One of the best ways that any new exchange traded fund can grab investors’ attention and assets is to deliver the goods when it comes to risk-adjusted returns.

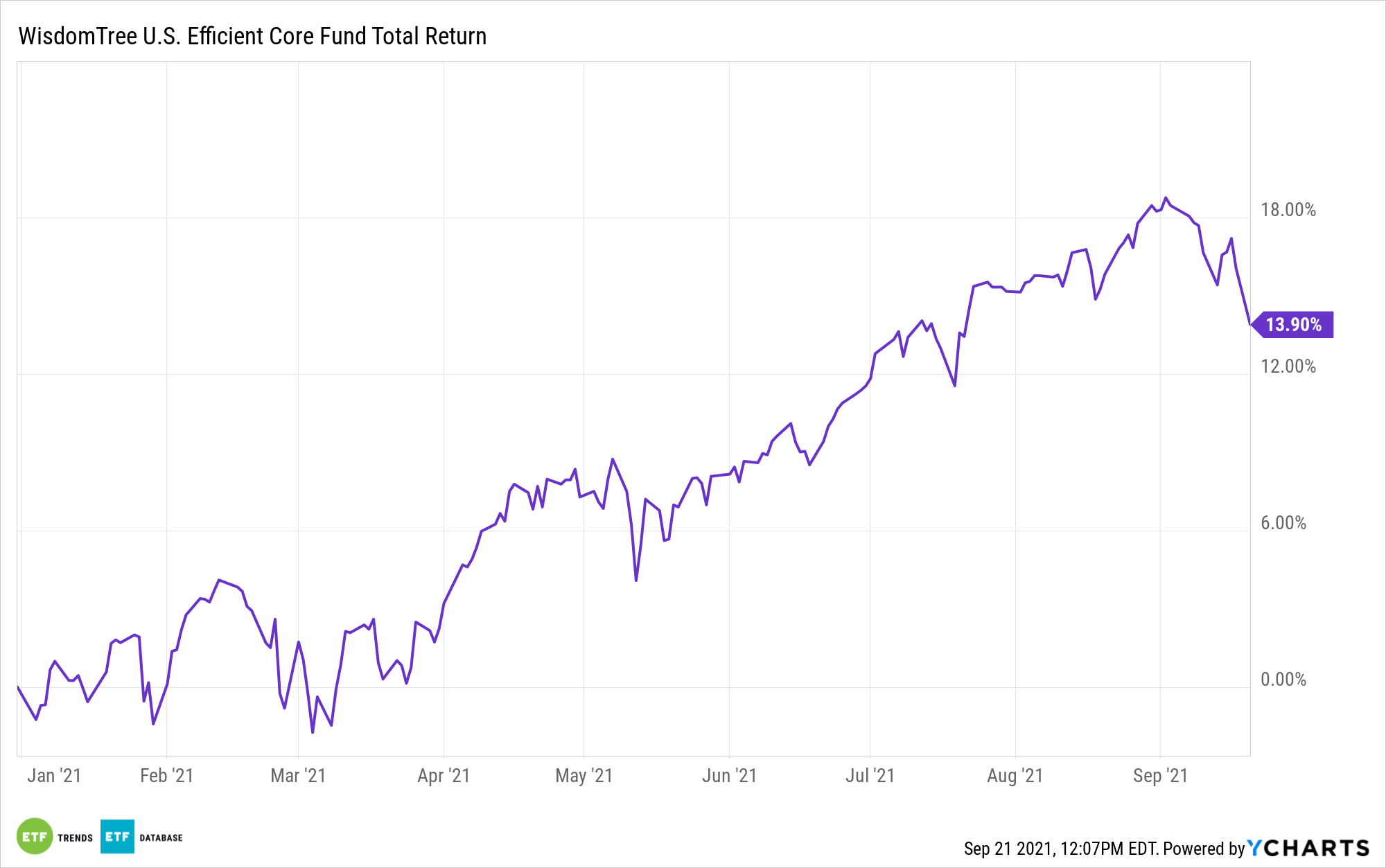

Just over three years after coming to market, the WisdomTree U.S. Efficient Core Fund (NTSX) is accomplishing that. New research from WisdomTree confirms that since its debut in August 2018, not only did NTSX top the S&P 500, it did so with lower drawdowns, representing a win-win for investors.

That’s an impressive start for any new ETF, and that start is leading to some prestigious accolades for the actively managed NTSX.

“Another way to quickly summarize the past performance, with three years of data now available, NTSX was awarded 5 stars from Morningstar, putting it near the top of the large cap blend category. Based on risk adjusted returns as of 8/31/21 out of 1,254 funds for the large cap blend category for the 3 year period,” according to WisdomTree.

What Sets NTSX Apart

In the world of ETFs, there are hundreds of funds purporting to offer lower risk and ample upside participation, and many of these products go about their business in varying fashion.

In the case of WisdomTree’s NTSX, the fund offers long equity exposure with the risk augmentation coming in the form of exposure to Treasury futures contracts. How NTSX provides Treasury exposure is important because the bulk of the contracts the fund holds are for bonds in intermediate-term territory. Intermediate-term Treasuries are historically less correlated to stocks, indicating that NTSX does the job that 60/40 portfolios are supposed to do but have struggled to accomplish in recent years.

“While clearly an environment of rising bond yields and falling stocks would be the worst outcome for absolute returns of NTSX, we’ve had a mini episode of that in the last three years, and NTSX has still tended to outperform long-only equity exposures,” adds WisdomTree. “This is primarily driven by the fact that losses on fixed income have historically tended to be smaller in magnitude than losses from equities. The net result may continue to be a less bumpy ride when equities swoon.”

Additionally, NTSX is relevant today amid concerns of rising inflation and fears that equities are poised to retreat as highlighted by Monday’s market pullback. In fact, NTSX may prove to be a better bet than traditional hedges like gold.

“Utilizing capital-efficient strategies like NTSX at the core of equity allocations creates room to ‘stack on’ any diversifying strategies—be it gold, commodities, managed futures or any creative alpha-oriented strategy seeking to add to returns or lower overall portfolio risk,” concludes WisdomTree.

For more news, information, and strategy, visit the Model Portfolio Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.