By Matt Wagner, CFA

Associate Director, Research

All eyes are on corporate earnings.

The collapses of Silicon Valley Bank (SVB) and Signature Bank in March have led investors to pay extra attention to first quarter earnings for any further signs of distress in the banking industry and for recession signals more broadly.

We have spent the last several months developing a tool called the Earnings Path as a way for investors to track trends in earnings throughout the reporting season.

How to Get There

All our tools are located in the PATH — Portfolio Analysis Tools Hub — drop-down on the WisdomTree website. The Earnings Path can be found at the bottom of this drop-down.

Blended Sales and Earnings Growth

The default setting of the tool shows the S&P 500 Index quarterly earnings summary for the current quarterly reporting season.

The tab that is selected — Growth (All) — shows a blend of actual reported sales and earnings growth with median analyst estimates as of the latest business date.

The below screenshot was taken on April 27. The data includes the actual sales and earnings growth of all companies that had reported 1Q earnings through April 26, blended with the latest analyst estimates.

At the aggregate Index level—summing all the aggregate sales and earnings in 1Q 2023 compared to 1Q 2022—S&P 500 earnings are anticipated to have margin compression, with sales estimated to grow slightly compared to a drop in earnings.

Information Technology—which we can see has the largest weight in the Index—is expected to have a modestly negative sales growth alongside a much larger decline in earnings.

Clicking on the Index entity or any of the sector names shows a time series analysis of year-over-year earnings growth.

From this series, we see that the earnings growth anticipated for 1Q 2023 would be the second consecutive negative earnings growth for the Index—typically called an earnings recession—and the worst earnings growth since the COVID-19 lockdowns in 2Q 2020.

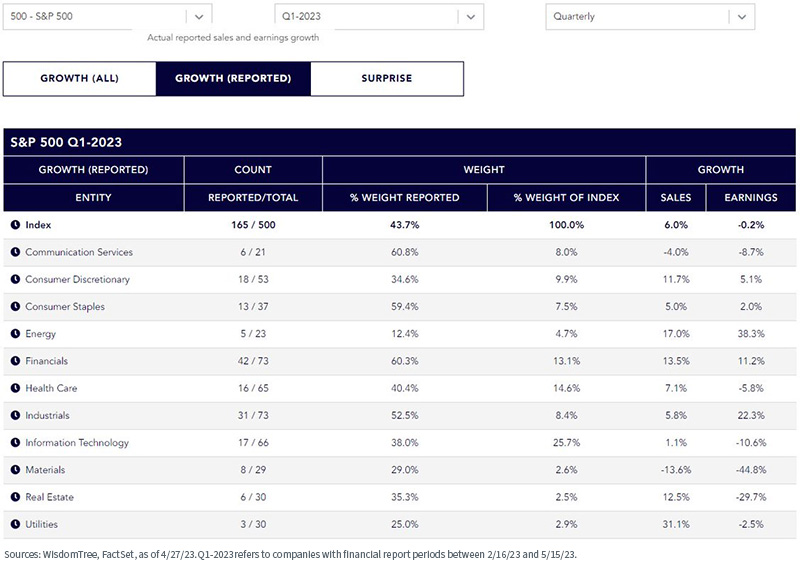

Reported Sales and Earnings Growth

The next tab in the tool—Growth (Reported)—is for actual reported earnings through the latest business date.

Through April 27, 43.7% of the Index had reported 1Q earnings. The biggest banks typically report earlier in the reporting season, which can be seen by the Financials sector having one of the greatest proportions of weight reported, at over 60%.

The Financials that reported by that date had resilient earnings, with sales growth of 13.5% and earnings growth of 11%.

Sales and Earnings Surprise

The last tab of the tool highlights sales and earnings surprise figures—actual sales and earnings reports compared to median analyst estimates.

Similar to the report growth tab, this tab will have greater statistical significance later in the earnings season as more companies report earnings.

To date, 10 out of the 11 sectors show a positive earnings surprise (with Real Estate being the outlier).

Compare Across Indexes

Included in the tool is a diverse sample of indexes to help give perspective on earnings trends in different segments of the market.

For example, those interested in tracking earnings trends in a thematic universe like cloud computing can select the BVP NASDAQ Emerging Cloud Index from the drop-down.

Bookmark Our Tool!

We hope this tool can be a valuable resource for those wishing to keep track of earnings throughout the reporting period and that you will bookmark this link for easy access to daily data updates.

As with all our PATH tools, we will continue to make enhancements over time, such as adding indexes, export functions and other unique ways of tracking earnings trends.

Originally published by WisdomTree on April 28, 2023.

For more news, information, and analysis, visit the Modern Alpha Channel.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Brian Manby, and Scott Welch are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.