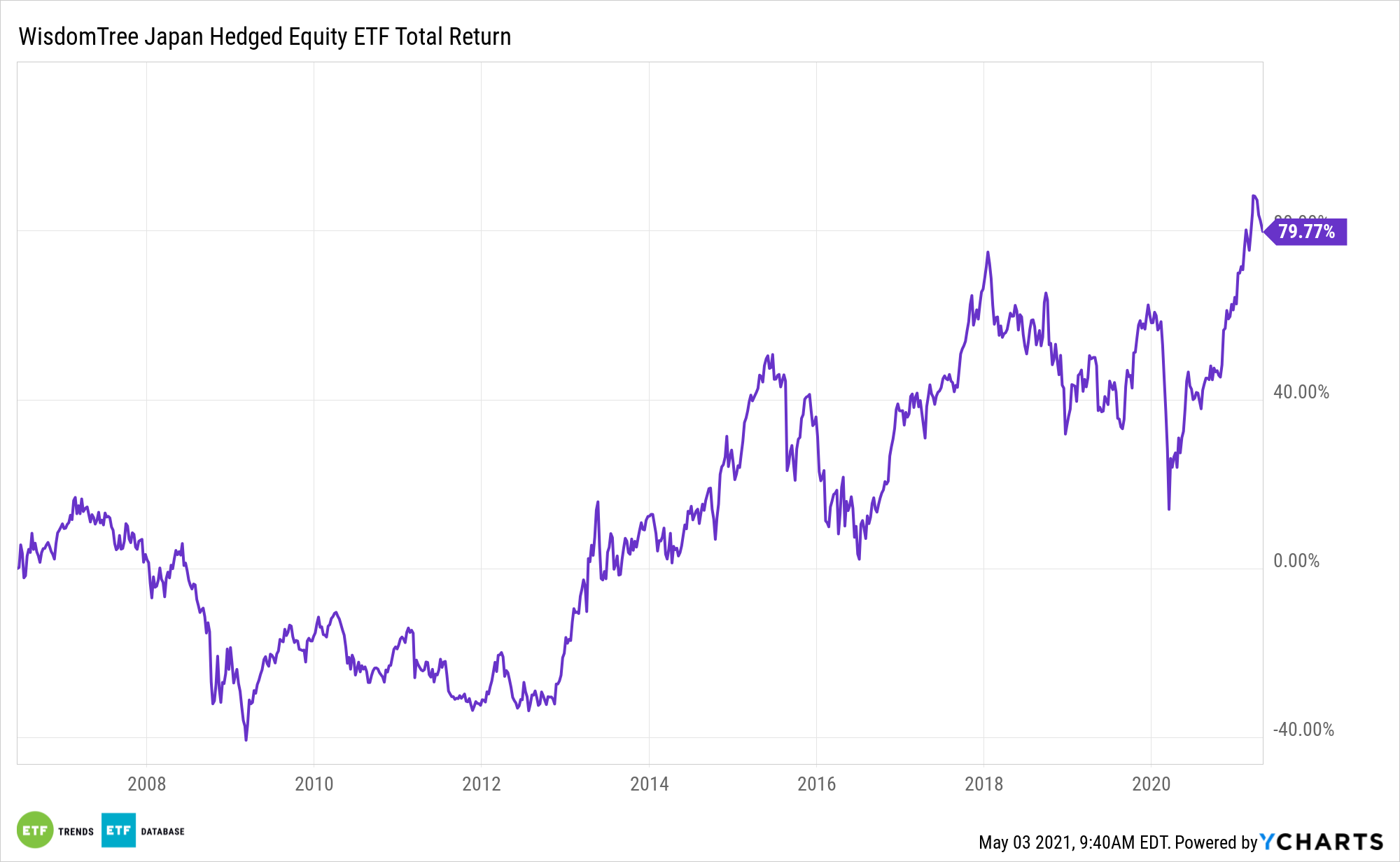

While the U.S. dollar remains weak, the WisdomTree Japan Hedged Equity Fund (NYSEArca: DXJ) is up nearly 10% year-to-date, highlighting opportunity in the world’s third-largest economy.

