The value factor is roaring back to life this year, providing some ballast for dividend equities. On the journey to embracing those concepts, advisors and investors shouldn’t forget about focusing on quality.

That task is made easier with the Global Dividend Model Portfolio, which is part of WisdomTree’s Modern Alpha series of model portfolios.

“This model portfolio seeks to provide capital appreciation and high current dividend income, through a globally diversified set of WisdomTree’s dividend income oriented equity ETFs. The model strives to deliver dividend income in excess of the global benchmark of equities,” according to WisdomTree.

The model portfolio is comprised of an array of dividend exchange traded funds, many of which feature value traits, quality characteristics, or both.

Value and Quality: A Desirable Combination

Measures of quality include profitability and earnings quality – traits many ETFs in the WisdomTree model portfolio tap into.

“Companies witnessing positive analyst earnings revisions are more likely to lead. This supports my recent preference for financials, including U.S. and European banks and consumer finance, mining companies, manufacturing and the more cyclical portions of tech, such as payment companies,” according to Russ Koesterich, portfolio manager, BlackRock.

Emphasizing quality while embracing value is also noteworthy because not all cheap stocks are good stocks. Bringing quality into the mix helps investors avoid that pitfall.

Quality is also relevant today because it can be an accurate gauge of dividend sustainability and growth – factors to remember at a time when many clients may be tempted to embrace high dividend fare owing to today’s low interest rate environment.

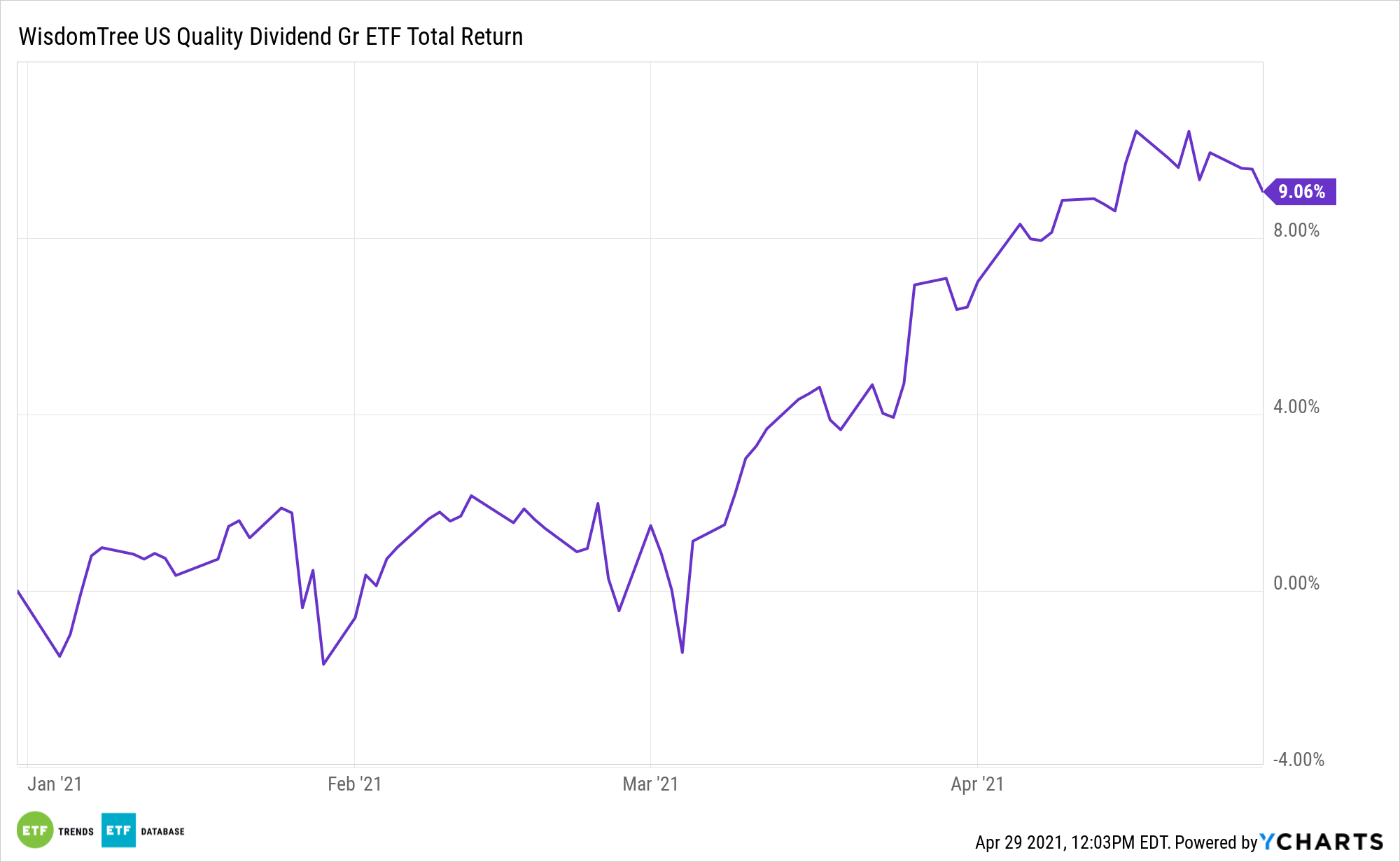

The WisdomTree U.S. Quality Dividend Growth Fund (NasdaqGM: DGRW) is a prime example of an ETF that marries quality and value.

DGRW seeks to track the price and yield performance of the WisdomTree U.S. Quality Dividend Growth Index. The index is a fundamentally weighted index that consists of dividend-paying U.S. common stocks with growth characteristics.

“While this bull market is barely a year old, with major averages more than 80% above the 2020 lows we are no longer in the first stage,” adds Koesterich. “As the bull market matures chasing volatility may be less rewarding. Instead, focus on cyclical exposure, a reasonable price and an ability to drive earnings growth.”

DGRW allocates nearly 26% of its weight to tech stocks, by far its largest sector allocation.

For more on how to implement model portfolios, visit our Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.