Investors often overlook ex-U.S. small caps, but financial advisors can ameliorate that scenario with model portfolios. The WisdomTree Strategic Model Portfolio is one excellent option.

“This model portfolio is designed for growth-oriented investors with a long-term horizon looking to maximize long-term potential for capital growth through a globally diversified set of equity and fixed income ETFs. The model portfolio strives to deliver performance in excess of an 80/20 combination of a broad-based global equity benchmark and a U.S. aggregate bond index,” according to WisdomTree.

This model portfolio features some international small cap exposure, which is a potential advantage in the current environment and over longer holding periods.

“Small caps have dominated to start the year, and value investing is finally gaining momentum. February was the best month for U.S. value relative to growth since the technology bubble in the early 2000s, outperforming by nearly 6%,” writes WisdomTree analyst Brian Manby. “While small caps and value stocks have benefitted from a changing paradigm in the U.S., developed market small-cap value stocks have not been left behind either.”

11 Incisive ETFs

The equity side of the model portfolios features 11 exchange traded funds spanning domestic and international (emerging markets included), encompassing large-, mid-, and small-cap equities.

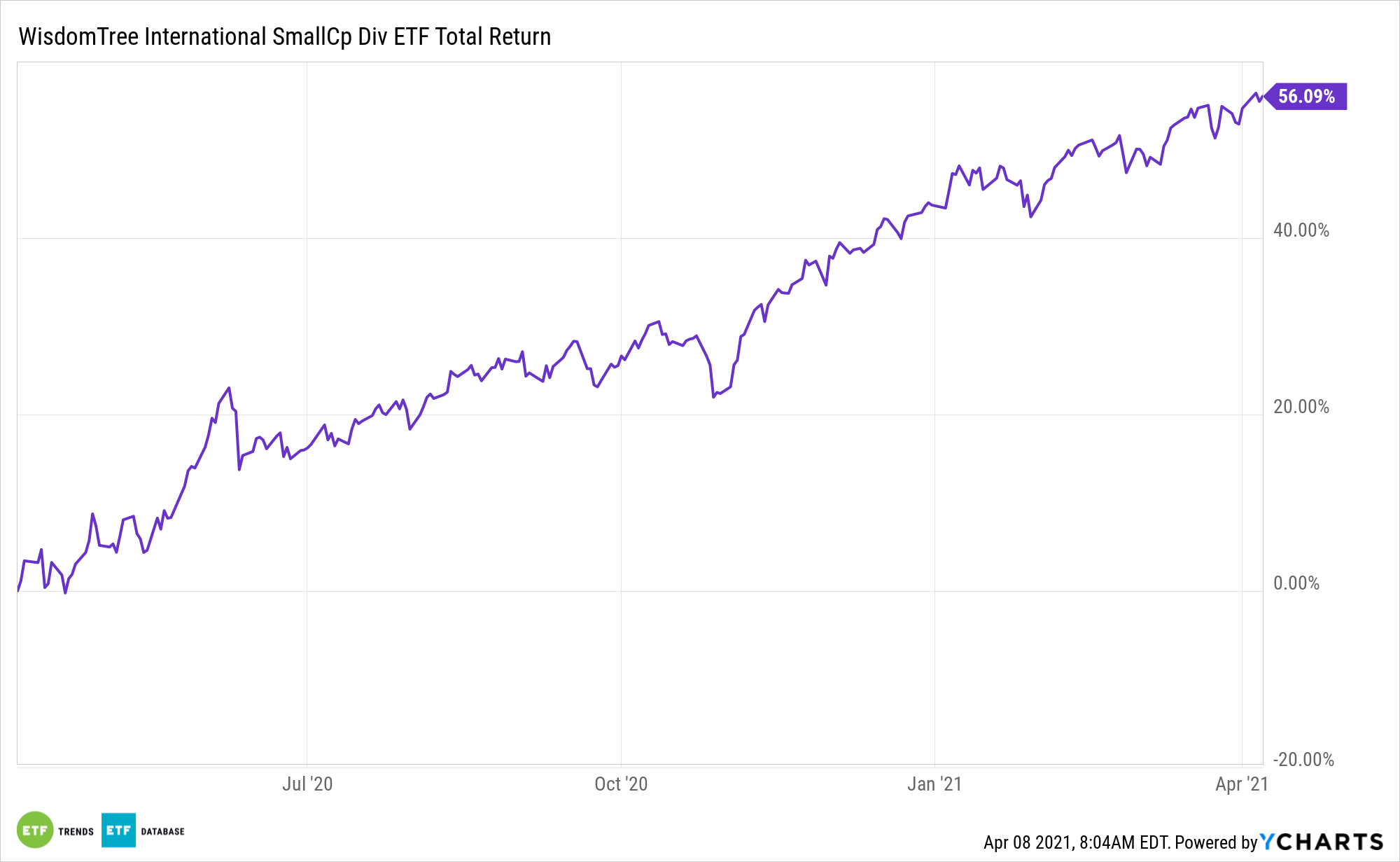

One of the prominent equity holdings is the WisdomTree International SmallCap Dividend Fund (DLS).

DLS seeks to track the price and yield performance of the WisdomTree International SmallCap Dividend Index, which is comprised of the small-capitalization segment of the dividend-paying market in the industrialized world outside the U.S. and Canada.

DLS’s sector allocations speak to positive possibilities.

“We think sector composition tendencies have been especially helpful in fueling the recent rally in small-cap value, especially in an economic environment that gives cyclical sectors plenty of runway,” adds Manby. “Many investment strategists anticipate a revival in economic growth in 2021, commensurate with the reopening of global economies, the COVID-19 vaccine distribution and a resurgence in consumer activity. Those trends may set up traditional value sectors, such as Industrials, Energy, Financials and Real Estate, for lasting success—key exposures in WisdomTree’s International SmallCap Dividend Fund (DLS).”

Additionally, DLS has some yield appeal.

“Second is the propensity for dividends in developed markets. Value investing and dividend payments are practically synonymous. After many European companies suspended their dividends last year during the throes of the pandemic, their resumption may be additive for a value rally that already seems to have caught a tailwind,” concludes Manby.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.