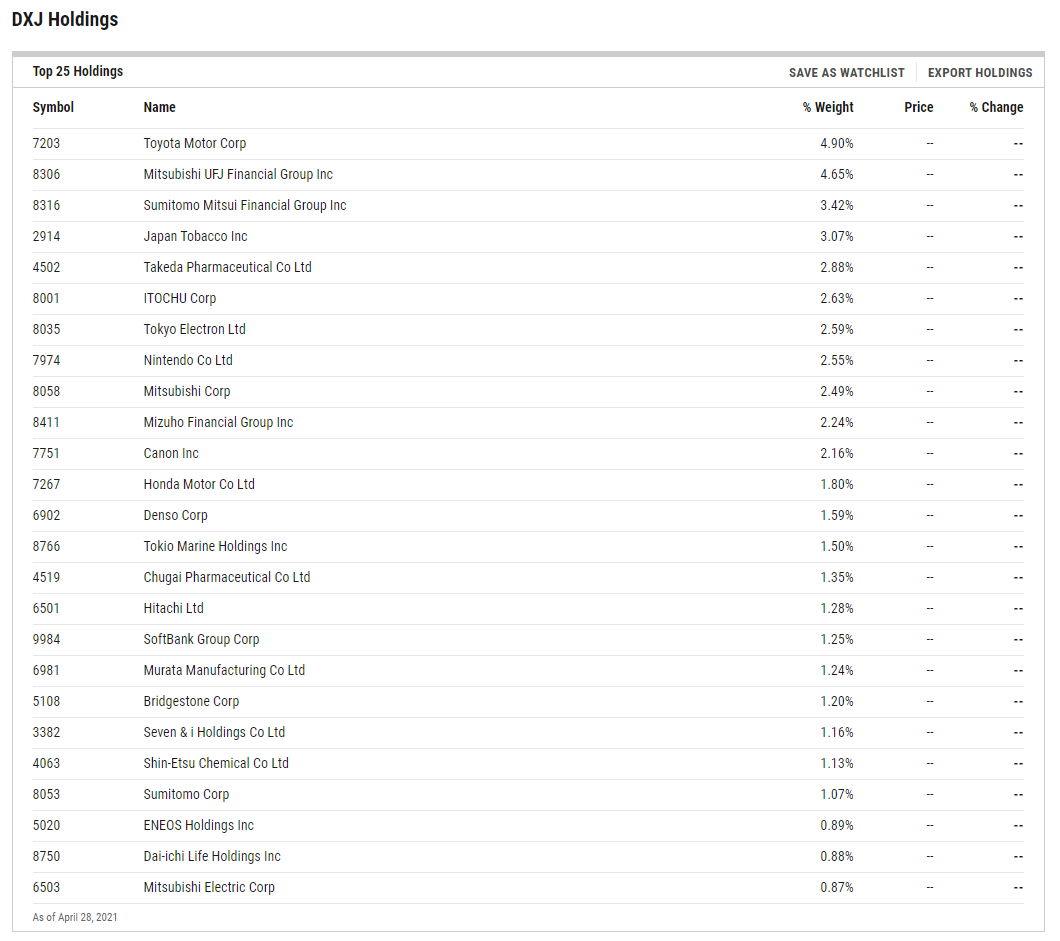

Although Japanese benchmarks scuffled in recent years due to light exposure to mega cap growth and tech stocks, investors’ return to cyclical value fare is lifting equities for DXJ. That theme could prove durable as 2021 moves along.

“While Japan’s position as a market more tilted to cyclical sectors was a headwind during a global rally in growth stocks, it may be perfectly primed for an environment in which economic growth is expected to make a significant recovery in the coming years,” said Matt Wagner, WisdomTree research associate, in a recent note.

As a currency-hedged ETF, the $1.64 billion DXJ capitalize on yen weakness relative to the dollar. However, a strong greenback isn’t necessary for the fund to thrive, as evidenced by this year’s performance.

Drilling Down the ‘DXJ’ Opportunity

DXJ tracks the WisdomTree Japan Hedged Equity Index.

“The Index is designed to have higher returns than an equivalent non-currency hedged investment when the yen is weakening relative to the U.S. dollar,” according to WisdomTree. “Conversely, the Index is designed to have lower returns than an equivalent unhedged investment when the yen is rising relative to the U.S. dollar. The Index consists of dividend-paying companies incorporated in Japan and traded on the Tokyo Stock Exchange that derive less than 80% of their revenue from sources in Japan.”

That dividend focus is noteworthy at a time when Japanese companies are flush with cash and looking to boost shareholder rewards. That benefit comes alongside DXJ’s notable cyclicals exposure.

“While Japan’s position as a market more tilted to cyclical sectors was a headwind during a global rally in growth stocks, it may be perfectly primed for an environment in which economic growth is expected to make a significant recovery in the coming years,” adds Wagner. “For example, WisdomTree’s Japan Hedged Equity Index—which tilts more toward cyclical sectors than the broad MSCI Japan Index and neutralizes yen fluctuations—has outperformed the S&P 500 by nearly 300 basis points since the end of August. The recently enacted lockdowns have been a headwind to year-to-date returns.”

DXJ is worthy of consideration for another reason: it can be a beneficiary of rising U.S. Treasury yields.

“Given the cyclical tilts of the Japanese equity market, as well as the tendency for the yen to weaken alongside a rise in U.S. rates, the WisdomTree Japan Hedged Equity Index has had a positive correlation between its outperformance and rising Treasury yields,” concludes Wagner.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.